Reflation

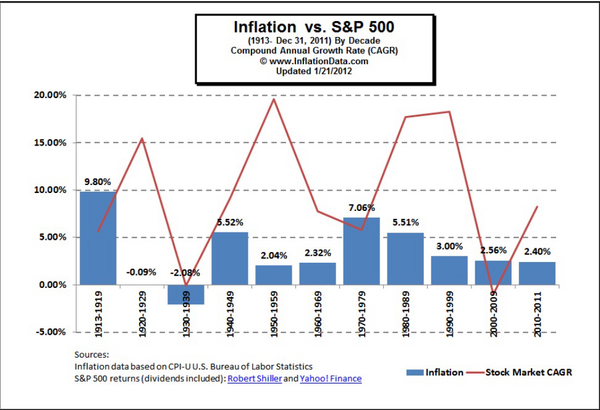

Usually, when discussing macroeconomic trends, we focus on fiscal or monetary policy, taxes, or political risks both domestically and abroad. However, we often don’t spend enough time discussing inflation. Inflation has a significant impact on equity investments. Take dividend-paying stocks, for example. During periods of inflation the purchasing power of those dividends diminishes, causing those stocks to be less attractive to investors.

Let’s put it another way. One factor not often considered is the effect that inflation has on the taxation of gains. For example, let’s assume you hold a stock and sell it for a gain at some later date. Ignoring all other circumstances, you would be expected to pay taxes on those gains. Now let’s assume that during the period you held that investment, the compound growth rate of inflation happened to be higher than the return on investment. This means that after adjusting for inflation, you actually had a loss. In this sense, inflation could actually cost you twice; first, in the loss of purchasing power, and second, in taxes on “phantom gains.” [i]

Compliments of Kensho, the hedge fund analytics tool, here is a list of industry sectors that have performed the best in rising inflationary environments.

When looking more closely at the macro theme of inflation, it generally looks like lower inflation levels produce better equity returns. [i]

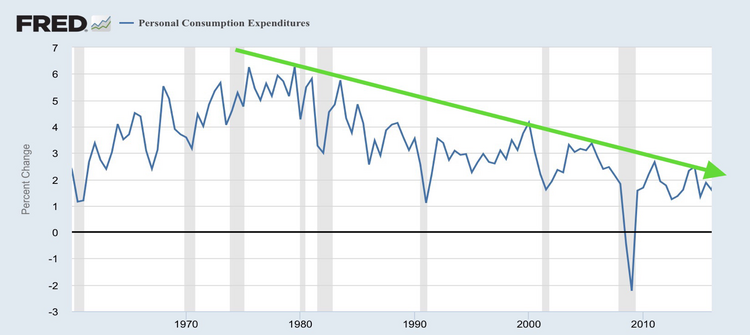

So let’s see how close we are to peak inflation levels.

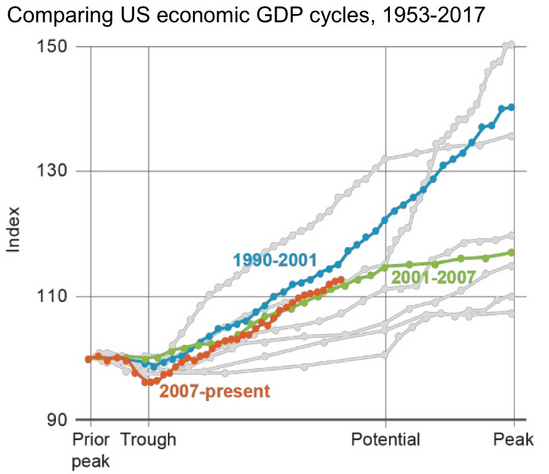

First, the United States is still below trend when it comes to GDP growth. [ii]

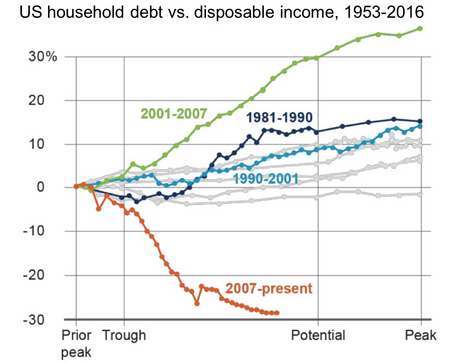

Second, it appears that U.S. households have not leveraged up yet to drive hyper-consumption, which tends to lead to rapid inflation. [ii]

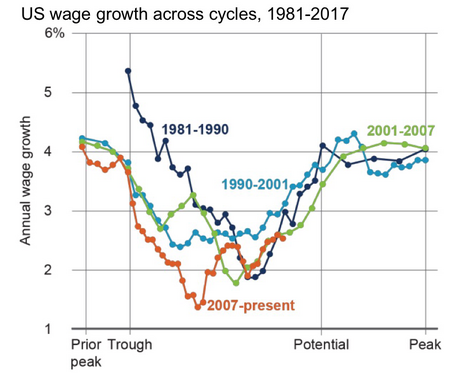

Third, and most importantly, wage growth also remains below historic trends during the current phase of the U.S. economic cycle. [ii]

Despite recent activity suggesting that the United States is facing some inflationary pressures, it’s hard to dispute the facts that the current economic cycle is far from past peaks when inflation reaches levels where equity investors ought to be concerned.

In fact, the long-term trend is still pointing lower, with no signs of a major break in trend. [iii]

The good news is that it appears we have a bit of time left before we hit peak inflation levels.

If you have questions or comments, please let us know. We always appreciate your feedback. You can get in touch with us via Twitter and Facebook, or you can e-mail me directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. https://inflationdata.com/articles/2012/01/21/inflation-stock-market-correlation/

ii. https://www.blackrock.com/investing/literature/whitepaper/bii-global-macro-outlook-may-2017.pdf