Lift Off Again!

Based on Friday’s very strong jobs report, the economy looks poised to launch into a higher level of growth. The Labor Department reported that the U.S. economy added 235,000 jobs during the month of February, which is consistent with the strong jobs report from January. [i]

With the last two months of solid jobs reports, the rolling three-month average is now at 209,000 jobs created; well above the rate at which you need to grow jobs to absorb new entrants into the labor force. [i]

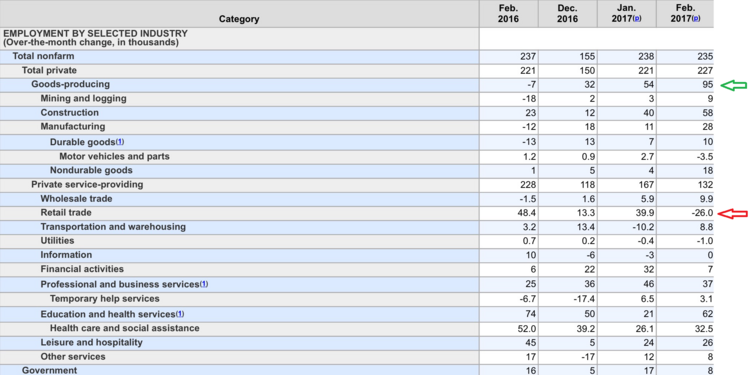

When you look at the breakdown of job growth in the United States, you can see some interesting trends. One trend that stands out to me is the growth in Goods-produce jobs relative to the decline in retail jobs. [ii]

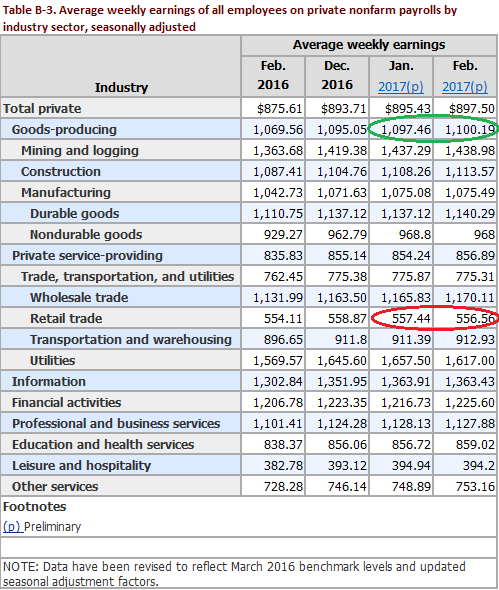

To further expand on that trend, not only do Goods-producing jobs make a significant contribution to job growth, their contribution produces higher wages than that of the retail trade. [iii]

Jobs gained at higher wages versus jobs lost at lower wages should result in further overall wage growth.

In fact, we’ve seen overall wage growth posting consistently stronger results. Average annual wages have grown by 2.8% year-over-year and continue to show a slow but steadily improving trend. [iv]

However, the one consequence we face from such a strong jobs report is the almost inevitable increase in the Fed Funds rate after the Federal Reserve meets next week. I’m referring to the almost certain probability of a rate increase of 95.2%, as measured by the CME Group’s 30-day Fed Fund futures prices. [v]

Many investors believe that higher interest rates may have a negative impact on stock market returns. However, when yields are below 5%, rising rates have historically been associated with rising stock prices. [vi]

In spite of our enthusiasm over the strength in jobs and wages, don’t mistake this for an unbridled green light to take on more risk. Quite the contrary, we do expect normal market corrections of 5% and 10% to occur sometime during the year. This is a normal part of the investment cycle.

Moreover, as I’ve preached many times, don’t think for a moment that you can time these market cycles with any level of consistent success. In my opinion, this is a trap into which many average investors fall. Just look at the data from JP Morgan on a buy and hold portfolio, allocated to 60% stocks and 40% bonds, compared to the consistent buying and selling of the average investor. [vi]

The results are staggering!

Although nerves and jitters may be forming with the pending Fed Funds rate increase and the stock market near all-time highs, the positive trends should continue.

After all economic liftoff is at hand!

If you have questions or comments, please let us know. We always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information, please visit our website.

Tim Phillips, CEO – Phillips & Company

Robert Dinelli, Investment Analyst – Phillips & Company

References:

i. https://www.economy.com/dismal/indicators/releases/usa_employ/D3A09D7C-78EF-4A86-9331-1E38E8A47B82/United-States-Employment-Situation

ii. https://www.bls.gov/news.release/pdf/empsit.pdf

iii. https://www.bls.gov/news.release/empsit.t19.htm

iv. https://fred.stlouisfed.org/series/CES0500000003

v. https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

vi. https://am.jpmorgan.com/blob-gim/protected/1383426387662/83456/MI-GTM_1Q17_March.pdf?segment=AMERICAS_US_ADV&locale=en_US