Being Negative

This Friday we will get another report on U.S. Personal Income, and I suspect it will continue to show real wage growth – that’s wages growing at a faster pace than inflation. This has been a trend for almost a year. 1

This one data point is really the key driver to ongoing consumption and GDP growth. The U.S. consumer is earning more money net of inflation. In the end, that adds more real dollars to their pocketbook.

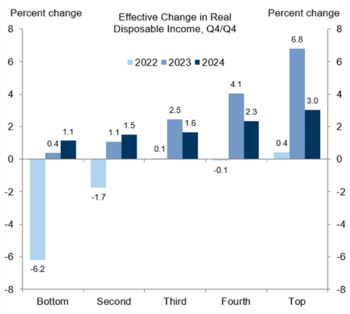

Disposable personal income, that’s income after taxes, is also outpacing inflation. Remarkably it’s across all income cohorts which is significant as those in the lower income brackets tend to spend more of their income on consumption than those in the upper income bracket. That’s a dramatic improvement since 2022. 2

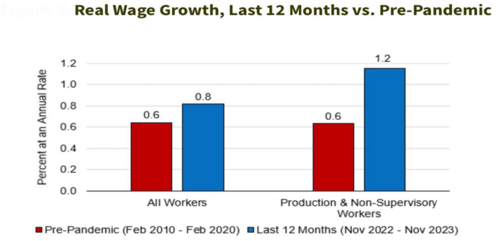

Real wage growth in the last 12 months has outstripped pre-pandemic real wage growth according to the BLS (Bureau of Labor and Statistics). That’s remarkable when you think about how much inflation Americans have faced over the last year. 3

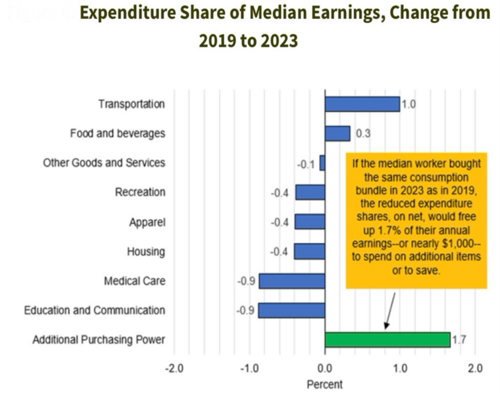

Again, according to the BLS, that real wage growth equals about an extra $1,000 to either save or spend for the median wage earner. That is some serious fuel for consumption or savings. 3

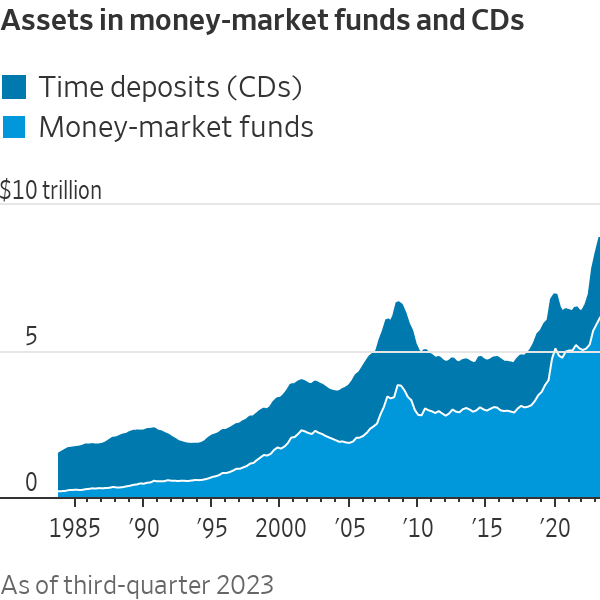

I believe that is one of the main drivers for the mountain of cash sitting in bank accounts and money markets. Nearly $9 trillion is a massive consumption arsenal. Whatever the catalyst to unlock those savings; the outcome will be more consumption and even better corporate earnings growth. 4

Oddly enough, Americans still seem to be in a sour mood. They look at the general economy, and inflation specifically, as a problem according to Gallup. Although their collective anger at Government is slightly higher than that of the economy. 5

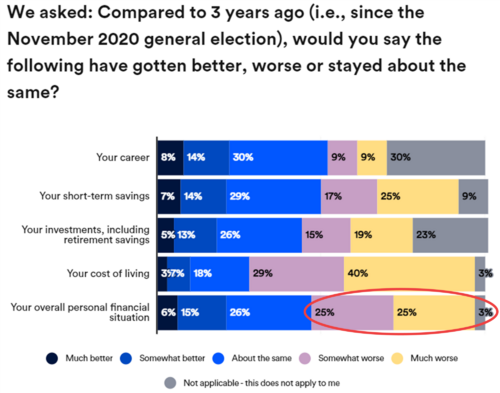

In another survey from Bankrate, Americans confirmed their displeasure with their current financial circumstances. Over 50% said they are doing worse than before the pandemic. 6

Despite the real wage growth, Americans are pretty dour about their personal circumstances. While I don’t know all the possible catalysts to unlock those gargantuan savings accounts, Americans will need to feel much better about their financial lives.

Being negative seems to be the theme of the day regardless of how much workers are making. As a side note, if there is a formula for a soft economic landing it will likely reside in the real wage growth that keeps workers consuming and companies growing earnings.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.statista.com/statistics/1351276/wage-growth-vs-inflation-us

- https://research.gs.com

- https://www.bls.gov

- https://www.wsj.com/finance/investing/the-8-8-trillion-cash-pile-that-has-stock-market-bulls-salivating-0a1b4a8c

- https://news.gallup.com/poll/1675/most-important-problem.aspx

- https://www.bankrate.com/personal-finance/biden-economy-and-personal-finances-survey/#cost-of-living