Earnings Must Deliver

As many of our regular readers and clients know, Phillips and Company publishes a Quarterly Look Ahead. Here is a link to the 2014 Q3 presentation with an audio narrative. We attempt to give a look at the most pressing issues that will impact portfolio values in the coming quarter.

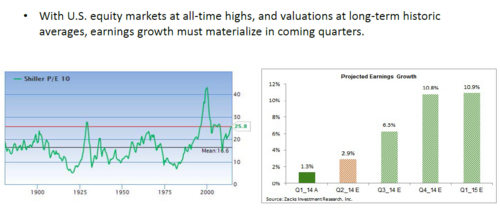

In one of this quarter’s slides, we discuss the fact that "Earnings Must Deliver."[i]

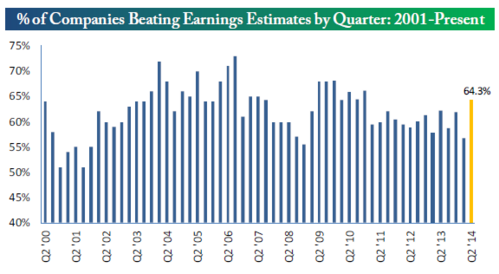

It seems relevant to give you a quick update on how earnings are actually coming in during this season. Our friends at Bespoke have compiled the following chart showing the percentage of companies beating earnings estimates by quarter.[ii]

Taken at face value, earnings are delivering and exceeding expectations.

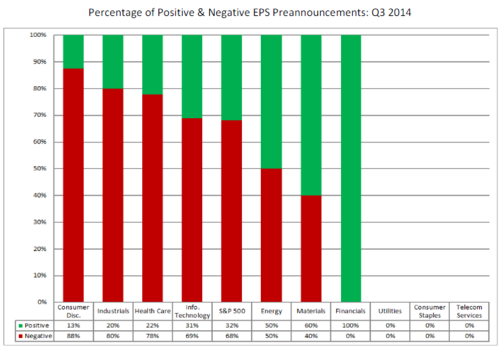

Even more important than the earnings reports for Q2 is the guidance for Q3 from CFOs and executives. After all, the "Wall Street Peanut Gallery" or sell-side analysts have created the expectation we will see earnings grow by as much as 6.3% in Q3.[iii] For my money, I will go with the financial folks in the companies versus the Wall Street analyst crowd.

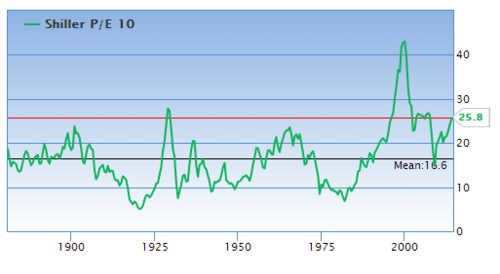

Realize with market valuation trading at near historic highs, US equity markets are poised to correct on the slightest disappointment.[iv]

Unfortunately, we are seeing some very dismal numbers being forecast for Q3. This graph from FactSet shows that a majority of Q3 EPS preannouncements so far have been negative.[v]

While it's still the middle of earnings season, the guidance is not suggesting a strong Q3 and there is certainly a potential for disappointment to market participants.

At this point in time, I strongly suggest bracing for some potential volatility in the coming quarter and a higher probability for an earnings-induced correction.

I know what many of you might be thinking. Why don't I sell now and reinvest later? Here is the answer in multiple choice format.

Answer: (d) All of the above.

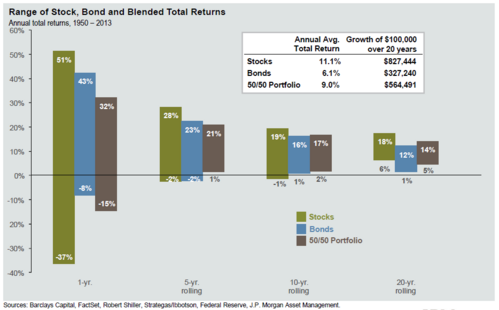

The time when you will need your resources should never be left up to the vagaries of the markets. If you think that you will need to draw money from your pool of equity capital within a 5-year window, adjustments to your portfolio are highly recommended. Again, from our Quarterly Look Ahead, time can shape risk if you have enough of it.[vi]

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Jeff Paul, Senior Investment Analyst – Phillips & Company

References

[i] Phillips & Company. (July 2014). Q3 2014 Look Ahead. p 5.

[ii] Bespoke Investment Group. (July 25, 2014). The Bespoke Report: Storm Clouds Brewing?

[iii] Phillips & Company. (July 2014). Q3 2014 Look Ahead. p 5. Data from Zack’s Research.

[iv] Phillips & Company. (July 2014). Q3 2014 Look Ahead. p 5. Data from GuruFocus.

[v] Butters, J. (July 25, 2014). Earnings Insight. FactSet. p 14.

[vi] JP Morgan Asset Management. (June 30, 2014). 3Q 2014 Guide to the Markets. p 64.