Getting Closer to Easier

With just a few days left in calendar Q3, it's probably time we set the stage for the upcoming earnings season.

Similar to last quarter, earnings and revenue growth are expected to be negative. Earnings are expected to decline by -4.5% and revenue is expected to decline by -3.3%.

If in fact earnings come in as expected, it will be the first back to back quarterly decline since 2009. [i]

The only sector that is showing improving expectations since June 30th is the Telecom Services sector.

In our estimation, we don't expect to see year-over-year earnings growth to return until Q1 2016.

The year-over-year earnings comparison will get tested this quarter in a limited way. At this time last year, Bank of America reported awful earnings losing -.1/share due to a write off of .43/share from legal settlements. This year they are expected to report earnings growth of .36/share. Bank of America is the largest positive contributor to year-over-year earnings for the S&P 500 for Q3. By simple comparison the S&P 500 would have negative earnings growth of -5.9% without Bank of America. [ii]

We expect earnings will return to growth by Q1 2016.

One thing to keep in mind is earnings were anticipated to decline by -4.5% in the last quarter and companies did significantly better with a much smaller decline of only -.7%. Perhaps, we get the same outcome this quarter. [iii]

You can be sure of one thing, we expect companies to continue to attribute the decline in earnings to the strong dollar. The dollar continued to strengthen against other world currencies by 4.2% in Q3. [iv]

You can see from the chart below the sectors that generate their revenue from exports. [v]

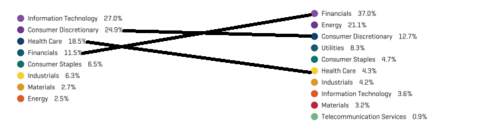

Which is why we are tilting toward Healthcare, Consumer Discretionary, and Financials. One way we will do this is by shifting some of the tilt from value to growth. When you compare value to growth you can see the differences. [vi]

S&P 500 Growth vs. S&P 500 Value

Expect continued volatility until market participants begin looking forward and not backward. Traditionally, this occurs when investors start seeing names they recognize report in-line or above consensus earnings estimates. Based on current consensus estimates, we can expect the current period of contraction to wind down late this year and possibly into early 2016.

We have a bit more time to wait until we get to look forward to easier.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Chris Porter, Senior Investment Analyst – Phillips & Company

References:

[i] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_9.25.15

[ii] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_9.25.15

[iii] Bloomberg, S&P 500 Earnings Analysis

[iv] https://research.stlouisfed.org/fred2/series/TWEXB

[v] http://www.valuewalk.com/2015/02/sp-500-guidance-2014/

[vi] http://us.spindices.com/indices/equity/sp-500