Are we overextended?

Are we overextended?

Weekly Market Commentary 8-19-2013

Tim Phillips, CEO—Phillips & Company

The number one question that I get asked is if the markets are overextended. Invariably, most people already have formed their own opinion, but my answer is no—based upon several metrics.

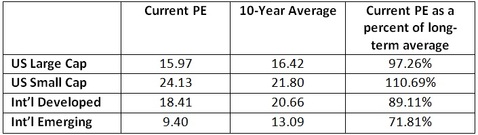

Look at the chart below of current PE ratios versus their 10-year average historic levels.[i]

As you can see, US market valuations are close to their long term averages, and emerging markets are below their averages. We have written before that market valuations have mean reverted closer to their average, but there is a big difference between moving up to the average level and being overvalued.

However, to keep moving upward from the average, you need a confident consumer and investor.

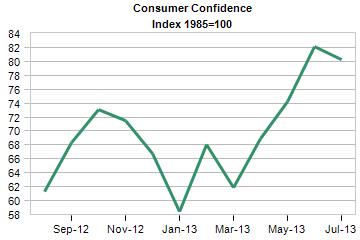

Consumer confidence has certainly improved from the lowest part of the recession, but the most recent report showed a slight decline.[ii]

Moody’s analyst on the consumer confidence report summarized the situation:

“Consumers are sending mixed signals. Despite feeling decidedly better about their current financial circumstances, shoppers are showing less faith that the economy recovery will stay its course over the latter half of the year.” [iii]

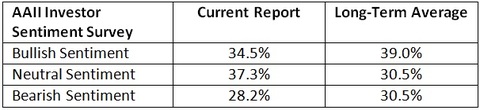

Investor confidence is tepid and slightly below average, as you can see below.[vi]

What really matters

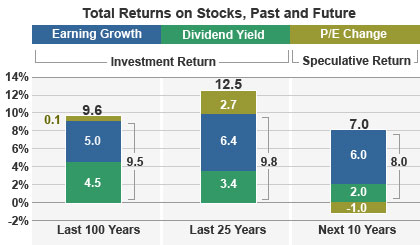

That all being said, the market timing question of whether or not the market is overextended doesn't really amount to much when it comes to real returns. We have written multiple times (here and here) about what really drives stock returns: earnings and dividends. That's the value that a company can give to shareholders.

Any return above earnings growth and dividends is the result of stocks moving on speculation. Historically, this speculative return has been minimal. In a 2007 paper [v], John Bogle from Vanguard quantified this amount of speculative return as being only 0.1% per year over the past 100 years:

Is the market overextended? The data doesn’t really suggest this, and in fact says markets are closer to average valuation levels. Regardless though, the real thing that investors should pay attention to is earnings and dividends, and not speculation on which way the market will move in the short term.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company

[i] Source: Bloomberg LP

[ii] “United States: Consumer Board Consumer Confidence”, Moody’s Analytics, July 30, 2013

[iii] Ibid.

[iv] “Sentiment Survey”, American Association of Individual Investors, Aug. 14, 2013

[v] “Stocks in the coming decade”, John C. Bogle, Forbes, Oct. 25, 2007