Facing the Ugly Truth- Is the Labor Market Stuck?

On Thursday of last week, The Federal Reserve released the minutes from their meeting on January 29, 2014. They made an astonishing statement:

"...the Committee continues to see the improvement in economic activity and labor market conditions over that period as consistent with growing underlying strength in the broader economy.”[i]

Let's just take a look at some data and see what exactly the Fed is talking about with respect to "improvement in...labor market conditions...".

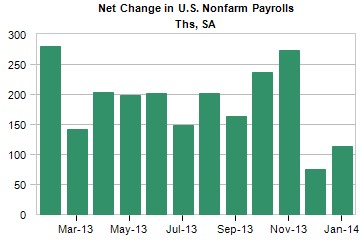

In the graph below, you can see the last two jobs reports suggest anything but improvement in labor market conditions.

(Source: Moody’s Analytics)

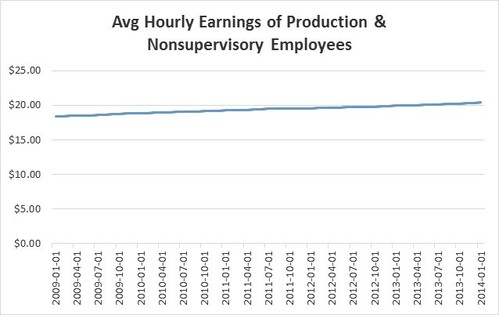

Let’s take a look at wage growth as well. I often remind readers of this data, as the macro US economy is almost solely consumption driven. Over the last five years, average hourly earnings for production and nonsupervisory employees increased at a compound growth rate of just 2.06%.[ii]

You can see that there is a systemic problem with wage growth in the American economy. Not to mention the labor participation rate is at a 35-year low and US consumers are spending down savings. [iii, iv]

What data is the Fed looking at when they see improvement in labor conditions? Can we now conclude stagnant economic growth is structural vs cyclical?

The challenge for investors is to evaluate the outcomes in light of the fact that we have never seen so much monetary intervention in our "free market" economy. The Fed balance sheet now has 23.7% of assets to nominal GDP.[v] As professional investors, we simply have no guide to help us navigate these uncharted waters.

Investment Implications

Fixed Income: The Fed seems very concerned with deflation and mentions low inflation on several occasions in their statement. The low duration profile of many fixed income portfolios will lag most benchmarks. We need to determine whether we should add more duration risk despite the Fed withdrawing stimulus from the economy.

Equity Exposure: Equity positions should continue to do well in a low rate environment with easy capital propelling earnings growth for companies. The challenge comes from more deflation threats. Stocks tend to perform poorly during deflationary periods, as observed by the performance of Japan’s Nikkei Index during an extended deflationary period from mid-2008 to the end of 2012.[vi]

(Source: Google Finance)

The fact that the Fed continues to withdraw monetary stimulus, in the face of overwhelming data that the labor markets are anything but improving, suggests to me that their quantitative easing tool kit is not working. Wage growth, job growth, and labor participation are all slowing. The only thing expanding is the Fed's balance sheet. In light of very low inflation, investors need to keep their heads on a swivel and watch for what no one is talking about...deflation or the threat thereof.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Jeff Paul, Senior Investment Analyst – Phillips & Company

[i] Federal Reserve. Jan. 29, 2014.

[ii] Federal Reserve Economic Data. Feb. 24, 2014.

[iii] Ibid.

[iv] Ibid.

[v] United States: FOMC Minutes. Feb. 19, 2014. Moody’s Analytics.

[vi] Japan Inflation Rate (annual change on CPI). Feb. 24, 2014. TradingEconomics.com.