A Little Inflation a Bit More Equity

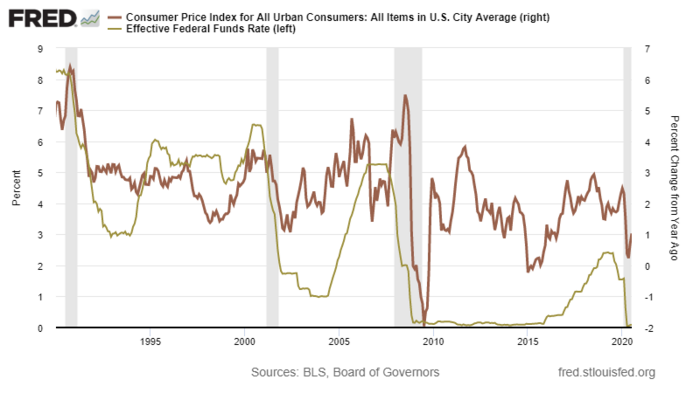

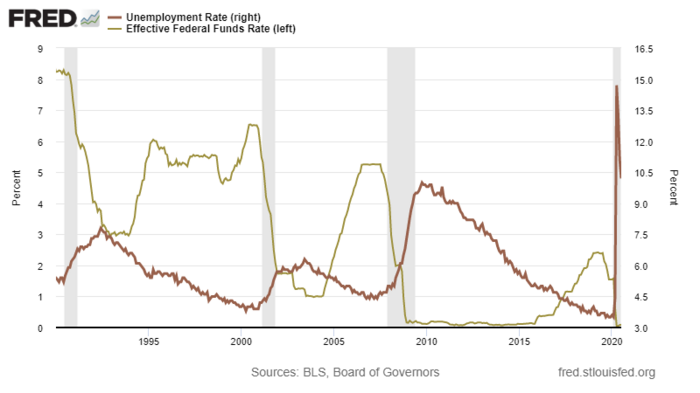

I’m sure most didn’t look at Chairman Jerome Powell’s statement as it relates to the Federal Reserve’s modification to their long-standing inflation target policy last week. He was addressing the dual mandate Congress gave the Fed to create price stability and full employment. Before I get to the salient points, it is critical to know what the Fed uses as their primary tool: interest rate control to manage the tensions between these two mandates.

When inflation runs hot and wages rise (caused by low unemployment) the Fed can raise rates, creating a drag on the marginal propensity to consume, decreasing employment, and, therefore, wages. [i]

When unemployment is running high (like it currently is) they can lower rates and stimulate the marginal propensity to spend, increasing employment and wages. [ii]

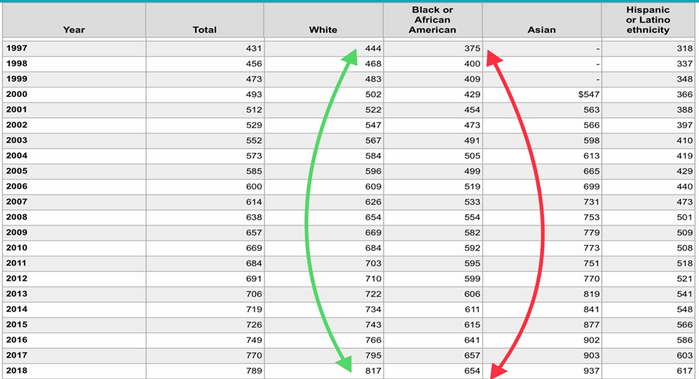

The challenge with this dual mandate is choking off the momentum of the economy just when employment and wages start to rise, and lives begin to improve. The question is, has this mandate had a negative impact on wages for people of color in America?

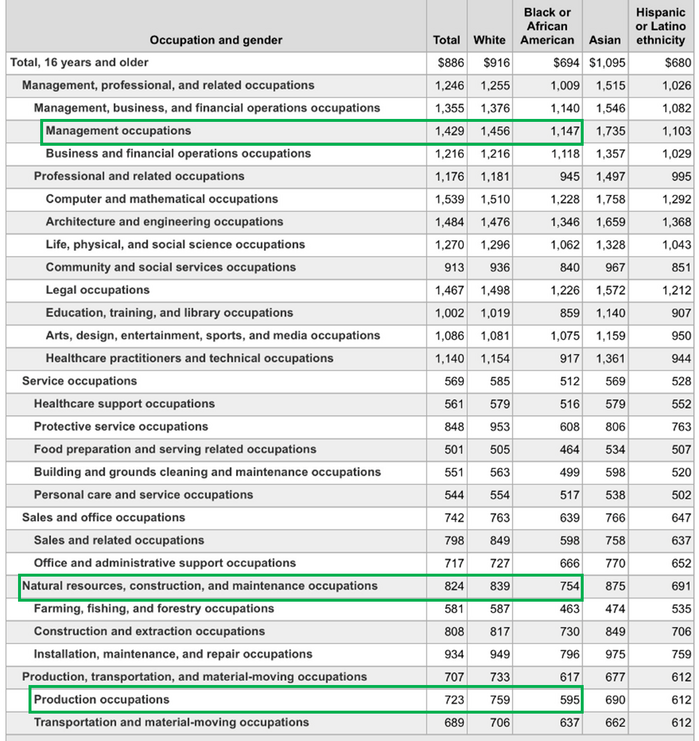

First, let’s look at the general wage disparity over the last 21 years. Black or African American wages grew by 74%, while wages for White workers grew by 84%. [iii]

