Going to the Dogs

In last week's post (link) we discussed an inflection point in the markets that would likely play out over the course of the week. We wanted to see how market participants would react to a continued absence of corporate earnings growth vs. the growing U.S. Economy.

We got our answer!

The U.S. Equity markets had their best week of the year. [i]

|

Dow Jones |

S&P 500 |

Mid-Cap |

Small-Cap |

|

+4.03% |

+4.15% |

+5.20% |

+4.37% |

My conclusion is that investors believe the Fed rate hikes will be on hold for a while, giving American firms who depend on overseas sales time to catch their breath from the crippling effects of a strong U.S. Dollar on their revenue. [ii]

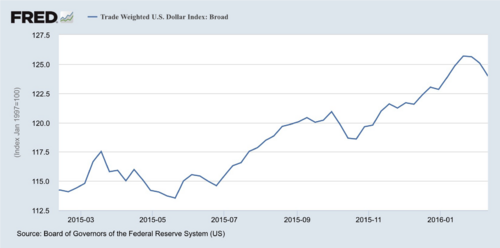

We are seeing, and hope to see the trend continue, a decline in the U.S. Dollar vs. other currencies. This will certainly help S&P 500 companies and American manufacturers that are large exporters of goods as well as major employers.

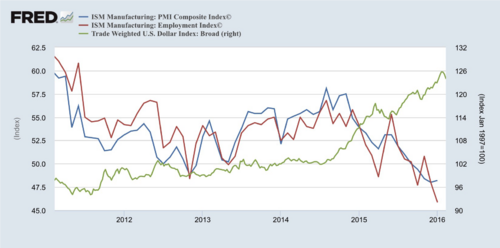

The strong U.S. Dollar has had a horrific impact on the ISM Manufacturing Index. This index measures 300 manufacturers and the health of their businesses. You can see from the chart above the strengthening dollar (Green) has hammered manufacturers (Blue) and manufacturing employment (Red). [iii]

Manufacturing represents just over 12% of our GDP, 8.8% of total employment, or about 12 million employees, and the average manufacturing wage premium for workers without a college education stands at 10.9% compared to other jobs. While the manufacturing recession won't likely push us into an economic recession, it's not something the Fed wants to fool with. [iv]

So once again we are betting on Federal Reserve intervention to prolong a business cycle that was resuscitated by the Fed in the first place. [v]

The current growth rate of GDP is almost 100bp below where we were from 2000-2005. [vi]

If we continue to have a prolonged slow growth economy, we can expect bouts of deflation, a weaker dollar and low-interest rates for longer. In all likelihood, we will continue to have equity rallies with subsequent corrections, although more frequently than in the past 5 years. (We’ve only had two to be precise)

The good news is not all market corrections lead to or foretell recessions. In fact, it's quite rare. [vii]

In summary, last week's inflection point suggests that we accept the Fed is on hold and investors will wait out the recent volatility until we get to better corporate earnings.

While the U.S. Economy is not "going to the dogs" as the ancient Chinese expression goes, it is

certainly testing the resolve of investors, even the ones that love dogs.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Chris Porter, Senior Investment Analyst – Phillips & Company

References:

[i] https://www.google.com/financeq=INDEXDJX%3A.DJI%2CINDEXSP%3A.INX&ei=wlHLVtr3FOTpigLh87H4Ag

[ii] https://research.stlouisfed.org/fred2/graph/

[iii] https://research.stlouisfed.org/fred2/graph/

[iv] http://www.epi.org/publication/the-manufacturing-footprint-and-the-importance-of-u-s-manufacturing-jobs/#manufacturing-wages

[v] http://www.calculatedriskblog.com/2014/10/qe-timeline-update.html

[vi] https://www.newyorkfed.org/medialibrary/media/research/snapshot/snapshot_february2016.pdf?la=en

[vii] http://www.valuewalk.com/2014/10/sp-500-corrections/