Chasing

At this stage of a bull market cycle we start to see investor behavior trump reason and logic. One of the most common behaviors/mistakes investors make is to chase valuations. They start to buy when in fact they should err on the side of caution.

As I wrote last week, market cycles where price/earnings multiple expansions, can last a lot longer than expected.

The expansion of multiples over long periods of time makes it difficult for investors that like to market time (move in and out of the markets) to know when to move back it and at what multiple.

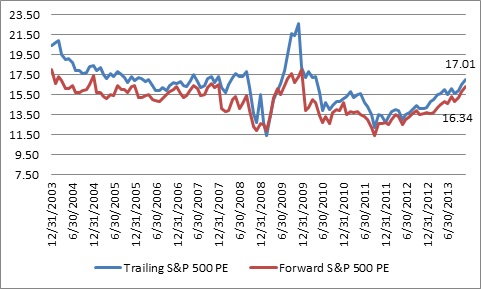

If you look at current valuation multiples you could get the picture that the equity markets are fairly valued. Two common measures are the price-to-earnings multiple on a trailing twelve month earnings basis The other is a PE on a next twelve month period based upon forward-looking earnings estimates. [i]

If an investor were to use just these metrics as determinants on when and what to buy you might come to the conclusion the coast is clear on buying.

The problem I have with these two measures is the limited amount of time with the earnings part of the equation. Simply put, 12 months of trailing earnings is a very short period of time and can't quite capture the natural cycles business go through over a longer period of time. Further, it's almost impossible to accurately forecast future earnings beyond 12 months.

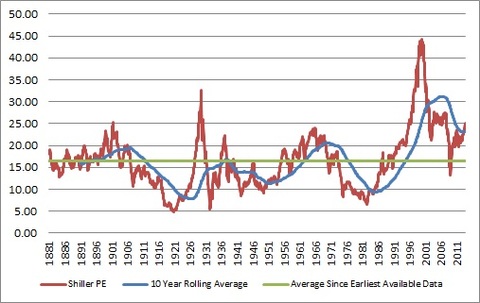

I tend to use a modified PE multiple called the Shiller PE named after the Nobel Prize winning economist Robert Shiller.

Shiller intuitively knows businesses run "hot and cold" over much longer periods of time than 12 months and so he modified the traditional PE methodology to incorporate a 10 year rolling average of earnings adjusted for inflation. Adjusting out inflation is critical over long periods of time as it has a tremendous impact on earnings growth if not adjusted. [ii]

Comparing the two methodologies gives two distinct pictures. With traditional PE's the S&P 500 is over its 10 year average by 4.4%, which for our purposes is essentially in line.

With the Shiller P/E, the S&P 500 is overvalued by 8.8% from its 10 year average, and overvalued by 51.9% from its average since its earliest available date in January 1881.

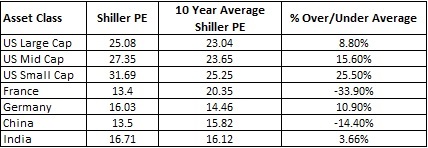

If you took this model and applied it to various markets and sectors you get the following valuations above and below averages. [iii]

Practicum

So what should investors do with sideline cash in the face of these two competing notions and the realization that markets can overshoot averages for long periods of time?

- Get "crystal clear" on your equity investment time frame. If it is shorter than a few years, then don't chase. Wait.

- If you have a longer time frame (5+ years), phase in the resources over a period of 12 months. Try to dollar-cost average into this market

- If you have a perpetual time frame (foundations, endowments or pension plans), you should avoid market timing altogether. However, if you are sitting on cash use a 4-6 calendar quarters to phase cash in.

- Make sure that your portfolio is properly diversified with assets that are not correlated to each other. Use this time to consider buying assets that are not correlated to overvalued sectors.

- Develop a target rate of return you need to meet your liability needs. When I say liability I'm not just talking about debt obligations but also spending requirements, inflation, fees and perhaps taxes.

a) A target rate of return will help you avoid timing traps and keep you focused on your long term objectives.

b) A target rate of return will provide you with a benchmark to measure your performance against that is not theoretical but significant to you or your organization

While many of our competitors might boast high returns this year, I can assure you of one thing: you are paying for those returns with the risk they are taking on your behalf. Whether or not you are made aware of those risks tends not to be of great concern in the wealth management industry.

If we have not worked with you on developing a return target, it's time we have that conversation.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company

[i] Bloomberg LP

[ii] “Stock market data”, Home Page of Robert J. Shiller, Yale University

[iii] Bloomberg LP, Federal Reserve Economic Data