Weekly Market Commentary 12-3-12

Stock Buybacks: Headline Investing or Looking Under the Hood?

Weekly CEO Commentary 12-3-12

Tim Phillips, CEO – Phillips & Company

Stock buybacks are expected to be on the rise, according to a report in the New York Times. We have already seen Starbucks, Procter & Gamble, and Chipotle announce buybacks, and ADT has announced both a buyback and a dividend. In the past, buybacks were generally viewed as a bullish sign, but there is more to the story. Here is what investors need to look out for to stay prudent.

Why do companies buy back stock?

As investors, the whole reason why we buy a piece of a company is to get a return on our investment. We can do this by either having the value of the stock increase in value, or we can get a return by the company paying a dividend. From a longer term perspective, if the economy is strong and there are lots of growth opportunities for the company, a way to increase value could be for the company to invest back into its own operations and grow the business further.

Clearly, we’re not in an economy where growth opportunities are abundant. But, corporations are sitting on record amounts of cash, so what do companies do to satisfy their investors?

When there aren’t many opportunities to re-invest into their own business, companies have two options. One of them we already discussed which is paying a dividend, but another option is for a company to buy back its own stock from the open market. Like any stock purchase, this puts an upward pressure on stock prices, which is good for investors.

But, there are some things that investors need to watch out for when it comes to stock buybacks.

The earnings management game

“Facts are stubborn, but statistics are more pliable.” –Mark Twain

Stock buybacks can create the illusion of growth when there really isn’t any. Let’s take an example of a fictitious company that has 10 shares of its stock outstanding, and the company makes $50 per year. This means the company has earnings per share of $5. Now, let’s say that one year later the company bought back two of its shares on the open market, and earnings stayed the same at $50. The company would now have earnings per share of $6.25.

That would make earnings per share look like it grew 25% in a year—seems pretty good in this economy!

But, let’s take a step back. Earnings didn’t really change at all; it was flat at $50 in both years. The only thing that changed was the number of shares on the market went from 10 to 8.

Earnings per share growth is one of the more common ways investors use to evaluate companies, but investors need to take this number in its appropriate context. If revenue growth or growth in operating cash flow is flat, but earnings per share growth is high, that might be a red flag that investors need to do some more research.

Real world data: Do buybacks actually work?

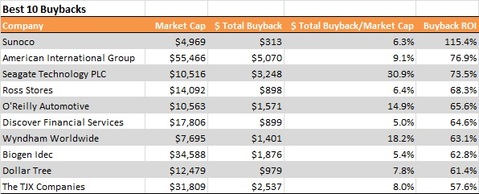

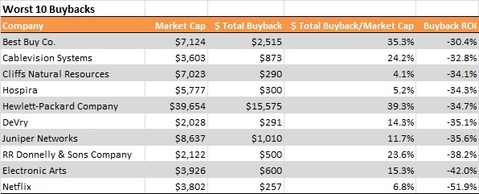

Some companies have had better success than others in giving shareholders value through stock buybacks. Fortuna Advisors and Institutional Investor magazine put together a study, where they ranked “the biggest spenders on buybacks among the members of the S&P 500 based on the two-year returns their repurchased generated.” Of the 253 companies they examined, the data shows quite a bit of disparity.

Here’s the return on investment over the last two years on the 10 best and 10 worst buybacks.

The real world data shows that buybacks have the potential to return value to shareholders, but they are by no means a cure-all if there is a more serious economic problem with the business.

The tax management game

We’re still waiting on the details of what will happen in the fiscal cliff negotiations. As we wrote about previously, one thing we do know for sure is that if nothing changes, the tax rates on dividends are set to go up significantly. The worst case on a dividend tax rate would be a maximum rate of 43.4%, and the worst case on a long-term capital gains rate would be 23.8%.

If this happens, investors may pressure companies to buy back stock rather than pay dividends, as the capital gains would be taxed at a lower rate.

Conclusion

With corporations sitting on large amounts of cash but not many opportunities for growth, expectations are that shareholder buybacks are going to be on the rise, and an increase in the tax rate on dividends could fuel this.

Even though the earnings per share growth would be manufactured from a buyback, I wouldn’t bet against irrational exuberance and investors chasing the headlines. When investors see 15% or 20% earnings per share growth rates, regardless of what the true cause was, we could see a round of speculative buying.

Investors need to be careful though. Buying back stock can, in theory, boost stock prices, but the actual results show there is a significant amount of variance in performance after buybacks.

If you have questions or comments please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Research supported by:

Alex Cook, Associate – Phillips & Company