Nowhere to Sleep Cheaply

We continue to focus on inflation as a primary driver for macro allocation. Inflation is going to determine interest rates and interest rates almost always impact the future value of investments like stocks, bonds, and real estate.

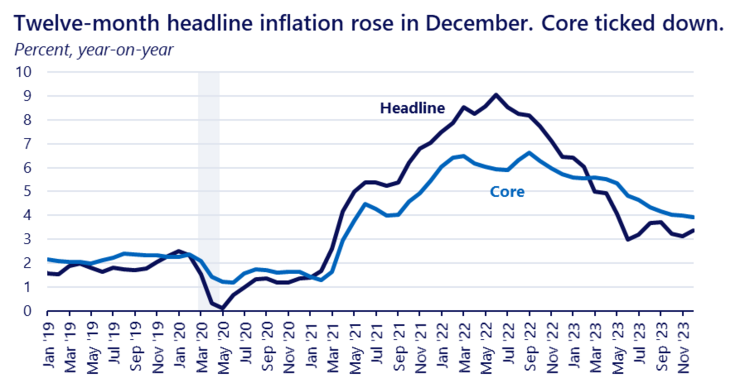

Recent consumer price data continues to point to lower inflation, albeit with a few bumps along the way. Headline consumer prices rose 3.4% on a year-over-year basis. That’s slightly higher than prices in November, although core inflation (excluding food and energy) held steady. 1

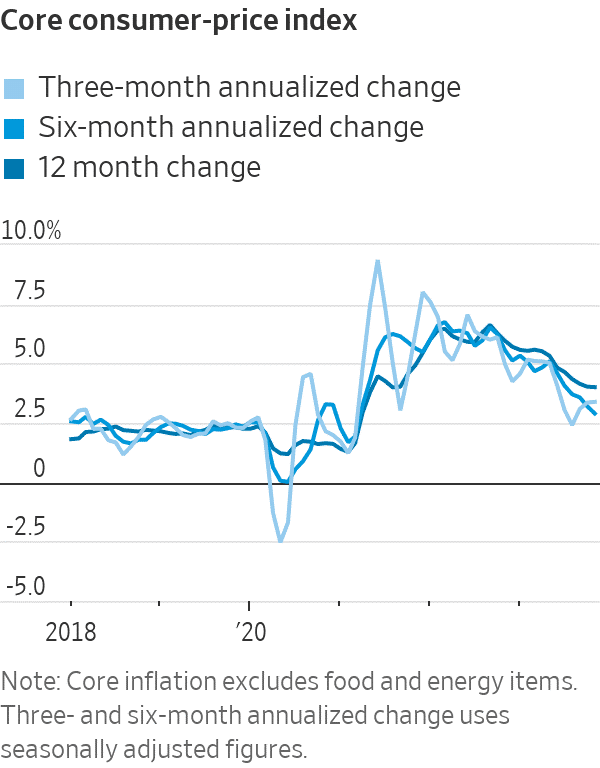

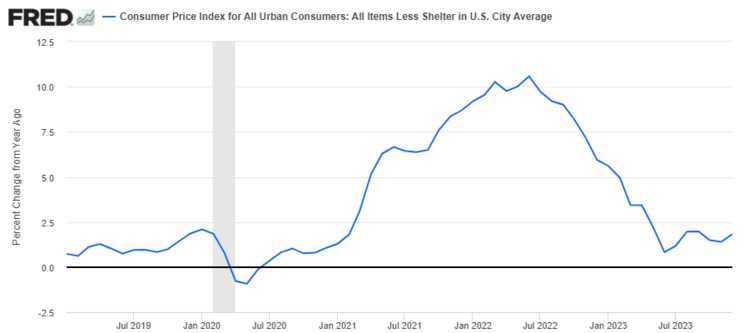

A much more accurate view is looking at the trends over time. In that case, inflation continues to trend down no matter which way you cut it. 2

