Pre-Positioning for Longer Duration

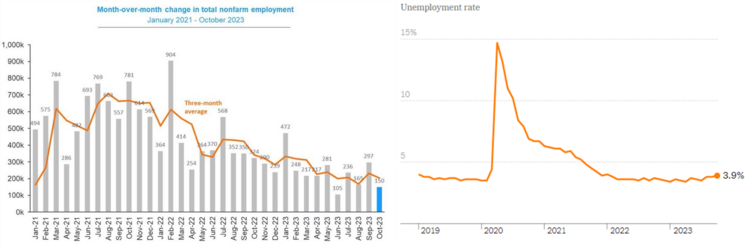

The recent jobs report should give some reprieve to the Fed’s rapid rate increase cycle. The U.S. economy added 150,000 jobs in October and the unemployment rate rose to 3.9%. On a revised basis, job growth is now averaging 204,000 over the last 3 months compared to the unrevised 266,000 jobs gained in September. 1 2

On top of the muted jobs data was a deceleration in average hourly earnings. Wages grew at the slowest rate since June 2021. 3

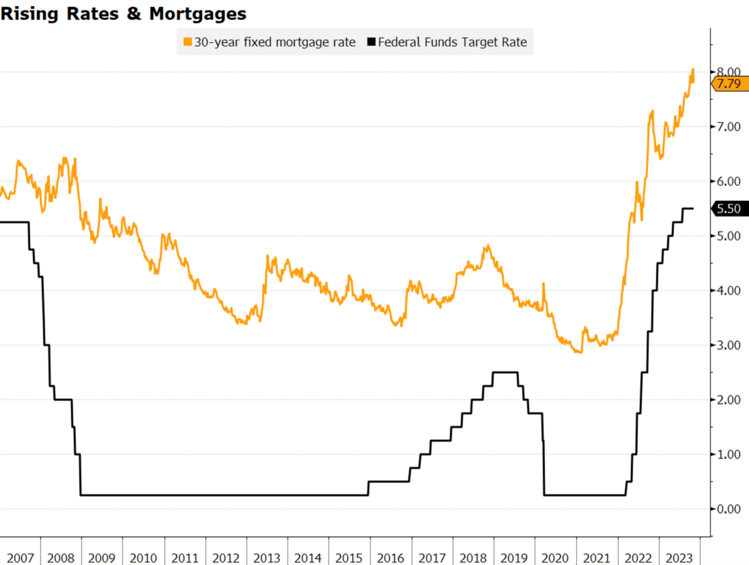

Rising rates and higher mortgages actually do have an impact on the economy, and the Fed can now rest assured their policy tools work. 4

In his post-meeting press conference last week, Fed Chair Powell indicated that his policy tools are working and left some room for doubt about the next round of rate increases. 5

“Our restrictive stance of monetary policy is putting downward pressure on economic activity and inflation.”

He went on to say:

“Financial conditions have tightened significantly in recent months, driven by higher longer-term bond yields.”

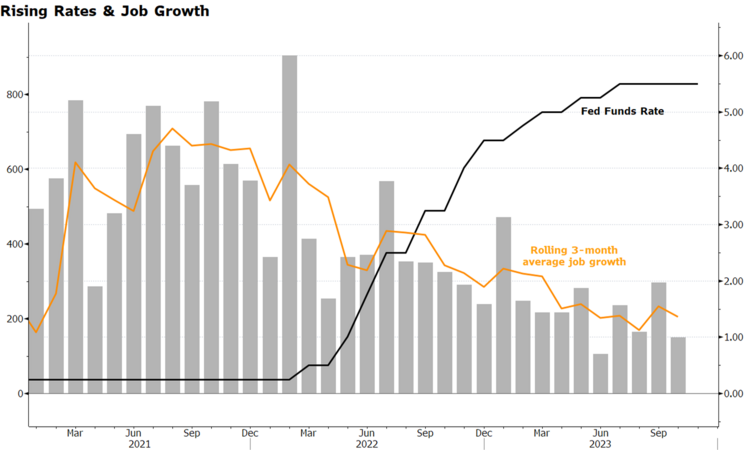

“Reducing inflation is likely to require a period of below-potential growth and some softening of labor market conditions.”

With the rolling three-month average job growth picture weakening over the same period of time rates have been increasing. I’d say mission accomplished. 4

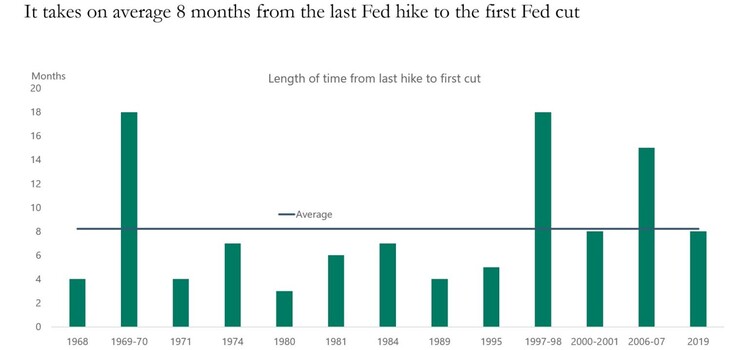

While investors will pre-position for a new risk premium for equities and a neutral Fed Funds rate, the actual rate cuts might still be months away. 6

