Back on the Roller Coaster

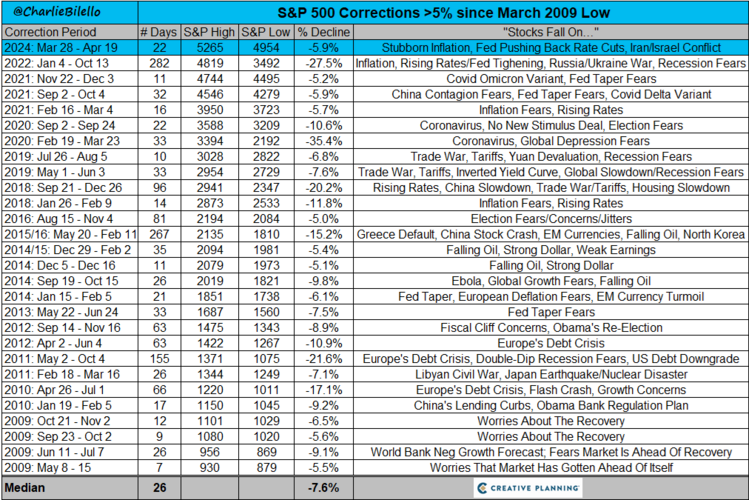

Not since October 2023 has the S&P 500 had a 5% pullback. That all ended last week with the S&P 500 down 5.33% from its record-setting peak on March 29th. 1

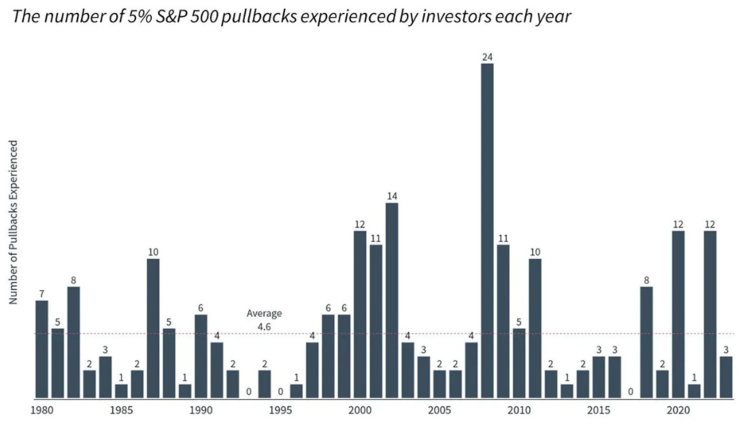

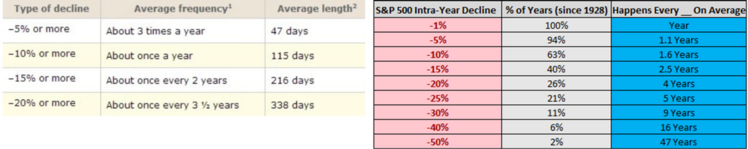

It’s been that long since I reminded our investor clients that adjustments, pullbacks, drawdowns, and corrections happen. Not only do they happen; they occur quite often. At a mere 5% pullback, it’s a very frequent occurrence. 2

5% drawdowns don’t last that long and, on average, don’t necessarily mean we are heading for a 10% correction. In fact, the average is about -7.6% since the 2009 market lows. 3

While bigger drawdowns materialize less often than the run-of-the-mill 5% drawdown, they do occur with some frequency. 3