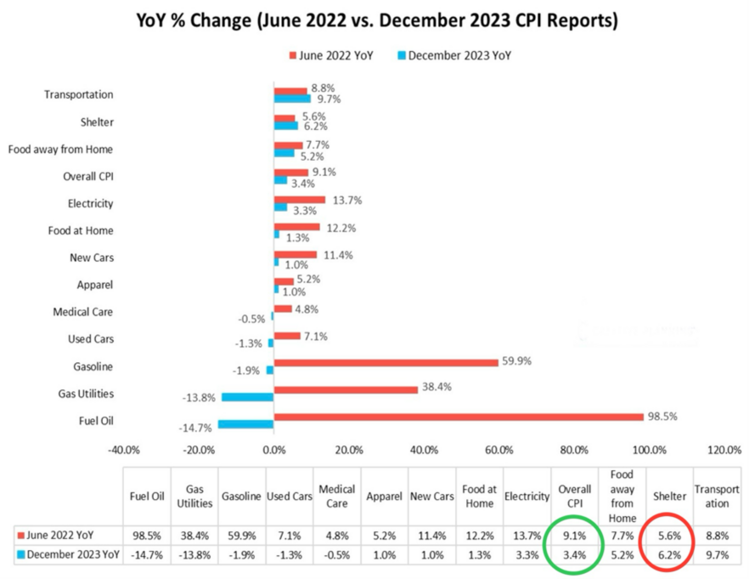

Flipping back to the month-to-month view, the component parts of the index tell a little different story. Yes, there is a dramatic moderation in price increases since the peak of inflation at 9.1% in June of 2022. Credit to the Fed for hamming prices down with their rate increase program. However, Shelter inflation rose from November to December. In fact, it even accelerated from 5.6% to 6.2%. 3

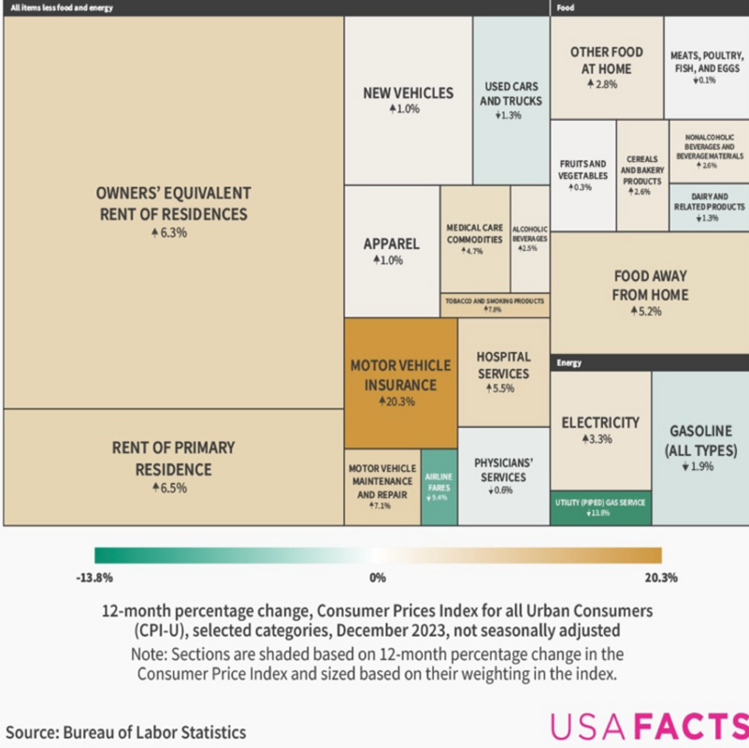

It’s hard to put that in context as it looks like just one of many categories. However, here’s how shelter stacks up compared to the basket of various goods and services. 4

Shelter prices make up over 40% of the consumer price index and, as such, it matters a lot. In fact, when you take out shelter you get an entirely different picture. 5

Inflation looks like it’s close to the Fed’s target of 2% when you strip out shelter from the basket of measured goods.

