The Dividend Trump Card

The Dividend Trump Card

Weekly CEO Commentary 5-6-2013

Tim Phillips, CEO—Phillips & Company

The most frequent question I'm being asked right now is, "Can this market continue to move higher?" The short answer, in my opinion, is yes. One basic rule of thumb on investing is anything can happen in the stock market and usually does.

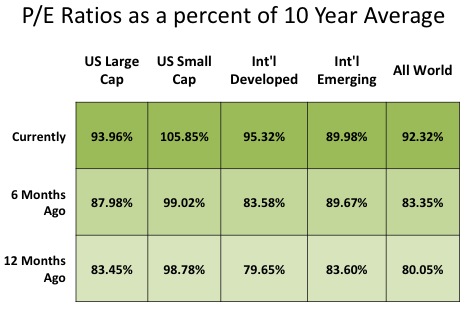

As it relates to our current rally, the best answer is vested in good data. For over a year now, we have seen stock valuations move much closer to their 10-year mean. Keep in mind that for something to have a mean, it must trade below and above that average for a period of time.

Source: Bloomberg LP

Historically, according to data compiled by Yale Economics Prof. Robert Shiller, earnings per share on US stocks grew at a 4.01% annualized rate between 1874 and 2012, and dividends per share grew at 3.46% over the same period.

Image source: Yale University website for Robert Schiller

Currently, the S&P 500 is posting a growth rate of 3.2% for companies that have reported Q1 2013 earnings so far, according to FactSet (May 3, 2013 article “Despite high negative EPS guidance, estimate cuts for Q2 on pace with recent averages”).

Image source: Yardeni Research article “Earnings, Revenues & Valuation: S&P 500 Sectors”, May 6, 2013

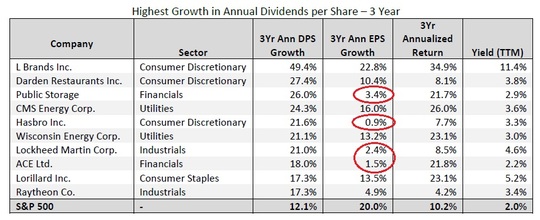

Clearly, companies are growing at a rate below mean averages. However, a close look at dividends can help round out the picture from a fundamental perspective. From a simple math standpoint if a company is growing its earnings at a certain rate and also growing its dividends at a certain rate, its value should grow (based upon a discounted cash flow model).

According to the FactSet Dividend Quarterly (March 28, 2013), aggregate dividends per share (“DPS”) on the S&P 500 grew by 15.9% year-over-year at the end of Q4, and the number of companies paying a dividend over the trailing twelve-month period (“TTM”) hit a new, thirteen-year high of 405 companies (81%).

So while EPS growth is moderating, dividends per share growth is exploding. From an increasing valuation perspective, companies are doing very well once you factor in dividends.

What matters more, dividends per share or earnings per share growth? Recent data might surprise you.

Image source: FactSet Dividend Quarterly, March 28, 2013

You can see from the data dividend growth rates were capable of overcoming some slow earnings growth rates.

While current EPS growth rates look troubling, dividend growth rates look exceptionally strong and perhaps prove to be the trump card when determining stock market sustainability.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company