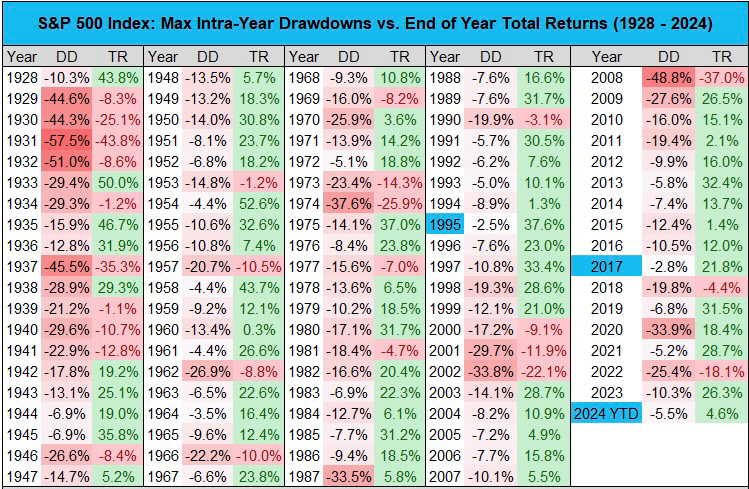

The max intra-year drawdowns most often result in positive outcomes by year-end. Only 26 times, since 1928, has there been a negative outcome by year-end. The odds of a positive outcome after our current drawdown are more than likely. 3

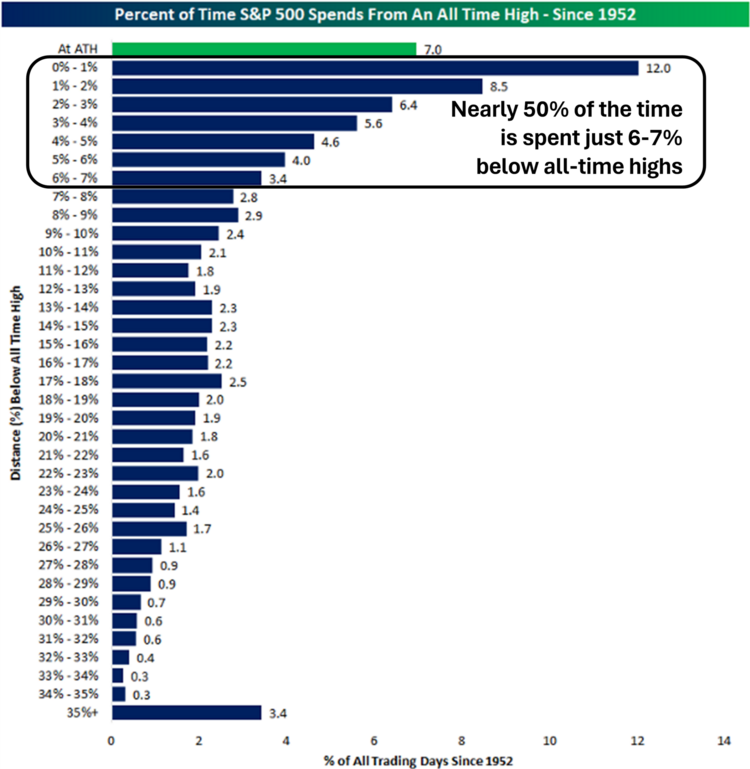

It's important to keep in mind as we wade our way through what could be a run-of-the-mill pullback, that we spend a lot of time below all-time highs. However, not too far off those highs. Nearly 50% of the time we are just 6-7% below all-time highs. It’s pretty hard to abandon ship on your equity strategy when the odds are in your favor. 4

Considering we will get a dearth of earnings reports this week – especially from our tech leaders – this might be an opportunity to find better valuations. Companies like Meta, IBM, Google, Intel, and Visa will dictate the pace and timing of any recovery. 5

With CEO confidence improving and technology earnings expected to exceed double-digit growth in Q1, it’s hard to get too pessimistic about market performance. 6 7

The equity roller coaster can be nerve-racking but is also a part of being exposed to equities.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- Bloomberg

- https://kingsviewim.com/category/insights

- https://x.com/charliebilello/status/1781675241934049593

- https://www.bespokepremium.com/interactive/posts/think-big-blog/sp-500-percent-of-time-at-new-highs

- https://www.earningswhispers.com

- https://research.gs.com

- https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_041924.pdf