A Little Sour

If you have been reading our recent posts, you know we have become increasingly concerned about corporate earnings growth. Although speculators will make investments based upon a host of reasons, we tend to stay focused on what matters...earnings.

Earnings have been abysmal in the first quarter as you can read from our prior writing. We also know Q1 US economic growth matched earnings with anemic growth, which could be revised to a contraction in the coming update on May 29th.[i]

It now appears consumers are starting to feel a little bit sour about their finances according to the widely used University of Michigan Consumer Sentiment Survey.[ii]

This is a survey based on at least 500 calls made in the United States asking consumers several questions.[iii] From this data we get a picture of how the US consumer is feeling. Before we get to the data from the latest report, it's important to understand why this is important.

- Consumers make up about 70% of US GDP; basically the foundation of the US economy is consumption driven.[iv]

- Any trends that can be gleaned from consumers on how they are doing can be instructive to how we allocate assets, especially when US equity prices are on the upper end of valuations.

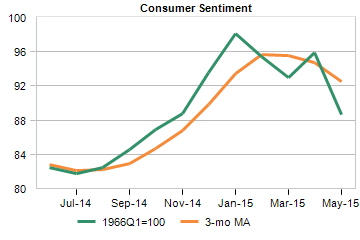

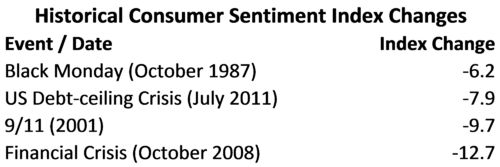

In the latest reading, consumer sentiment dropped a whopping 7.3 points from 95.9 to 88.6 (normalized scale where the 1966 Q1 value = 100).[v] A casual observer might conclude the overall drop is not very large. However when you consider how the index performed during some pretty bad times in our economy, you can start to contextualize the concern.[vi]

These were big events with big drops, comparable to what we saw this month.

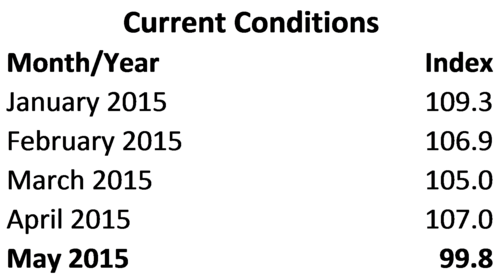

The real sour juice is found deeper down in the data set, well below the headlines. The current conditions measurements show consumers that are feeling much worse about their current conditions.[vii]

People are also feeling much less optimistic about their personal finances.[viii]

- Only 39% of the respondents felt better about their personal finances from a year ago versus 47% that felt that way last month.

- Further, 32% of respondents say they are in worse financial shape now than they were a year ago, a 5-percentage point rise since last month.

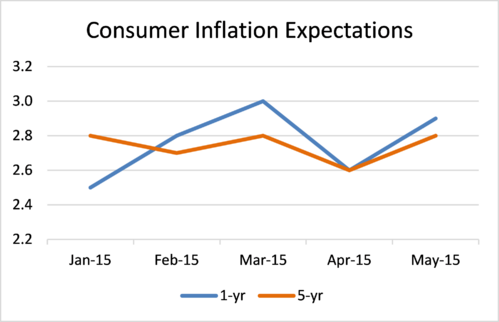

Finally, consumers are expecting inflation to rise.[ix]

The sum total is a consumer that is less confident in their personal situation and expects inflation to eat away more of their income. SOUR!!!!

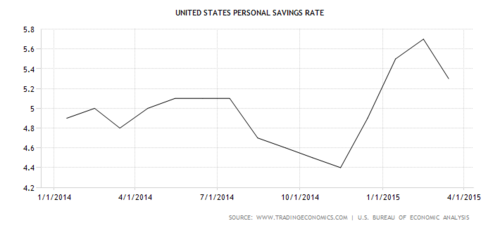

Perhaps this is reflected in the consumer savings rate, which is creeping up.[x]

While I still expect the consumer to spend down their gas savings in the coming quarter, I'm certainly watching consumer enthusiasm closely.

How do we react to this data? First, this is volatile data as we all know consumers (all of us) can change their opinions quickly. Second, we need to continue to find asset classes that are cheaper to own:

- Small cap growth over large cap value.

- Emerging markets over US equities.

Continue to diversify and tilt to protect gains, buy what's cheap and lower risk.

We will continue to do exactly these things as long as US consumers do not give up their multi-generational shopping spree.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Jeff Paul, Senior Investment Analyst – Phillips & Company

References

[i] Bespoke Investment Group. (2015). The Bespoke Market Calendar 2014/2015.

[ii] Kelley, N. (May 15, 2015). United States: University of Michigan Consumer Sentiment Survey. Moody’s Analytics.

[iii] Wikipedia. (May 18, 2015). University of Michigan Consumer Sentiment Index.

[iv] JP Morgan. (April 2015). Guide to the Markets 2Q 2015.p 16.

[v] Kelley, N. (May 15, 2015). United States: University of Michigan Consumer Sentiment Survey. Moody’s Analytics.

[vi] University of Michigan. (May 2015). Index of Consumer Sentiment. Surveys of Consumers.

[vii] Kelley, N. (May 15, 2015). United States: University of Michigan Consumer Sentiment Survey. Moody’s Analytics.

[viii] Ibid.

[ix] Ibid.

[x] TradingEconomics.com. (May 18, 2015). United States Personal Savings Rate.