Looking Under the Hood

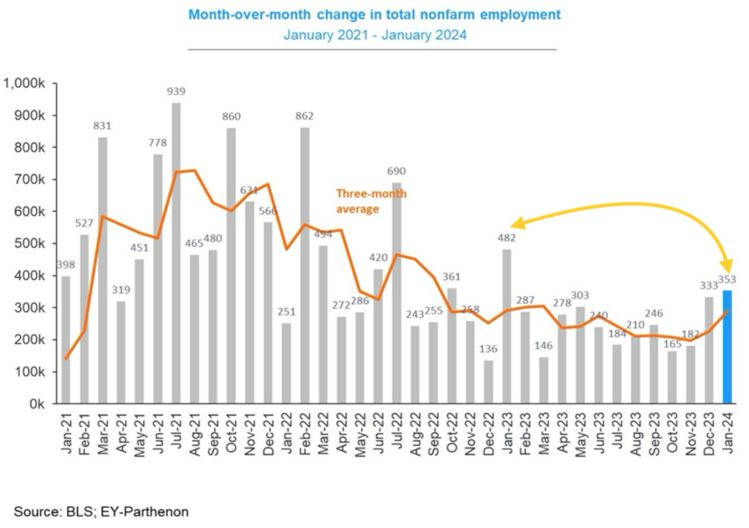

The January Jobs Report was released on Friday and the headline number put an end to the March Fed interest rate cut, as the U.S. economy added 355k jobs – much stronger than expectations. 1

Oddly enough, we had the same type of jobs surprise in January of 2023. There is certainly something lurking under the hood of the headlines that is worth uncovering.

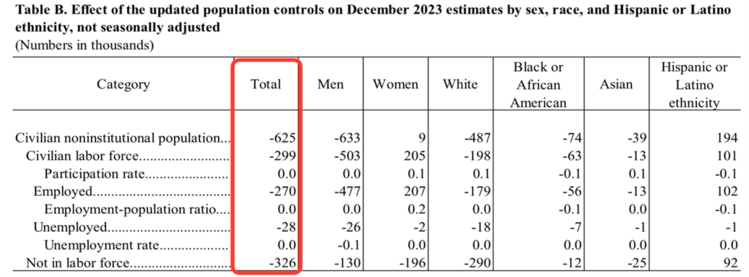

The easiest place to look is in the data tables provided by the BLS (Bureau of Labor Statistics). What you will find is an adjustment each December. The BLS makes a population control adjustment and while it’s not clear how it skews the January 2024 numbers, it clearly does.

Last year, the population control adjustment had the U.S. economy losing 625k jobs in December. Something is clearly amiss in the way the jobs report is being managed. While we should believe the economy is very strong, it’s probably not as strong as suggested. 2

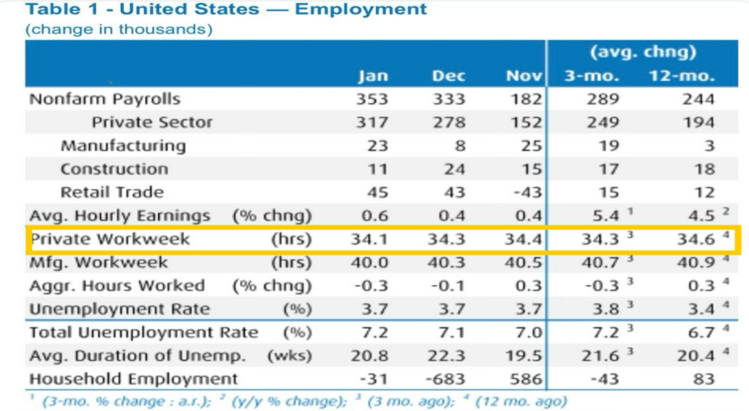

Looking under the hood further you see there was a spike in average hourly earnings. This number would suggest wages went up substantially and that’s another red flag for the Fed when trying to fight inflation. However, the bump in wage gains is most likely driven by a historic drop in hours worked. So, while average hourly earnings rose by 4.5% on a year-over-year basis, the average work week dropped by 0.5 of an hour. 2

