Getting It Wrong

We are approaching a very large US macroeconomic data point on May 29 – the revised Q1 US GDP reading. I want to raise a little red flag.

It should come as no surprise to our readers that Q1 US GDP came in at a very anemic .2% growth.[i] In fact, for several years we have seen the Fed’s GDP forecasts completely miss the mark for Q1 and for the year.

You can see from the chart below in 2012 the Fed forecasted GDP growth to come in at 3.50%.[ii] In Q1, the Fed’s reported GDP growth was an anemic 2.3%.[iii] In fact the year came in at 2.30%, a staggering 1.20% below their initial prognostication.[iv]

That "Getting It Wrong" trend continues in 2013, 2014 and most likely in 2015.

Getting it wrong does not appear to be an unusual outcome for the Fed, which is staffed with over 300 Ph.D. economists.[v]

Here are the problems with this year.

- Expectations for the revised Q1 GDP on May 29 are for it to show a contraction in the economy of -0.30%.[vi]

- If we get a Q2 GDP report that shows a contraction, the US economy will be in a recession.

- Given the current estimated risk of recession at 15% [Moody’s], few are expecting us to be in a recession, especially market participants.[vii]

- Unlike past years of Fed "Getting It Wrong" syndrome, this year we are also facing a collapse in earnings growth in Corporate America. In fact they barely grew by 0.3% in Q1.[viii]

Currently, earnings per share growth is anticipated to shrink by 6.6% according to Zacks.[ix] While GDP growth may indeed be positive for Q2, we are facing an earnings strike.

Poor earnings in Q1 were blamed on the following conditions:

- Strong dollar.

- Bad weather.

- West Coast port strike.

- Rapidly declining energy prices (energy companies represent 8.5% of the S&P 500.)[x]

Fortunately we know the following:

- The weather is better in Q2 than Q1.

- The West Coast port strike ended on February 21.[xi]

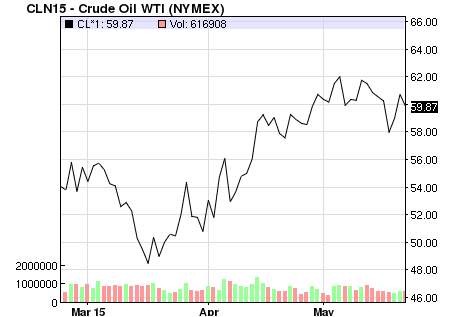

- Energy prices stabilized and rallied a bit from the lows in Q1.[xii]

- The dollar weakened by 4.9% so far in Q2.[xiii]

With markets trading at all-time highs, getting it wrong could create quite a shock event as we approach the moment of truth in early Q2.

We will continue to watch events unfold and communicate to our readers.

We wish you a very happy Memorial Day Weekend, our thanks to the men and women who have served and are serving in the US Armed Forces.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

References

[i] FOMC Minutes (June 2011, June 2012, June 2013, June 2014).

[ii] Ibid.

[iii] Ibid.

[iv] Ibid.

[v] Board of Governors of the Federal Reserve System – The Economists (May 2015)

[vi] FOMC Minutes (June 2011, June 2012, June 2013, June 2014).

[vii] Moody’s Analytics – United States: Risk of Recession (March 2015)

[viii] FactSet Earnings Insight (May 2015)

[ix] Zacks “Q1 Earnings Season Winding Down” (May 2015)

[x] S&P 500 Constituents (March 2015)

[xi] Washington Post “Labor fight at West Coast ports comes to an end – for now” (February 2015)

[xii] Nasdaq Crude Oil WTI Price (May 2015)

[xiii] Federal Reserve Bank of St. Louis: Trade Weighted US Dollar Index (March 31 2015 – May 15 2015)