Hero to Zero

On the heels of Congress and the president passing one of the largest tax cuts in American history, which included a complete re-write of the corporate tax policy, the political circus picked up on cue and shut down the government. Talk about a reversal of fortunes. [i]

The good news is that the investor class appears to view the government shutdowns as only slightly negative. [ii]

It is unfortunate that the political class continues to look ridiculous in the eyes of most Americans, and all this noise could interrupt what looks to be a promising growth trend in the United States.

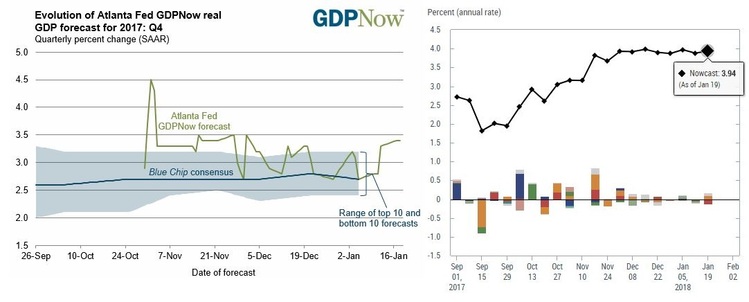

Fourth-quarter U.S. GDP is anticipated to grow at levels not seen in many years. Both the Federal Reserve Bank of New York and the Federal Reserve Bank of Atlanta are anticipating GDP growth between 3.5 and 4 percent, with the New York Fed also projecting north of 3 percent GDP growth for the first quarter of 2018. [iii] [iv]

One point I’d like to address is that stock market returns are loosely correlated to GDP growth. [v] As demonstrated by the below scatterplot, you can see that the farther GDP growth moves away from zero, the more inconsistent stock market returns become. [vi]

Despite GDP growth’s loose correlation to stock market returns, it’s important to recognize that the direct correlation between GDP growth and corporate profits, which we’ve discussed in previous commentaries and Quarterly Look Ahead reports, has a direct relationship with equity prices, except when investors discount those profits incorrectly. [vii]

With the government shut down at the time of this writing, investors will likely look past the political silly season and continue to invest alongside rising corporate profits as we continue to experience GDP growth beyond 3 percent. Unfortunately, we might have to wait beyond this Friday to get the report on fourth-quarter GDP because the office is likely to remain shut down through the rest of this week.

It amazes me that the political class can go from looking good to looking so bad so quickly.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can email Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. http://www.politifact.com/truth-o-meter/statements/2017/oct/26/donald-trump/donald-trump-wrong-his-tax-plan-biggest-cut-ever/

ii. https://www.marketwatch.com/story/should-wall-street-fear-a-government-shutdown-heres-how-stocks-fared-during-past-closures-2017-04-21

iii. https://www.frbatlanta.org/cqer/research/gdpnow.aspx

iv. https://www.newyorkfed.org/research/policy/nowcast

v. http://www.schroders.com/staticfiles/schroders/sites/americas/us%20institutional%202011/pdfs/equity-returns-and-gdp.pdf

vi. https://www.northerntrust.com/insights-research/detail?c=90d8415c0bd569d09d2cdf2ff3645349

vii. https://www.msci.com/documents/10199/a134c5d5-dca0-420d-875d-06adb948f578