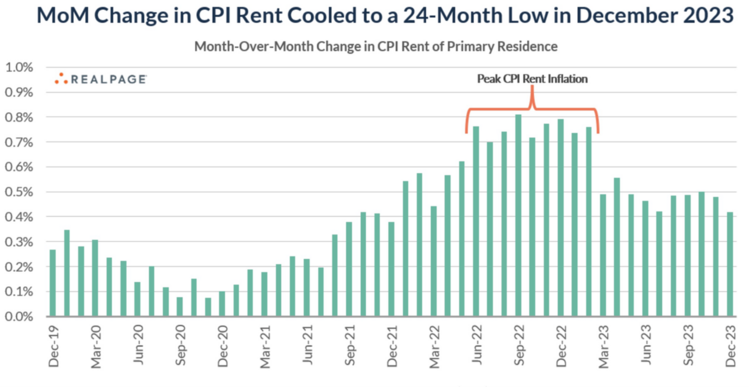

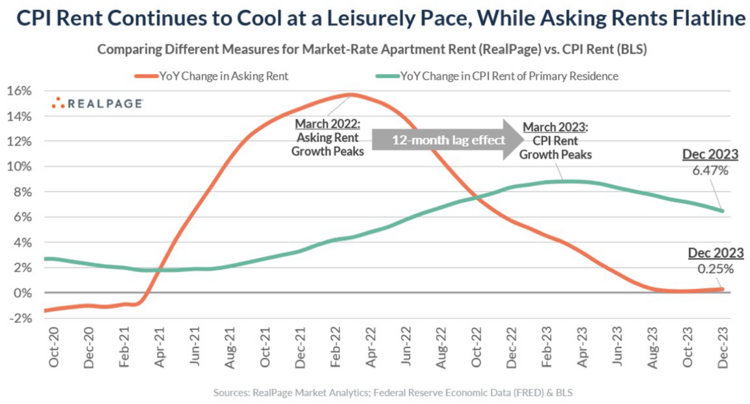

Shelter prices on a month-over-month basis are moderating but it’s still far too high for the Fed to pull the trigger on rate cuts. 6

Shelter inflation has a lag effect and perhaps those lags are starting to show themselves in actual renters’ contracts. 6

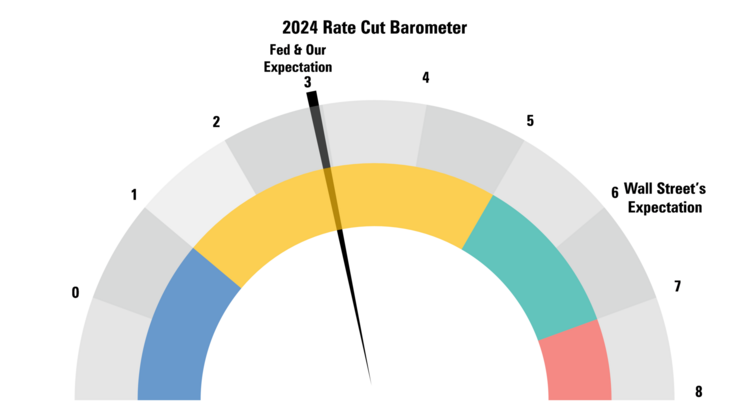

Since there was a small bump from prior month’s inflation reading (first chart), I would suspect the Fed’s estimate of three rate cuts now look more likely than Wall Street's six rate cuts. I tilt my thinking to match the Fed’s at this point.

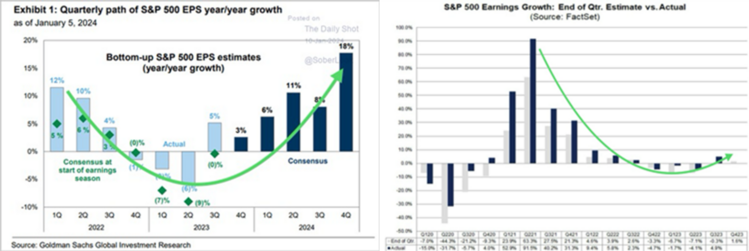

The bigger news will be a dearth of earnings reports in the coming weeks. We are climbing out of the earnings trough of 2023 and Q4 earnings should support the turnaround. From Goldman Sachs and Fact Set: 7 8

If the consumer can find a cheaper place to sleep, rates can get cut and equity valuations might find another leg up. I believe prices will soon moderate on shelter and provide the absolute confidence the Fed will need to assure their three rate cuts in 2024.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://x.com/WhiteHouseCEA/status/1745454353383846355?s=20

- https://x.com/NickTimiraos/status/1745439190286786704?s=20

- https://twitter.com/charliebilello/status/1745448178034540717

- https://usafacts.org/

- https://fred.stlouisfed.org/graph/?g=1eb9c

- https://www.realpage.com/analytics/

- https://research.gs.com

- https://insight.factset.com/topic/earnings