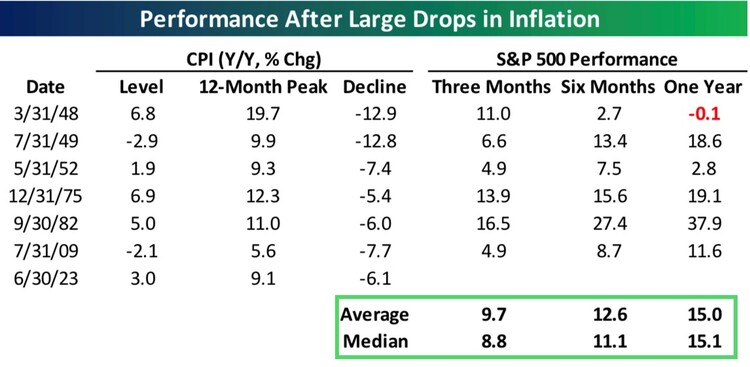

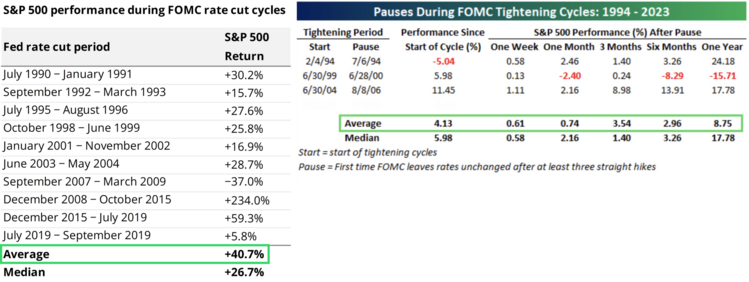

Typically, the Fed will need to see large drops in inflation before cutting rates and that has led to some stellar market performance. 7

When the Fed does pause—as they have now done in two consecutive rate decision periods—markets tend to perform well. Further when it comes to rate cuts, equity markets also outperform. 7

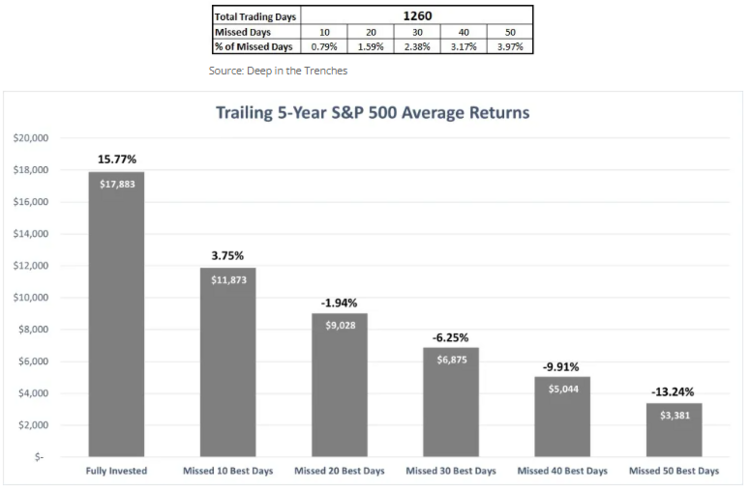

The challenge isn’t really in the macro rate cut call. The challenge is in pre-positioning portfolios ahead of the cut. It’s those periods that foment the most doubt and uncertainty. However, if you don’t do some pre-positioning, you will likely miss the biggest part of the moves. Markets move in brief bursts; if you miss just a few days you lose all the advantage.

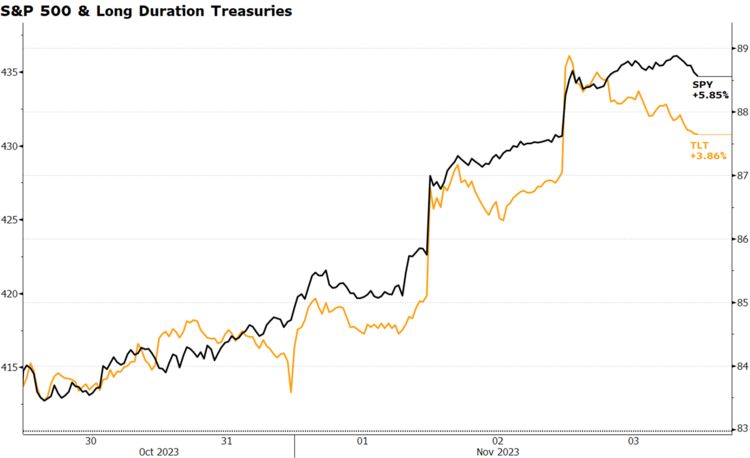

Just look at equities last week and long duration treasury bonds – both had great price gains for the week. 4

We are getting into a soft spot with the economy and owning longer duration equities like Technology and above average duration Treasuries are reasonable pre-positioning.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://www.nytimes.com/2023/11/03/business/economy/jobs-report-october-2023.html

- https://www.ey.com/en_us/strategy/macroeconomics

- https://fred.stlouisfed.org/graph/?g=1b3aP

- Bloomberg

- https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20231101.pdf

- https://apolloacademy.com/eight-months-from-last-fed-hike-to-first-fed-cut

- https://www.bespokepremium.com