Looking Ahead

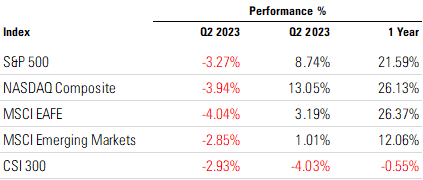

Equity markets declined in the third quarter after the strong market rally seen in the first half of the year. 1

Take a look at how we see the coming quarter by clicking on this link to our Q4 2023 Look Ahead.

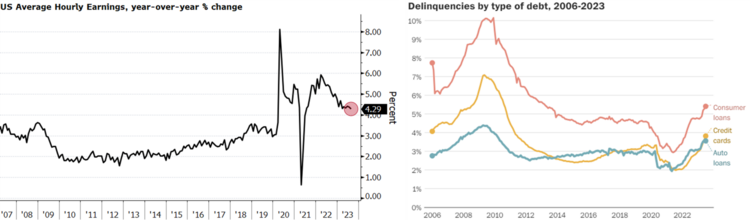

After a prolonged period of rate increases, the U.S. consumer is starting to show some early signs of distress as wage growth is moderating and credit delinquencies are on the rise. The degree of consumer distress will determine the future interest rate trajectory; however, we expect a contained amount of strain as higher wages continue to present needed consumption firepower. 2 3

Our Look Ahead for Q4 lays this out in greater detail.

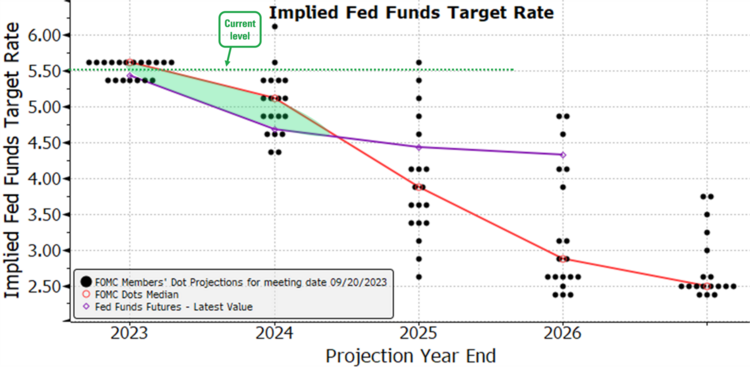

Our expectation is for the Fed to raise rates one more time in this cycle, however the gap between the Fed’s forecast and investors suggests another round of volatility as the course for future rates continues to be debated. 4

Click here to listen to all of our views on what we think will happen with the Fed and interest rates in Q4.

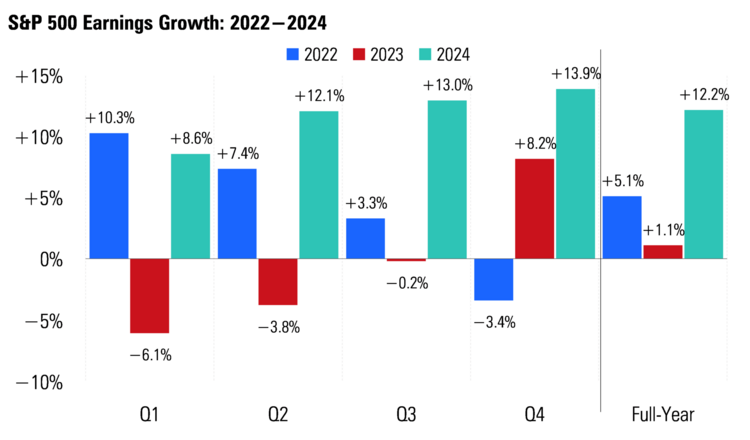

As for earnings growth, we are in a soft patch currently, but that should be in our rearview mirror. It’s not hard to see the hurdle rate for 2022 earnings growth was harder to beat for calendar year 2023. Yet, 2024, by comparison, will get the benefit of the weak earnings growth seen in 2023. 5

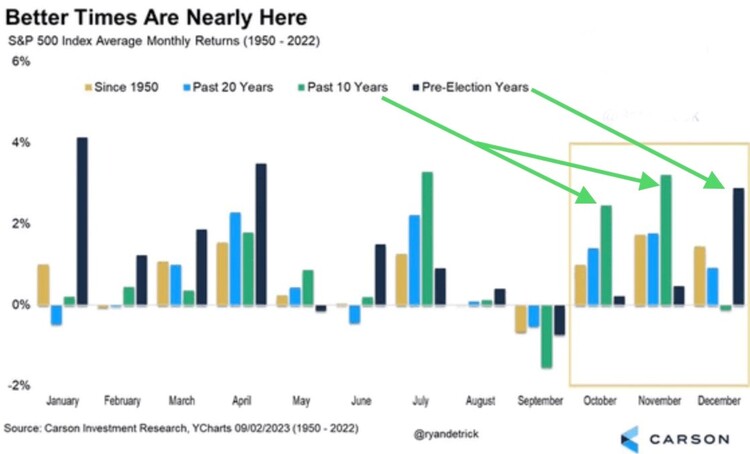

Historical patterns for the fourth quarter – especially in a pre-election year – are positive, suggesting a stronger finish to the year for equities as we emerge from the earnings growth slumber. 6

Take a look at our Q4 2023 Look Ahead here

Watch our narrated version here

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: