Weekly Market Commentary 8-20-12

Divergence

Weekly Market Commentary 8-20-12

Tim Phillips, CEO – Phillips and Company

The definition of divergence:

Di·ver·gence (diˈvərjəns) Noun: A difference or conflict in opinions.

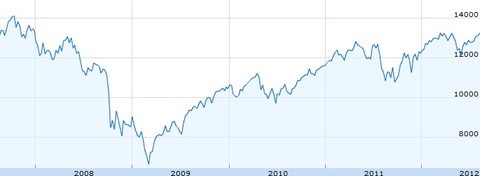

On the one hand, we have the Dow Jones Industrial Average approaching five year highs:

Chart provided by Google Finance

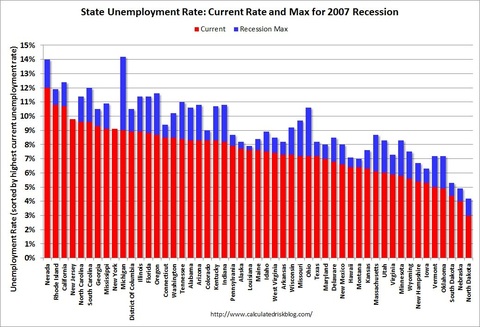

On the other hand, we have the Bureau of Labor Statistics saying 44 out of the 50 states are reporting higher unemployment in July, including New York and New Jersey at unemployment peaks not seen since the beginning of the recession.

So what gives? How can the market be approaching pre-recessionary highs while unemployment is still rising? Is the unemployment data showing signs the economy is losing steam again? Perhaps the market is betting this unemployment data will force the Fed to bail out the economy again.

In my opinion they are both right, for now. For the last two years, economic data has been weak in August, coincidently right before the Federal Reserve’s annual meeting in Jackson Hole, Wyoming.

August 2011*:

- S&P Downgrades USA AAA Credit Rating

- Consumer Sentiment in US falls to three-decade low

- Manufacturing PMI indices weaken from US to China

August 2010*:

- 500K Initial jobless claims – highest reading since November 2009.

- Retails Sales (Ex. Autos & Gas) down 0.1%

- US Existing Home Sales fall to their lowest reading since 2000.

Now cut to the current environment:

- Companies reported weaker revenues

- Unemployment numbers are not improving

Given this weak economic data, the market participants have been trained to anticipate action from the Federal Reserve providing two decent rallies in the equity markets.

On November 3, 2010 The Federal Reserve announced QE2 purchases through June 30, 2011 and in that time frame the S&P 500 rallied 11.72% according to Bloomberg.

On September 21, 2011 The Federal Reserved announced “Operation Twist” and the S&P 500 rallied 18.14% through June 20, 2012 where the Federal Reserved announced they would be extending “Operation Twist” through the end of the year according to Bloomberg.

As economic data began to show weakness in June, the markets began to rally on hopes of additional action from the Federal Reserve. Since June 1, the S&P 500 is up 11.50% according to Bloomberg.

Unfortunately, when market participants anticipate an event, usually there is a hard sell off once the event occurs. We have all seen this with earnings announcements and I believe we could see this with another dose of quantitative easing. Studies show actual events are less fulfilling than the anticipation of those events. I believe an economist won a Nobel Prize for a theory on this (more on him in a future post).

Needless to say diverging perspectives can create winners and losers.

If you have questions or comments please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can Email me directly.

Tim Phillips, CEO – Phillips & Company

Research supported by:

Adam Gulledge, Associate – Phillips & Company

*2010 and 2011 August headline data provided by Bespoke Investment Group