Questions For 2018

“Before I refuse to take your questions, I have an opening statement.” – Ronald Reagan [i]

Last year was stellar for investors. What does 2018 hold for us?

With this bull market getting long, it is reasonable to expect markets in 2018 to take a pause. [ii]

In fact, the current bull market is more than twice the average length of any bull market since the early 1900s. [ii]

This leads me to a set of six questions I am asking myself – questions to help me determine whether we will continue on this path in a forward direction. Frankly, all my questions are simple and pertain to the U.S. consumer. After all, the consumer represents nearly 70 percent of our economy. [xvi]

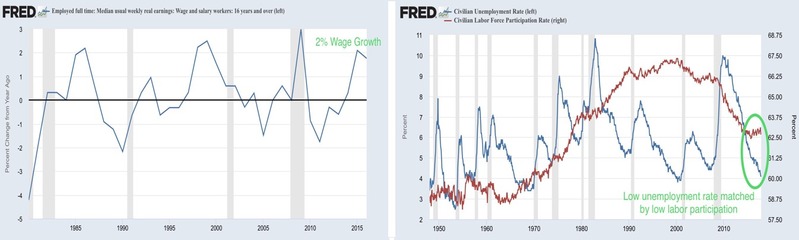

This brings us to my first question: Will wages continue to grow in 2018?

Based on the observed 2 percent year-over-year wage growth and the low unemployment rate, matched by a low labor force participation rate, my answer to this first question is yes, but I suspect at a modest level. Furthermore, with the labor force participation rate remaining at a low level, we would expect to see continued muted wage growth. I caution you not to be fooled by the unemployment rate at its currently benign level. Many members of the political class will express the unemployment rate’s relevance to wage growth, but I believe it to be irrelevant to wage growth at this stage. [iii][iv][v]

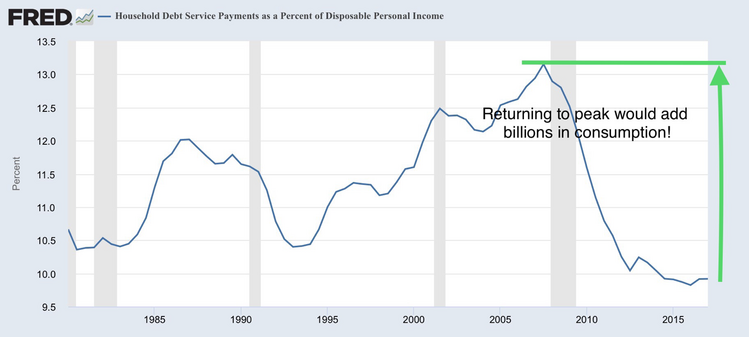

This brings me to my next question: Will the consumer continue to borrow?

Debt service as a percentage of household disposable income remains at reasonably low levels, leaving much more room for expansion. In fact, we alluded to this in a prior market commentary (here), but a return to peak levels would add $5.9 trillion to consumption over the next ten years. [vi]

My answer to this is clearly yes; I believe consumers will continue to borrow as they demonstrate ample capacity to service the debt.

Now with spending, we have to think about saving, or lack thereof, which brings me to my next question: Will consumers spend down their savings?

Looking at the current trajectory of the personal saving rate, consumers appear to have certainly been spending down their savings for some time now. There hasn’t been anything that would indicate to me that this would change. However, spending down savings has a limited lifespan. For now, there is still room to spend. [vii]

I believe the answer is clearly yes to this question as well.

Continuing with the theme of consumer spending, will all this consumer spending benefit corporate earnings? Remember, corporate earnings are the long-term fuel that drives equity returns.