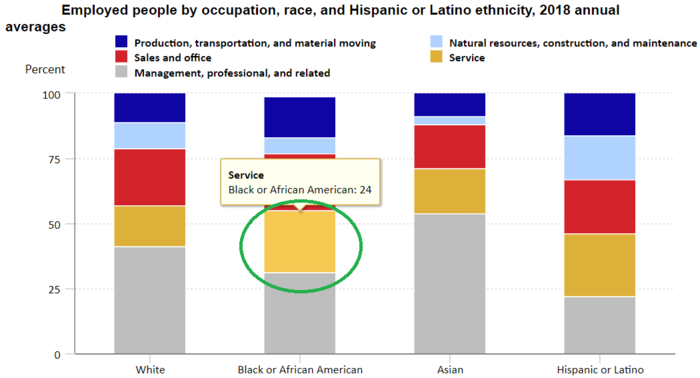

When you look at what general occupations Black or African Americans occupy at a higher rate than other groups and segments, it is in service occupations. [iii]

It would be fair to point out that anyone working in the service sector is significantly disadvantaged versus other sectors. Unfortunately as more Black or African Americans occupy these jobs by percent of cohort, you can see the additional challenges. According to the Bureau of Labor Statistics, Black or African American generally receives lower wages by 19.7% in management jobs, 17.7% lower wages in production jobs, and 8.5% in natural resources, construction, and maintenance jobs. [iii]

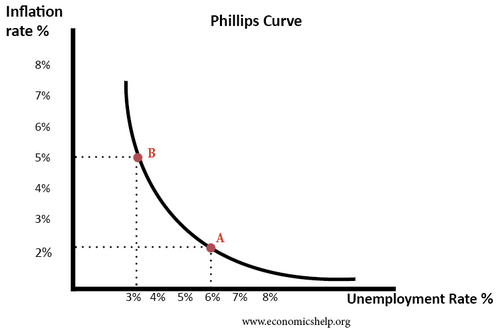

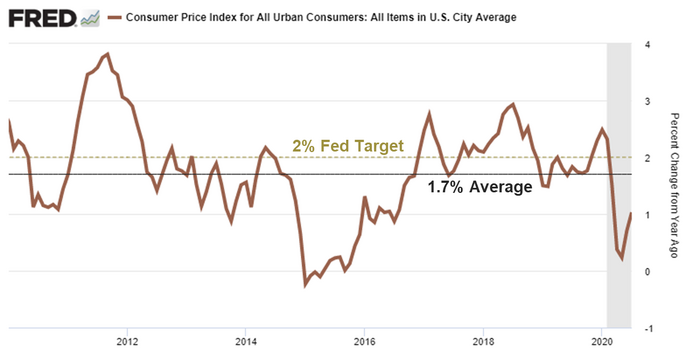

Let’s connect the dots back to the Fed and their prior policy stance. Their stated policy was to target a 2% inflation rate, using employment as a gauge in seeking that target rate. When the economy was deemed to be running at “full employment,” the Fed might tap the breaks on the economy to manage inflation. The Phillips Curve [no relation] has driven this philosophy for a very long time. [iv]

Their newly minted policy adjusts the 2% inflation target to factor in an average of 2%, not the previously hard target of 2%. It’s nuanced but the implications are significant. While the Fed does not state a time frame to form the average, we can surmise it will be awhile before we operate above 2% based upon how long we have operated below 2%. [v]

Here is what Chairman Powell said, as it relates to the new policy: [vi]

“Many find it counterintuitive that the Fed would want to push up inflation. After all, low and stable inflation is essential for a well-functioning economy…However, inflation that is persistently too low can pose serious risks to the economy…The result can be worse economic outcomes in terms of both employment and price stability, with the costs of such outcomes likely falling hardest on those least able to bear them.”

So, with the Fed allowing for a policy of lower interest rates for longer, this should permit jobs to grow and perhaps wages to grow at a higher than natural rate.

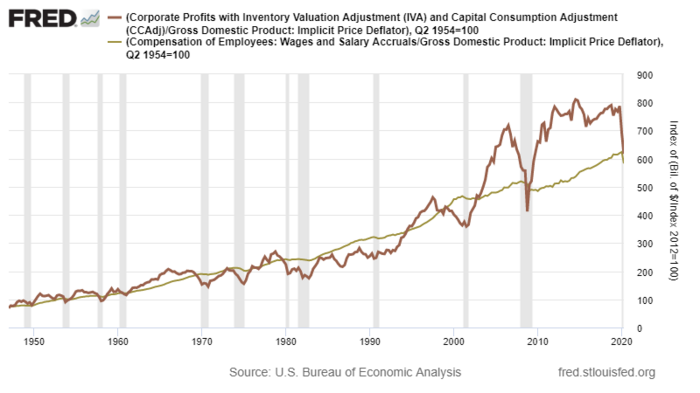

The impact on profits will be a critical factor for investors to watch as the Federal Reserve adjusts to a different measurement standard. Rising wages will have an impact on profits, but I don’t underestimate corporate America’s ability to adapt. [vii]

Certainly, the turmoil in the world has elevated our collective thinking about health and welfare for Americans. It undoubtedly has shined a light on our consumption-oriented, Keynesian economy. Allowing both jobs and wages to grow for all Americans is a good thing, especially Americans receiving less than their White counterparts. Modest inflation might be worth the price for a little more equity.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://fred.stlouisfed.org/graph/?g=v1eL

ii. https://fred.stlouisfed.org/graph/?g=v1eP

iii. https://www.bls.gov/opub/reports/race-and-ethnicity/2018/home.htm

iv. https://www.economicshelp.org/blog/1364/economics/phillips-curve-explained/

v. https://fred.stlouisfed.org/series/CPIAUCSL#0

vi. https://www.federalreserve.gov/newsevents/speech/powell20200827a.htm

vii. https://fred.stlouisfed.org/graph/?g=v1cm