Horriblization Part 2

U.S. stocks stabilized and closed more than 2 percent higher on the last trading day of January. The market still posted the worst start to a year in at least seven years. That left investors on the edge with fears’; some real and some made up.

In our post last week, we reviewed China and Oil as two topics that are driving investor sentiment. While those topics attract much of the media’s attention, earnings, in my opinion, are the main driver of market dislocation.

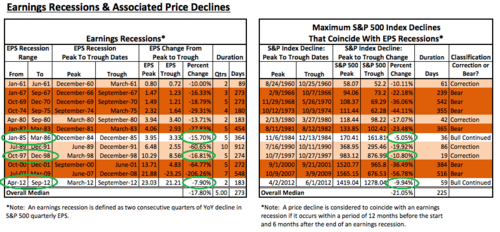

Forty percent of S&P 500 companies have reported their fourth quarter results; earnings have declined -5.8%. If this trend continues for the rest of the reporting season, it will mark the 3rd consecutive quarter of earnings declines, confirming we are in an earnings recession.

The last time we experienced three-quarters of earnings declines was in 2009. At that time, we had an economic and earnings recession. We will continue to monitor signs of an economic recession, however unlikely.

Certainly that's not good news and worthy of caution. However, earnings recessions are not unfamiliar episodes, and far less bad than economic recessions. [i]

Further, investors have a tendency to horriblize recent events and discount the larger picture. As a part of human nature, “recency bias” explains this behavior. It appears to be what's happening now. [ii]

Thanks to our friends at FactSet, we can look further into the full picture and an expectation for higher earnings in 2016. [iii]

For the full year 2016, S&P 500 companies are expected to grow earnings by 5% and revenues by 2.7%.

Looking forward, the estimated year-over-year declines in earnings from the S&P 500 Energy sector are expected to continue to decrease each quarter during the course of the year. For Q4 2016, analysts are actually projecting year-over-year growth in earnings of 64%. [iv]

Looking further, you can see 2017 earnings restore to above average levels, led by Energy. [v]

The median annual earnings per share growth for the S&P 500 is 12.01% and expectations call for 13.2% growth overall in 2016. Certainly not something to horriblize about. [vi]

Of course, these are expectations and susceptible to disappointment.

While earnings have been contracting so have valuations. The forward price to earnings ratio for the S&P 500 is now at 15.2 down from the peak of 16.1 but slightly above the average of 14.2. [vii]

Markets appear to be getting closer to longer term values.

There is no doubt that earnings are horrible. However, the recent contraction in the market has moved us closer to fair value and closer to a return to earnings growth. At some point, investors will start to look ahead and it's better to be invested before they do.

In the meantime, we have to patiently withstand some excess volatility.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Chris Porter, Senior Investment Analyst – Phillips & Company

References:

[i] http://seekingalpha.com/article/2978956-the-earnings-recession-of-2015-stock-market-in-danger

[ii] http://www.wikinvest.com/wiki/Recency_bias

[iii] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_1.29.16

[iv] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_1.29.16

[v] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_1.29.16

[vi] http://www.multpl.com/s-p-500-earnings-growth

[vii] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_1.29.16