Complacency

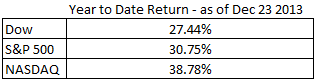

It's the holidays and there is no better time to relax with family and friends. We have had an amazing year in the US equity markets.

Source: Bloomberg

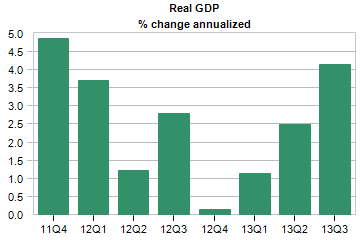

The economy looks like it certainly reached "escape velocity" from the latest Q3 GDP revisions. GDP was up 4.1%. [i] Consumption even ticked up a touch from prior reports.

Investors appear to be very happy and enjoying opening their statements at month end. This is quite a change since the financial crisis.

It's also apparent to me that clients are becoming complacent, at minimum, and in some cases forgetful about the risks associated with investing (This conclusion from the thousands of investors we serve).

Complacency is the byproduct of some very nice success. We have seen portfolios this year far exceed their intended performance targets" [ii]

Just remember what it felt like during this period of time in 2008-2009:

Source: Bloomberg

The world markets looked like they would freeze up, money markets looked insolvent and doubts about the creditworthiness of our banking system were a daily reality.

Since that time, we have enjoyed many years of investing success.

Source: Bloomberg

It's easy to see how we can all become complacent.

There is absolutely no free lunch when it comes to the returns you are experiencing with us or any investment advisor/manager. Make no mistake about it: you are paying for your returns with an associated amount of risk in your portfolio. Nothing has changed when it comes to that.

The time to prepare for the next event, whenever that will be, is now.

Knowing the risks you are taking—or in some cases, the risks your advisor is taking on your behalf—would be the first thing I would do. Make it a goal to examine those risks with us early in the new year.

Second, take a macro view of your entire portfolio (401k's, IRA's investment accounts, real estate, business valuation) and see how all the component parts can work with each other. We can help you with this.

Third, reassess your time frame. How much time do you have before you need to draw on your assets? How are different parts of your portfolio aligned to your personal and professional time frames?

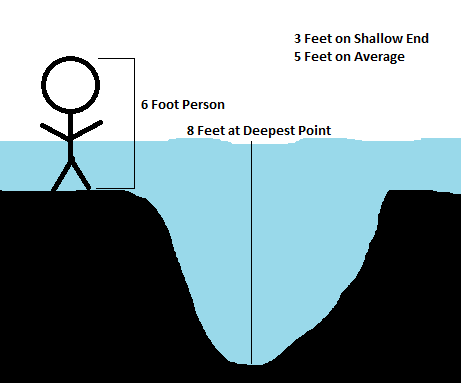

Finally, realize the averages can kill you. A 6 foot person can drown in 5 feet of water on average. You need to also look at surviving the worst.

The headlines on the economy look great. However, below the surface there are indeed a couple of currents that are concerning. Inventory buildup accounted for 40% of GDP in Q3. [iii] That will likely not be the case in Q4. Corporate earnings growth has remained stagnant from 1.9% growth from Q1 to Q2, and 1.7% from Q2 to Q3 [iv]. Analysts are also revising down year-over-year earnings growth estimates for Q4: [v]

I know you might be thinking this is certainly not the cheerful email you want to read before the holiday. While I acknowledge I could be much more Pollyanna, I think it's more prudent I encourage introspection. Let's all take a hard look at how things are working with your holdings.

Helping you fight complacency could be the best gift we can give you for the New Year.

We are grateful for your partnership with us and feel blessed you allow us to serve you and your family. All of us at Phillips & Company wish you and your family Happy Holidays and Merry Christmas.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company

[i] “United States: GDP (Third Estimate), Moody’s Analytics

[ii] Investor Advantage Year to Date model returns calculated by Morningstar Direct. Returns are based on model portfolios and may not reflect actual account performance and the impact of management fees. Phillips & Company composite capital market expectations based on data from JP Morgan Asset Management "Long-term Capital Market Assumptions: 2013 Edition", Neuberger Berman "Asset Allocation Committee: Market View & Capital Market Assumptions Methodology", Cambridge Associates "Equilibrium Asset Class Assumptions”, and AllianceBernstein “Capital Market Projections.” Cambridge Associates figures were originally presented in real terms and have been adjusted to nominal terms based on Cambridge Associates 'inflation expectations. Capital market expectations are merely projections and are not guarantees or promissory of future returns. There is no guarantee that events will occur as planned.

[iii] “United States: GDP (Third Estimate), Moody’s Analytics

[iv] “Earnings Insight”, FactSet, December 20, 2013

[v] “Fed in Focus as Q4 Earnings Reports Trickle In”, Zachs Investment Research, December 13, 2013