The Fed: Do we trust them?

The Fed: Do we trust them?

Weekly CEO Commentary 4-22-13

Tim Phillips, CEO—Phillips & Company

“Inflation, not if, when"- A noted Wall Street firm

Like you, all of us at Phillips and Company are very sad at the events that occurred this week in Boston. Our hearts are broken for all the victims.

It made traveling to New York City a little more interesting than usual this week. I had an opportunity to spend a couple days in the city meeting some of the finest minds on Wall Street. (I say that with a healthy dose of skepticism in some cases).

One firm that I admire posited, "Inflation, not if, when". Good question. Getting a feel for this answer can guide investors immensely when it comes to their overall allocation.

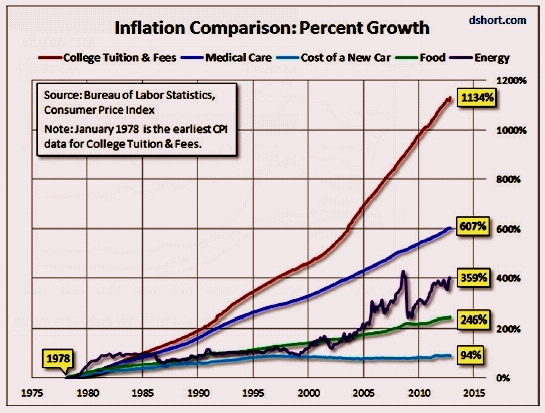

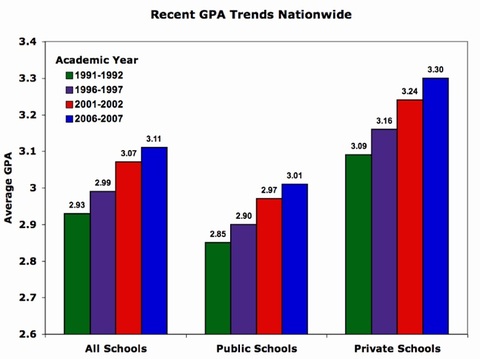

Here's the problem: I'm not sure it's a "when" question as much as it's an "if" question at this point in our cycle. No question when you look at food prices, taxes, health care, higher education—and don't forget grades—you see some serious inflation.

Source: gradeinflation.com

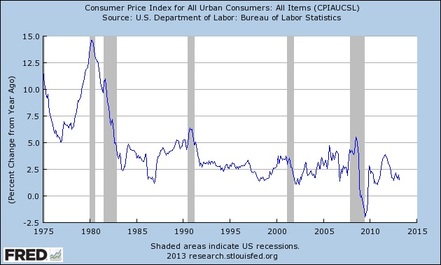

But, for the last 30 years, we have seen the rate of inflation trend downward. Granted there are issues within the measurement. Nonetheless, all things being equal, inflation has been an "if" question and not a "when” question.

Granted, there are issues within the measurement. Nonetheless, all things being equal, inflation has been an "if" question and not a "when” question.

What are we facing now?

Noted professionals have been pounding the "When vs. If" paradigm for decades:

“Among the biggest worries have been higher import prices generated by the decline in the dollar’s value over the past year and increased wage demands from the nation’s workers. Even the trade bill pending in Congress and the new immigration law could add to the upward pressure on inflation, some economists said.” –Associated Press article from August 8, 1987

“Once inflation starts in the US, it usually is not interrupted until a recession.” –Allen Sinai, chief economist for Boston Co. Economic Advisers, quoted in January 20, 1988

Inflation, loosely defined, is a function of too many buyers vs. sellers, more dollars vs. more goods and services, and more demand than supply.

The challenge we face in our economy is from the demand side.

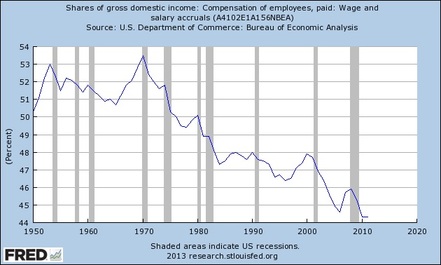

First, look at wages as a percent of the economy (44 percent currently). Wages are not rising and in fact have been steadily falling. You can see this on the chart below:

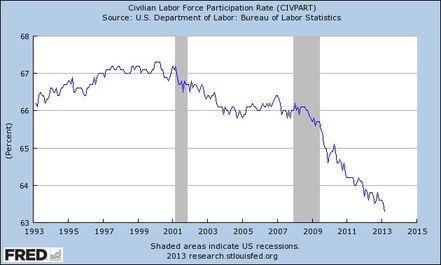

Secondly, there are fewer workers who spend that 44 percent. The total rate of unemployed and underemployed Americans is 13.8 percent. Also, the labor force participation rate has been dropping since 2000, as you can see below:

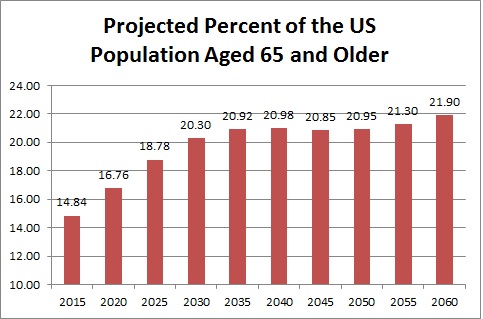

Third, you can see a trend if you look at American demographics and aging. Assuming older Americans 65 years and older consume less (eat less, go out less, need smaller homes, fewer cars), inflation gets a little harder to see.

Source: US Census Bureau

The one noted exception is health care. While it might be inflationary for the government, because health care is a social cost, the government passes the cost increases along to producers in the form of higher taxes. This is deflationary when it comes to producers having money to consume other goods and services.

Changing paradigm

Structurally, we also face technological changes. In the book "Nothing Like it in the World...." by Stephen Ambrose he noted the systemic economic shift brought on by the completion of the Transcontinental Railroad. Travel costs dropped from $1,000 a person to $150.

More recently, we saw the same thing with the internet and telecommunications. In 1956, an international phone call on the original trans-Atlantic cable cost $12 for three minutes. Compare that to services now like Skype that let you call people or video conference globally for free using your existing internet connection.

No inflation there, because of new technology that lowered costs.

What this all means

While I know this time is no different than other times, I would not expect inflation to rear its ugly head in the coming couple of years. Perhaps in 2015, which is how far out the Fed says it will maintain “exceptionally low levels” for interest rates.

Banks are still not lending and with the excess reserve interest rate and inflated FICO requirements, it looks like it could be a while before they pump the economy with their excess cash.

What I would do is trim duration risk, be patient with cash and work to squeeze more risk out of the portfolio through correlation diversification.

"If, not when" seems to be answered for us by the Fed for now at least. The real question is: do we trust them?

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company