What's Next?

What's Next?

Weekly CEO Commentary 3-4-13

Tim Phillips, CEO—Phillips & Company

The world did not come to an end. As I traveled through security lines at airports this weekend, I saw absolutely no signs of long lines caused by cuts to government budgets, nor did the air traffic controllers have to leave their posts.

What I did see was people shopping, eating out and spending money. From the looks of things, the Great American Ponzi Scheme, consumerism, is alive and well. I have written several times that the essence of growth in our economy is largely driven by the US Consumer. The formula is simple:

It's clear our current consumer is a little more cautious and consumes a little less, with the final outcome being fewer jobs created and not much support for wage inflation.

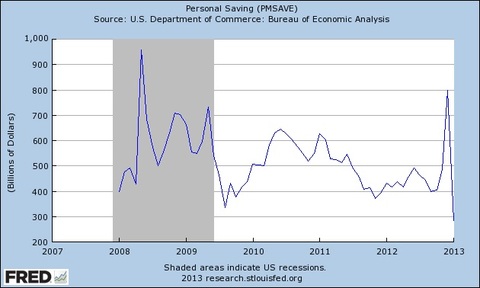

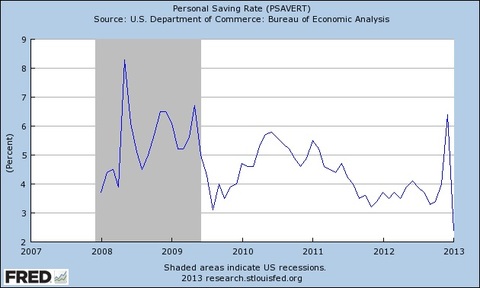

Fortunately for all of us, consumers can get their hands on money to spend through their savings. That's exactly what we saw recently.

The Federal Reserve reported that the US Savings Rate dropped from 6.4% in December to 2.4% in January. This means that consumers deployed $513.5 billion from savings. This more than compensates for the $85 billion that is being cut from the federal budget.

It's also encouraging to see the US equity markets greeted the news with some support. Bloomberg shows that the S&P 500 is up 8.40% over the last three months.

- Is it possible global investors want a more responsible US fiscal policy?

- Perhaps the investor class cheered the fact that further tax increases might not be as easy to capture?

- It could also be a welcome indicator that the political class can focus on tax reform to help companies unlock the nearly $1.7 trillion in cash[1] sitting on their balance sheets.

I am comforted that there is plenty of dry powder in our system (corporate cash and personal savings/credit). It's also comforting to see the Federal Reserve’s Flow of Funds showing that US homeowner’s equity improved by $387 billion from Q2 to Q3 2012 (most recent quarter available), largely due to a recovery in real estate prices.

On the other hand, I am also cautioned that there is a continued concern over slow growth that may be a precursor to a mild recession.

What I am working on with our investment staff is how to continue to optimize our equity allocations, and at the same time realign fixed income to reflect the transition phase we may be entering when it comes to interest rates.

Some specific fixed income issues we are also working on:

- Lower duration risk (how your bond portfolio reacts to rising rates)

- Yield curve opportunities

- Geographic credit dislocations that are improving

- Industry specific debt

- How fast to run away from Treasuries and TIPS on the longer end—and actually, you should have already run from the longer maturities

- Equity risk substitutions for fixed income

As long as the consumer has dry powder and housing prices improve, it's critical we start thinking about what's next for valuations in all asset classes.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company

[1] Source: Federal Reserve