Disappointing, But Not Devastating

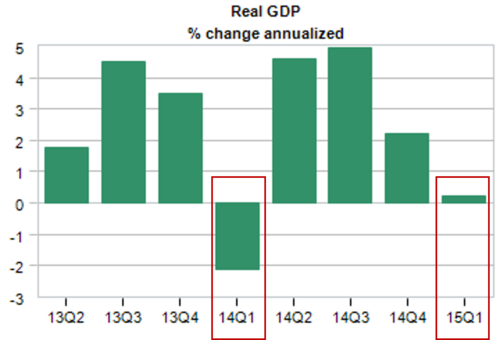

As we anticipated in last week’s post, US GDP did come in at a very disappointing 0.2% growth.[i] This was anemic and also much slower growth than the expected growth of 1.0%.[ii]

When you examine the component parts of US GDP, (Consumption + Investment + Government Spending - Net Exports), there are signs of hope and despair.

- US Consumers held up their end of the bargain by willingly spending in spite of tough winter conditions. They added 1.31 percentage points to GDP.[iii]

- US Businesses grew more optimistic about the consumer by increasing inventories and adding 0.74 percentage points to GDP.[iv]

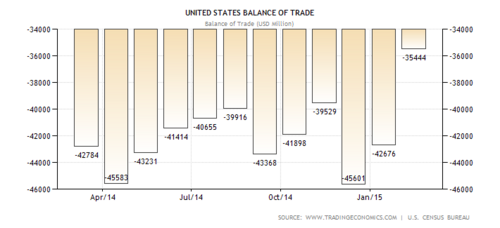

- The big drag (no surprise) was the massive headwinds created by a huge, strong-dollar-induced trade deficit. Net exports subtracted a whopping 1.25 percentage points from GDP.[v,vi]

US GDP was in a similar position last year at this time contracting by 2.1%. In some regards, we are a little better off.[vii]

One big difference between today and this same time last year is in corporate earnings.

When you look back at Q1 2014 earnings, you see US companies in much stronger shape than today.[viii,ix]

While both periods had analysts predicting earnings shrinking, actual results vary substantially. We had decent growth in Q1 2014, but now we are facing an earnings drought.

Certainly more volatility will be in our future and that's observable for most watching their portfolio values.

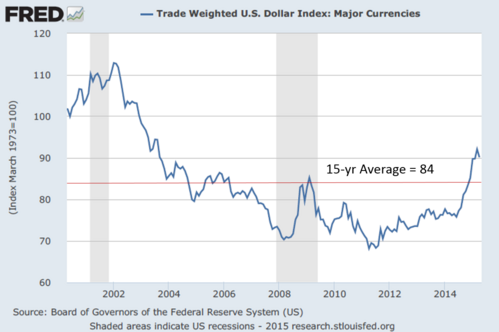

What's less obvious is how much more earnings, trade, and GDP headwinds we have to face from a continued strong dollar. The dollar is up over 18% since it began its rally in mid-2014.[x] However, when looking at the trade-weighted dollar over longer periods of time, you can see we may have more to go.

A strong dollar has not been devastating at this point and the consumer is anything but disappointing. With lots of fire power in the consumer’s wallet (income growth, credit and savings accounts), we can see the US economy stumble forward for the foreseeable future while we continue to fight a strong dollar.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Jeff Paul, Senior Investment Analyst – Phillips & Company

References

[i] CNBC.com. (Apr 29, 2015). US economy stalls in Q1 as weather, lower energy prices bite.

[ii] Ibid.

[iii] Hoyt, S. (Apr 29, 2015). United States:GDP. Moody’s Analytics.

[iv] Ibid.

[v] Ibid.

[vi] TradingEconomics.com. (May 4, 2015). United States Balance of Trade.

[vii] Hoyt, S. (Apr 29, 2015). United States:GDP. Moody’s Analytics.

[viii] Butters, J. (May 23, 2014). Earnings Insight. FactSet.

[ix] Butters, J. (May 1, 2015). Earnings Insight. FactSet.

[x] Federal Reserve Economic Board. (May 4, 2015).