Is That Possible?

Phillips & Company is privileged to service thousands of investors, from foundations and family offices to CEOs and those trying to save for retirement. We also get to interview capital allocators and asset managers around the world. This combination gives us what I believe is great insight into what the supply of money is doing and what those that demand returns are also doing.

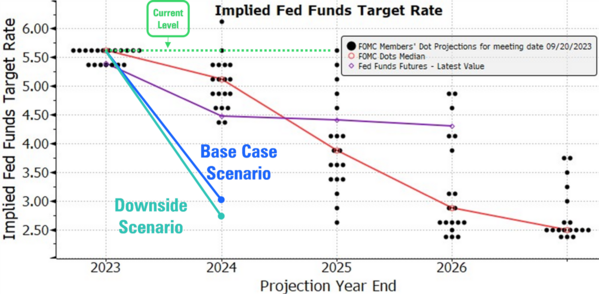

Recently, I interviewed one of the largest cash management teams on Wall Street who foresees further cooling in inflation and slower global growth. Their 12-month forecast for the Fed Funds rate is 3% in a base case and 2.75% in a downside scenario. They also anticipate a soft landing for the economy or a very mild recession.

So how do you get such a dramatic drop in the Fed Funds rate without economic destruction? Is that possible?

It turns out, that it could be possible.

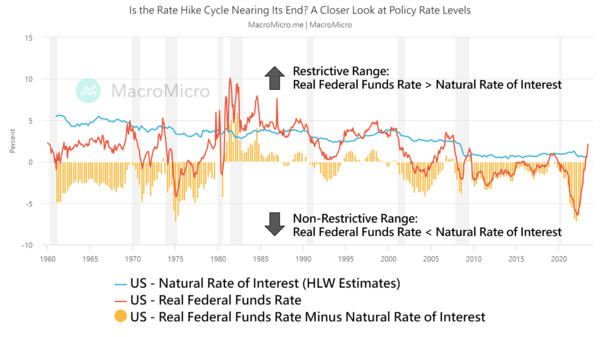

Follow me on this. On September 20, 2023, Jay Powell said that the Fed’s policy stance was “restrictive” and was putting “downward pressure on economic activity, hiring, and inflation.” 1

A restrictive Fed Funds rate means that the Federal Reserve has raised interest rates to a level that is high enough to slow economic growth and reduce inflation. Mission accomplished. 2

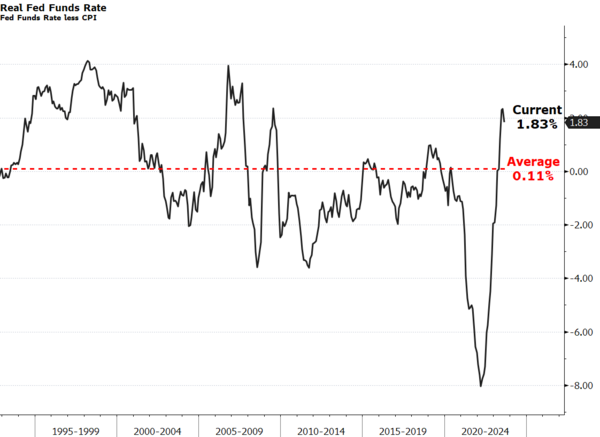

At some point they will need to move to a neutral interest rate policy. That is an interest rate policy that is neither expansionary nor contractionary. To achieve that neutral rate, the Fed Funds real rate should be near zero. The real Fed Funds rate is the nominal Fed Funds rate (what you hear on TV) minus inflation. That’s also about the historic standard. 3

In our current case (see charts above), the Fed Funds policy rate is restrictive by 1.8% when you consider the Fed Funds rate at 5.5% and inflation at 3.7%.

Currently, the long treasury bond has been massively destructive (remember, banks are buried with these). In fact, the rout in long treasury bonds has been more destructive than investing in tech during the dot-com bubble in equity markets. 4

The Fed will need to make adjustments to the yield curve in order to move towards a neutral stance – perhaps as soon as the end of Q1 2024. Between the banks’ balance sheet destruction and the real-world implications from extremely restrictive policy, the Fed will have to react if they want that soft landing. 5

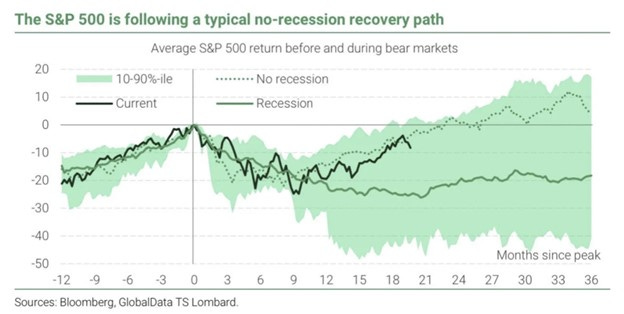

If it is possible that we could see a Fed Funds at 3% by this time next year, investing in long bonds now along with the S&P 500 might make for a great opportunity. It looks like we are on that path.

It’s possible!

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: