A Tale of Two Forecasts

Simmering behind the political intrigue of our fiscal stimulus narrative, and the reassertion of the U.S. military presence in the world as a force for good, lays a hidden paradox: conflicting signals for market growth.

According to Moody’s Analytics, the latest projections for U.S. GDP growth show that the U.S. will grow 2.2% for the full year of 2017.[i]

Additionally, from a larger vantage point, global GDP growth is projected to grow 3.4% for the full year of 2017. [ii]

Now, these projections look fairly rosy compared to the numbers we have seen over the last several years, following the reemergence from the global financial crisis. Valuations seem slightly richer, with stocks trading approximately 17.5x their next twelve months’ EPS estimates, when the average is more in line with 15.5x. [iii]

Valuations of this magnitude aren’t completely unwarranted, especially considering the overall EPS for the S&P 500 is projected to grow 9.8% this year. [iii]

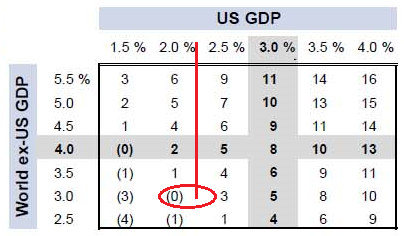

However, herein lays the conflict. To add some color, let’s look at the relationship between GDP growth and EPS growth. Given the current projections, EPS growth should be 0 – 1%, not 9.8%. [iv]

Despite drastically different EPS growth estimates, it’s no secret that we remain in economic recovery mode. In fact, this has been the longest economic recovery in history, with expectations of the recovery lasting until 2020. [v]

What adds to the conflict is that weak economic growth has fueled this recovery, which doesn’t exactly add to either case for EPS growth. [v]

I’ve been doing this a while and it comes as no surprise to see conflicting economic signals. The one thing that experience has taught me is that these conflicts tend to occur near economic inflection points. Now, I’m not sounding any alarms yet; the risk of a U.S. recession still remains low. [vi]

As long as the U.S. consumer remains in the driver’s seat, as our Q2 2017 Look Ahead indicates, the larger narrative remains intact.

If you have questions or comments, please let us know. We always appreciate your feedback. You can get in touch with us via Twitter and Facebook, or you can

e-mail me directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. https://www.economy.com/dismal/countries/IUSA

ii. https://www.imf.org/external/pubs/ft/weo/2017/update/01/pdf/0117.pdf

v. http://realestateconsulting.com/files/JBREC-Industry-Cycles-White-Paper.pdf

vi. https://phillipsandco.com/files/3214/8399/3505/NFM-13126AO.pdf