Misery Lingers

It’s hard to imagine why Americans seem so miserable – record real wage growth, all-time highs in the stock market, home price appreciation, record low unemployment, and moderating inflation. Why President Biden and the current political class are in any trouble at all is a head-scratcher.

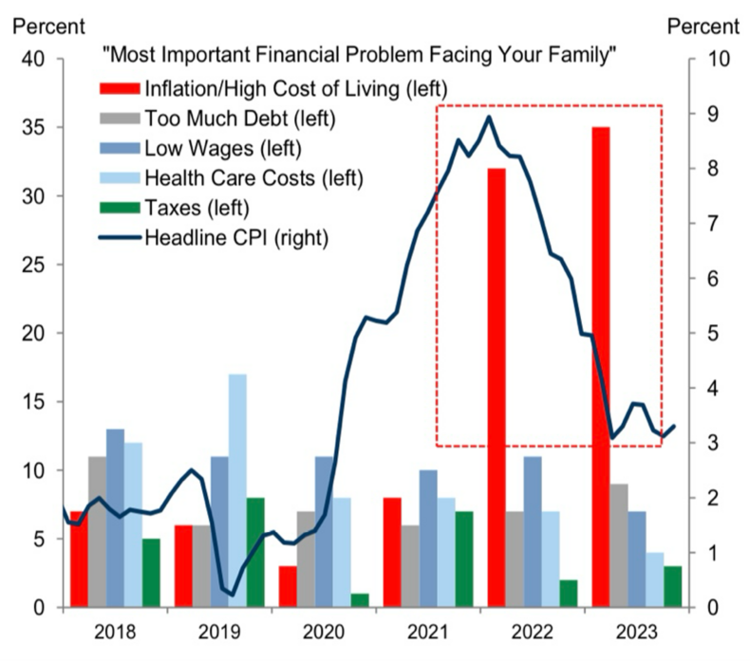

A recent survey by Goldman Sachs suggests that inflation is still the main concern. While inflation (blue line) has been moderating rapidly; inflation and the high cost of living (red bar) as a concern for families has been rising.1

I know when I tell my audience that inflation is moderating, they look confused. I too was confused by their reaction until now. It’s as simple as it is definitional. While the economic term inflation suggests rising prices (a function of a change) the consumer looks at inflation as high prices that are not receding (a function of static). In our current circumstance, inflation or prices are not rising as fast as they were in the recent past. Yet the consumer only sees prices stuck at higher levels. It’s a simple concept of price anchoring. Prices are stuck and the consumer is not happy.

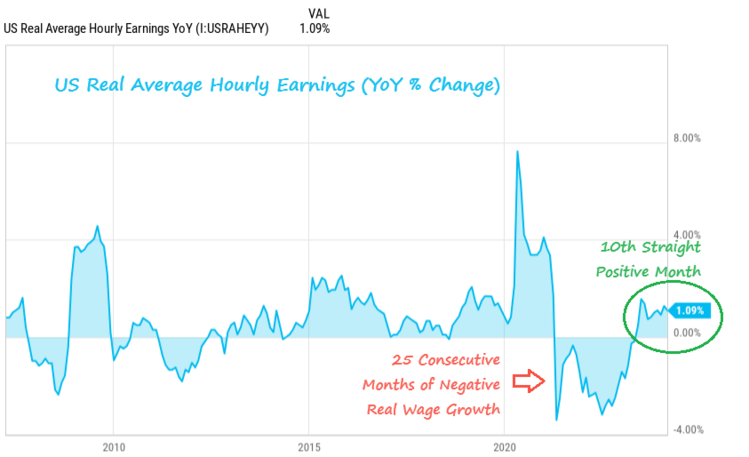

Even with real wages (wages net of inflation) positive for 10 consecutive months, consumers have spent a long time with wages lagging inflation.2

25 months of negative real wage growth is a traumatic economic experience that won’t go away with just 10 months of positive real wage growth.

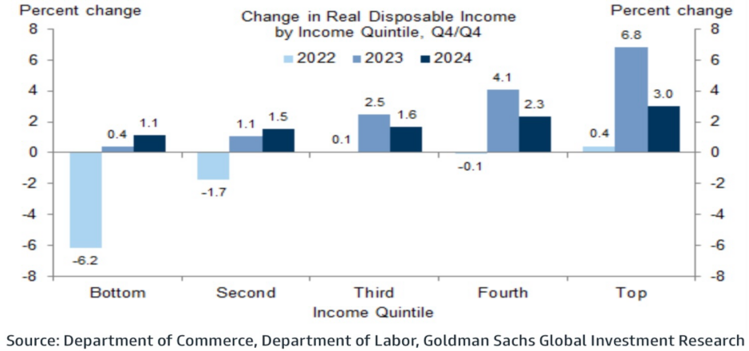

In fact, the lower your income cohort, the harder price anchoring has been on you in the last two years.1