By the way, that’s the lowest number of hours in a work week since 2010. 3

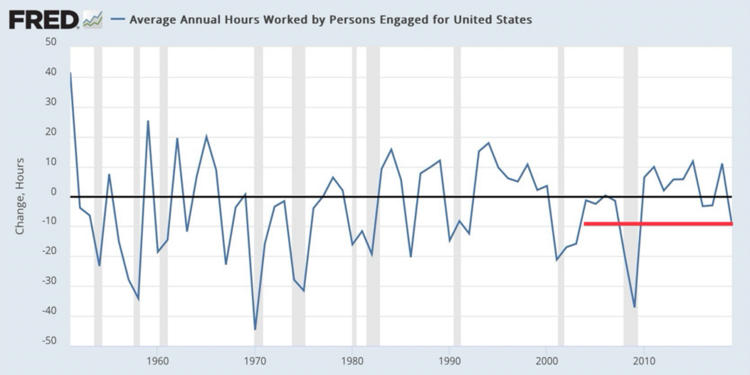

In summary, the U.S. Government will tell us that between January 2023 to January 2024 the U.S. economy added 2.9 million jobs. Yet during that same period, people worked less hours on an annual basis. That’s like losing 1.9mm jobs.

The actual job equivalent growth is about one-third of the reported total, or about 1 million jobs added. While that’s strong, it’s not nearly as advertised. This is how the Fed can get caught looking at the wrong scoreboard.

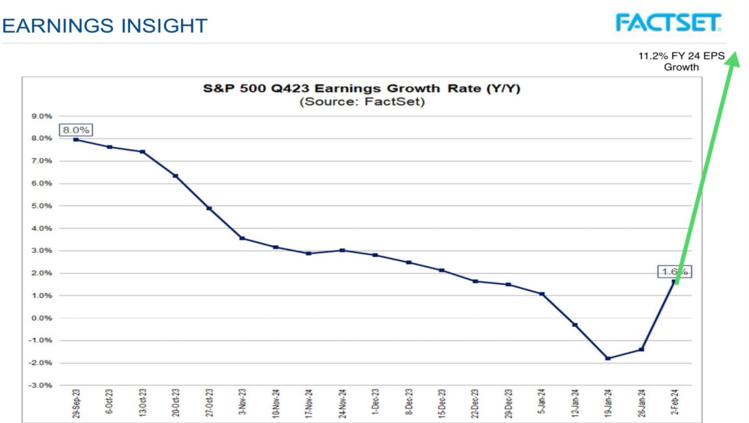

The good news is investors really should focus on earnings growth as the main driver of portfolio support. The recent earnings season suggests corporate earnings are turning around. With 45% of S&P 500 companies reporting, we are looking at a second consecutive quarter of positive earnings. Year-end expectations for EPS growth at 11.2% would be a welcome breakout from months of declining corporate earnings growth. 4

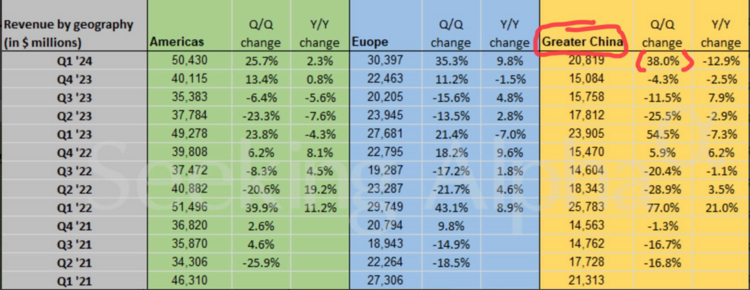

Apple is a great example of another misleading headline. The story we were fed was “Apple disappoints due to a drop in China sales.” Daniel has that very thoughtful look in his photo below, but he must be missing something. Let’s look under the hood one more time. 5

Looking at the earnings data tables, Apple tells an entirely different story. 6

China revenue was up 38% quarter-over-quarter. That certainly matched our visit to various Apple stores in China. Yes, on a year-over-year basis Apple’s sales in China were down 12.9% but the recovery in China is well underway. Again, had this “Technology Editor” looked under the hood he might have had a different headline. But that probably wouldn’t generate many clicks.

Looking under the hood is going to be a critical function as we transition from cycle to cycle. Let’s keep doing that.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.ey.com/en_us/strategy

- https://www.bls.gov/news.release/pdf/empsit.pdf

- https://fred.stlouisfed.org/graph/?g=1fHFr

- https://insight.factset.com/topic/earnings

- https://finance.yahoo.com/news/apple-stock-sinks-despite-earnings-beat-as-china-sales-slow-144509608.html

- https://seekingalpha.com/news/4061713-apple-in-charts-iphone-revenue-rises-6-yy-services-revenue-climbs-11