Turmoil Part ___?

Turmoil Part ___?

Weekly CEO Commentary 9-3-2013

Tim Phillips, CEO—Phillips & Company

We had a spate of economic data released last week some suggesting continued growth:

- Auto sales are expected to rise broadly in August, and are estimated to be an increase of 13% from a year earlier[i]

- The investment component of GDP increased by 4.4% in the second quarter[ii]

- Exports increased by 8.6% in the second quarter[iii]

Some suggest continued sluggishness:

- Consumption, the largest component of GDP, only increased by 1.8% in the second quarter[iv]

- Jobless claims last week were slightly higher than expected, and consensus for Friday’s employment situation report is no change and remaining at 7.4% unemployment[v]

- Personal income growth is still anemic[vi]

What prevailed in last week’s light volume on Wall Street were Syria and our potential military involvement in that country. 100,000 people dead and chemical weapons use is a serious matter.

Notwithstanding the very grave nature of the killings, Syria’s impact as an economic power is very limited to America. The country has about $107.6 billion in GDP (about 6/10th of 1% of our GDP) and only 22 million people (similar to the New York City metropolitan area). The country also has a staggering 18% unemployment rate and 37% inflation rate. They export virtually nothing to the US and we export virtually nothing to them. Most of their business happens with other Middle Eastern countries, such as Saudi Arabia, the UAE, and Iraq[vii].

Addressing the humanitarian issues is certainly a legitimate discussion; however, as it relates to any economic impact, there is little to be concerned with. Even if you consider the larger issues with Iran, which is already under sanctions, there are limited economic effects.

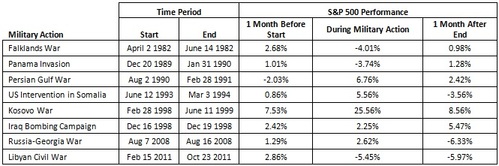

As far as any stock market reaction, consider recent conflicts. You can see on the chart below that there is really no consistent pattern to market performance either before, during, or after the military action[viii]:

Markets during the 1998 Iraq bombing campaign and the Kosovo War continued to rise, largely due to the tech boom, and markets after the Georgia-Russia War fell due to the US financial crisis.

Some leading economists, including Larry Summers, conducted a comprehensive study of non-economic events, such as Pearl Harbor and Kennedy’s assassination:

“They came up with little evidence that non-economics events had a big effect on the stock market. On average, across all 49 events on their list, the S&P 500 moved just 1.46%, less than one percentage point more than the 0.56% that prevailed on all other days. Because of this small difference, the professors concluded that there’s “a surprisingly small effect of non-economic news” on the stock market.” [ix]

The bottom line is we have much more relevant issues to worry about when it comes to market reactions than the Syrian crisis, such as the upcoming debt ceiling debate, fiscal budgets and continued sequestration cuts.

In fact, any temporary pullback derived from a Syrian conflict might bring US equity valuations back to a strong buy level.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company

[i] “Week Ahead: Jobs Report on Friday; Auto, Retail sales”, Wall Street Journal, August 30, 2013

[ii] “News Release: Gross Domestic Product”, Bureau of Economic Analysis, August 29, 2013

[iii] Ibid.

[iv] Ibid.

[v] “Jobless Claims”, Econoday, August 29, 2013. “Employment Situation”, Econoday, September 3, 2013.

[vi] “Personal Income and Outlays”, Econoday, August 30, 2013

[vii] “Syria”, CIA World Factbook

[viii] Performance source: Bloomberg LP

[ix] "What US intervention in Syria would mean", MarketWatch, August 28, 2013