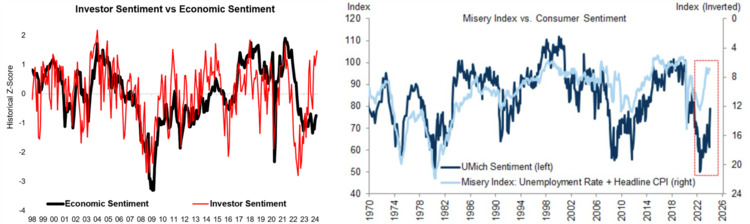

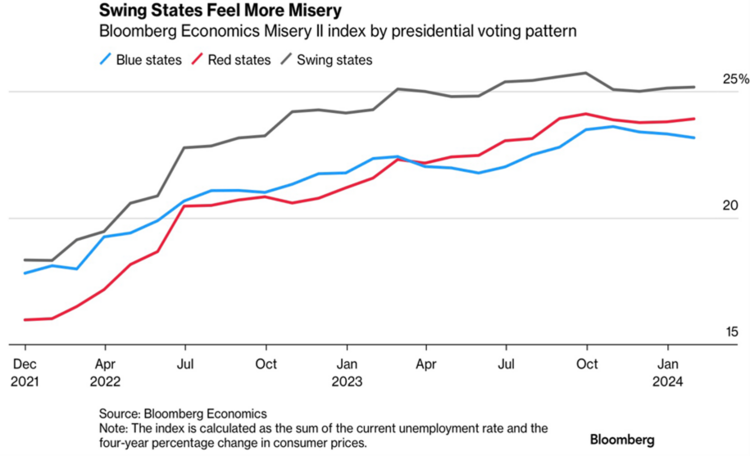

Even though investors’ sentiment has been much stronger than economic sentiment, that simply won't translate into less misery. Misery is up and consumer sentiment is down, as measured by the misery index.3 1

The misery index is calculated by adding the seasonally adjusted unemployment rate to the inflation rate. While unemployment is at lows, inflation has been at very high levels over the last 4 years. That’s the misery index in short.

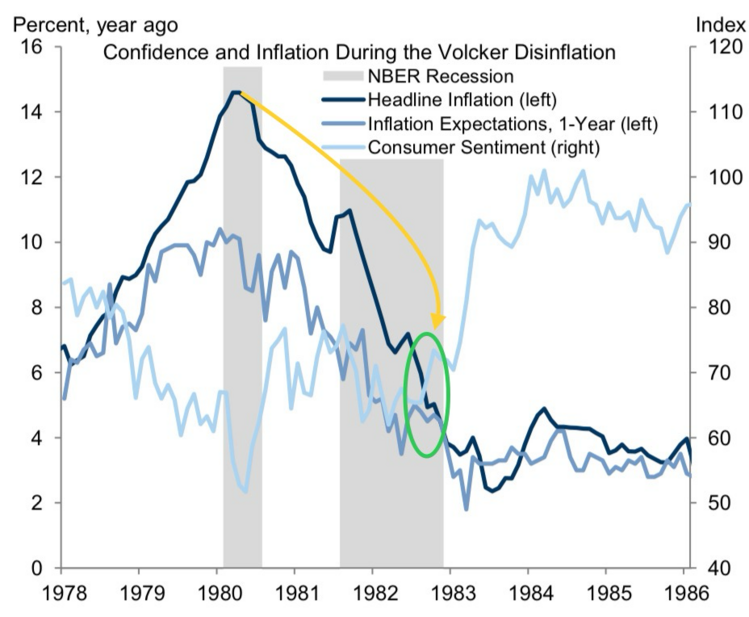

Inflation trauma takes time to get over. It requires not just moderating inflation for a period of time but also moderation of inflation expectations. Looking at the inflationary periods of the 80s suggests that when inflation and inflation expectations both moderate, consumer sentiment improves. However, it took about 2.5 years from peak inflation in the 80s.1

The American consumer is feeling miserable by that definition, and I understand why. It simply takes time for real wage growth to defeat the power of price anchoring and lower Americans’ misery.

That time lag will certainly prove painful for the incumbent political class. The misery index for swing states is much higher than for red or blue states.4

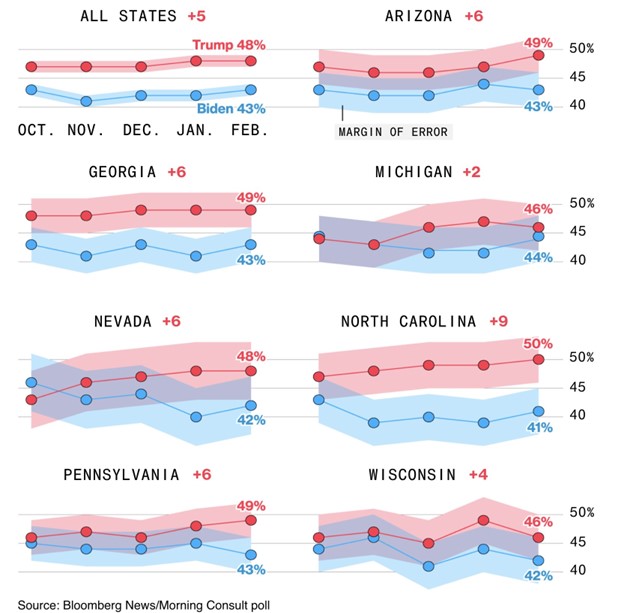

That’s going to bring some misery to President Biden. While I don’t make any political prognostications, my views are intended to inform possible economic and political policy.

As it stands now, we should anticipate inflation expectations to remain anchored higher than the Fed’s 2% target and a turnover in political leadership. If swing states are any guide, that’s what will happen.5

Unless there is a cure for Americans' misery, we should be thinking ahead for what a Trump Presidency could mean in terms of policy prescriptions.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://research.gs.com

- https://x.com/charliebilello/status/1767926346246689079?s=20

- https://www.topdowncharts.pro/

- https://www.bloomberg.com/news/articles/2024-03-08/swing-state-residents-lead-misery-index-as-2024-election-ignites

- https://www.bloomberg.com/news/articles/2024-02-29/biden-age-worries-swing-state-voters-trump-seen-as-dangerous-poll-shows