In light of the recent tax reform, I suspect there to be a tax hit to earnings in Q1, as many companies are expected to begin the repatriation of offshore funds back to the United States. These funds would be taxed at 8 percent for illiquid assets and 15.5 percent for cash and cash equivalents [viii]. In fact, some companies are anticipating a temporary loss as they pay taxes and deleverage their balance sheet. Here are a few headlines from companies speaking out about the short-term impact to their earnings:

- “Goldman Warns Tax Reform Will Slash Its Q4 Earnings By $5 Billion” [viii]

- “BP to take $1.5 billion charge from US tax overhaul but expects earnings uplift” [xiv]

- “Barclays expects $1.3 billion write-down from US tax reform” [xv]

Even with the impact of one-time tax events, earnings growth going forward remains strong, from which we can conclude that consumer spending does benefit corporate earnings going forward. [x]

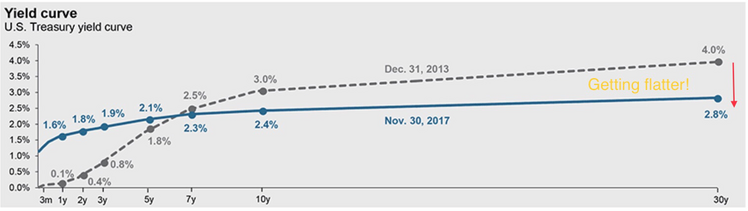

Moving on to interest rates and the impact that interest rates will have on the consumer leads me to another question: Will rising interest rates put a crimp on the consumer?

First, we think the Fed will raise rates two to three times in 2018, but a flight to safety from foreign investors will likely keep long-term rates lower in 2018. In short, this leads to continued flattening in the yield curve. [ii]

However, lower long-term rates, albeit not the best for lending institutions, should continue to support housing, autos, and other major purchases that require long-term financing.

This brings me to my last question regarding the consumer: What could scare the U.S. consumer in 2018? A few things come to mind here:

- North Korea: In fact, retired U.S. Navy Admiral Mike Mullen just said, “We’re actually closer, in my view, to a nuclear war with North Korea and in that region than we’ve ever been.” [xi]

- Iran/Middle East: Notwithstanding the recent protests in Iran, an internal Muslim war has already broken out between Iran (Shiite) and Saudi Arabia (Sunni). [xii]

- In my opinion, Ukraine and Turkey are two of the most critical geographically located countries (I would add Mexico as another) to protect against large democratic regions from ideological regimes. Ukraine and Turkey are showing signs of stress, which could be destabilizing for the European Union. [xiii]

Although it would be foolish not to assume real risks in 2018, along with a normal market correction or two, we don’t anticipate the beginning of a bear market correction (20 percent decline) until late in 2018 or most likely 2019. However, the more specific we are with the questions we ask, the more inaccurate we will be. That is why I ask all of these questions with caution.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. https://www.brainyquote.com/topics/questions

ii. https://mail.phillipsandco.com/files/8915/1490/9826/MI-GTM_4Q17_December.pdf

iii. https://fred.stlouisfed.org/series/LES1252881600Q

iv. https://fred.stlouisfed.org/series/UNRATE

v. https://fred.stlouisfed.org/series/CIVPART

vi. https://mail.phillipsandco.com/blog/as-good-as-it-gets/

vii. https://fred.stlouisfed.org/series/PSAVERT

viii. https://www.zerohedge.com/news/2017-12-29/goldman-warns-tax-reform-will-slash-its-q4-earnings-5-billion

ix. http://www.businessinsider.com/gop-tax-bill-american-companies-to-use-repatriation-to-pay-down-debt-2017-12

x. https://insight.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_122217.pdf

xi. http://www.foxnews.com/politics/2017/12/31/us-closer-than-ever-to-nuclear-war-with-north-korea-mullen-says.html

xii. https://www.huffingtonpost.com/daniel-williams2/saudi-arabia-vs-iran-the_b_8916488.html

xiii. https://eu.boell.org/en/friends-or-foes-tensions-or-ties-eus-relations-turkey-russia-and-us

xiv. https://www.cnbc.com/2018/01/02/bp-expects-us-earnings-uplift-from-tax-reform.html

xv. https://www.cnbc.com/2017/12/27/barclays-expects-1-point-3-billion-writedown-from-us-tax-reform.html

xvi. https://www.thebalance.com/components-of-gdp-explanation-formula-and-chart-3306015