Our Behavior and Bad Decisions

Lately everyone I talk to from small business owners to “the men on the street” are words of doom and gloom. They all express significant doubts about the global economy and think a recession is all but guaranteed at this point.

- Consumer confidence is near a 30 year low, last seen during the “Great Recession.”

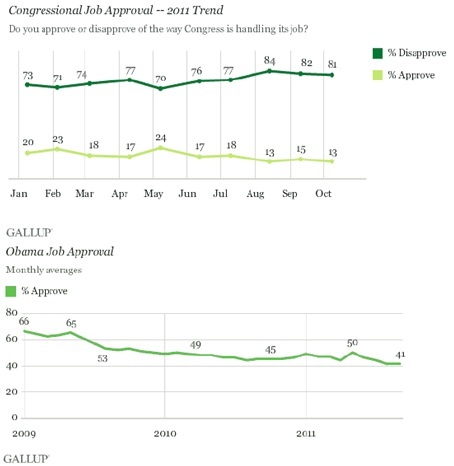

- Congress’ approval rating is at an all-time low – 13%

- Presidential approval rating remains at term-low – 41%

Overall, the mood of the country is awful and the people are targeting Wall St. and K St. for their general malaise.

Despite all of the negativity in the air, the US economy is still posting some signs of growth. To be clear, the signs suggest very slow growth, but growth none-the-less. If you look at the last few weeks of economic indicators most of them have been above expectations. For example, retail sales in September rose 1.1% from last month and 7.9% from the same month last year. Retail sales are now 4.5% above the pre-recession peak.

There seems to clearly be a divergence between the mood of our country and its economic indicators. This phenomenon can happen for a couple of reasons.

The first is that indicators have not caught up to our mood. This is usually the case when only lagging indicators are above expectations. However, we have seen some leading, lagging and coinciding indicators come in above expectations over the last few weeks.

The second is a straight forward but less obvious psychological explanation. Over the course of my 25 year career in money management I’ve made a few observations about human behavior. One observation is people tend to weigh recent events more than prior events.

I believe this is the reason for the divergence between our mood and our economic indicators. We just went through a very traumatic financial crisis that most people have yet to fully recover from. Now, we have a similar situation potentially developing in Europe and those feelings from our own financial crisis might be bubbling up again.

You might be a bit skeptical of my behavioral observation and dismiss it as anecdotal; however, this is actually a well-known cognitive memory bias. It’s called the Peak-End Rule and it’s related to the Recency Effect. This bias was discovered by Daniel Kahneman, an Israeli-American psychologist and Nobel laureate.

Despite the “okay news” from the economic indicators, we are still projecting our fears forward judging our past experiences almost entirely on how they were at their peak and that wasn’t pretty. This is not to say that we aren’t in or heading towards another recession, but I’m suggesting we should be mindful of our human biases and avoid letting them lead us to bad decisions.

A few weeks ago we talked about getting paid for volatility and we continue to look for good investment opportunities that can pay the rent. Including high yield corporate bonds, high dividend US large cap equities and preferred equities.

If you have additional feedback we encourage you to get in touch with us via Twitter, Facebook, or Email me directly.