Story Tellers

"Get your facts first, and then you can distort them as much as you please." – A visionary quote by Mark Twain.

With the election of a new President and the media's prediction for the demise of world order, I think it's important to keep your eyes on the facts that matter to investors most.

There is no doubt that the narrative over the last 8 years is now changing. Not referring to President Obama's politics, but the simple coincidental timing of the bottom of the financial crisis and the start of the U.S. Economic recovery.

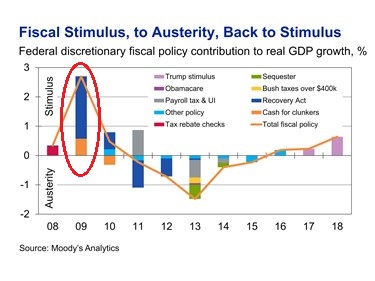

By and large, the last 8 years of economic recovery have been driven by one strong shot of fiscal stimulus and a consistent regiment of monetary stimulation. [i]

Additionally, as you can see from Exhibit 1 below, a clearer impact of the constant monetary stimulus is evidenced by the decrease and increase in the Fed Funds Rate. [ii]

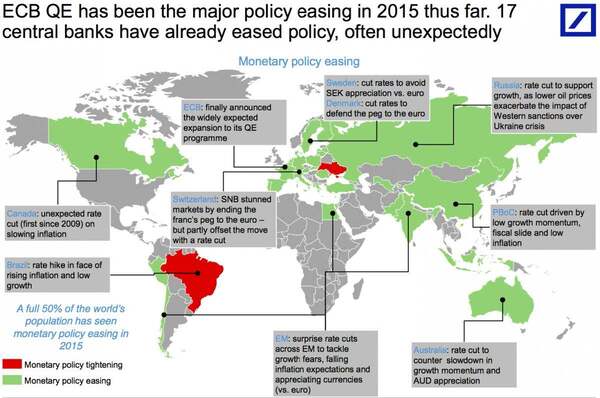

It’s no secret that monetary policy has ruled the global landscape for quite some time now. And when I say ‘global,’ that's no exaggeration of the facts. It’s not just the U.S. playing Russian Roulette with the Fed Funds Rate. A full 50% of the world’s population saw monetary policy ease in 2015 alone. [iii]

As evident by the above chart, changing the story line from lower rates and monetary stimulus, to higher rates and more fiscal stimulus, will likely have rippling effects, not just here in the United States, but globally as well. [iii]

Make no mistake that changing the long-running narrative will not come without some degree of pain and confusion. In an effort to keep the facts straight, let me focus your attention on what I think matters to investors:

1. Earnings Matter – Earnings per share are back in the driver’s seat and are expected to continue throughout 2017. [iv]

2. Wages Matter – More people are at work and are making more money than they have in the last 6 years.

3. Consumption Matters – With the bulk of our economy and earnings driven by consumption, as we outlined in our Q1 2017 Look Ahead, the consumer's health counts:

Consumers have more savings than before the financial crisis. [ii]

4. Debt Matters – While there may be some frothiness to auto and school debt, household debt service as a percent of disposable personal income is at an all-time low. U.S. consumers have much more credit capacity in the form of servicing debt than before the financial crisis. [ii]

Going forward we expect to hear plenty of confusing misstatements, alternative facts, fear mongering, and the creation of fake news, which will be working to interrupt the changing narrative. However, we will stay the course and continue to review the facts that matter to our investors.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Robert Dinelli, Investment Analyst – Phillips & Company

References:

i. https://www.economy.com/dismal/analysis/292377

ii. https://fred.stlouisfed.org/

iii. http://www.businessinsider.com/central-bank-rate-cut-map-2015-2?r=UK&IR=T

iv. http://insight.factset.com/hubfs/Resources/Earnings%20Insight/EarningsInsight_012017.pdf