Slower, Higher, Longer

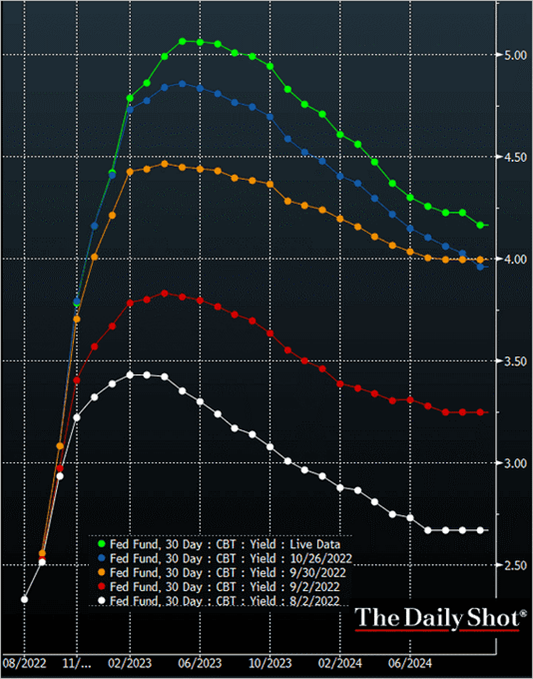

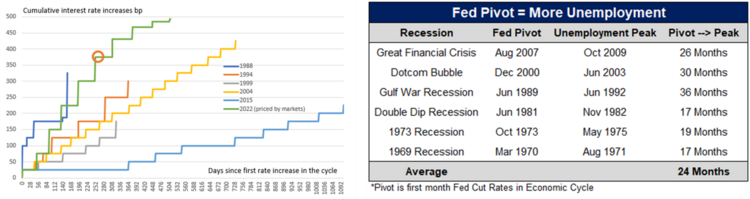

Once again, we are left in monetary limbo. The Federal Reserve raised interest rates by 75 basis points last week, taking the Fed Funds rate to 4%. Unfortunately for investors trying to understand how to value future cash flows, the Federal Reserve was also uncertain about the trajectory of forward rates. What was once anticipated to be a 3.5% terminal rate in August, now looks more like over 5% today. The rapidity with which forward expectations are changing makes for a very challenging investment environment. 1

Here is what Chairman Powell messaged during his most recent press conference. 2

“The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

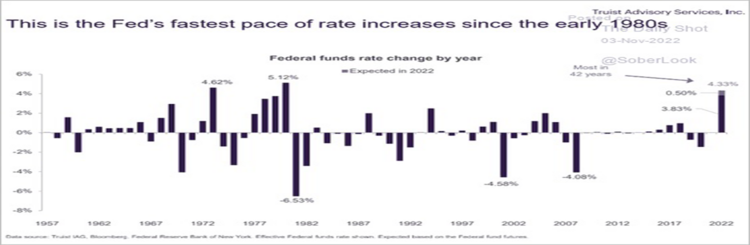

The unprecedented pace of increases has been the fastest in over 40 years and the impacts of rapid rate increases on the economy are uncertain.

Further, Powell said, “the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity.” 2

It’s pretty clear the Fed will become less connected to the frequency of rate increases and more tethered to the economic impacts of those increases based upon any lag effects.

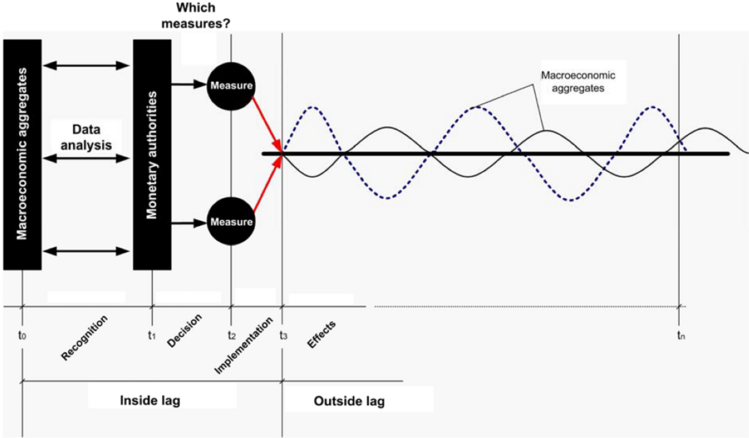

Almost all things economic are made more complex by the PhD class. Believe it or not, there are various types of policy lags, but suffice it to say they are all about the same thing; how long it takes for policy to impact financial and economic conditions. 3

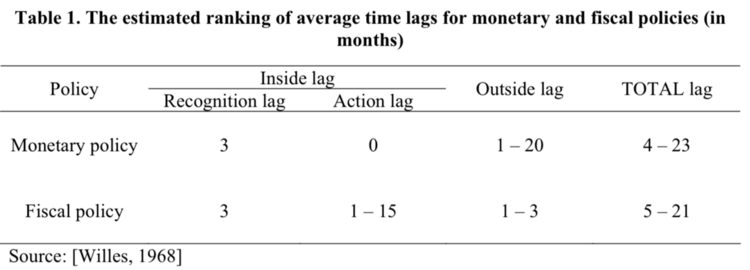

If the Fed is going to consider lag, they might want to reflect on their own PhDs’ work. (After all, they have over 400 of them working for the Fed). From a paper published by the Fed, the lag effect is as follows: 3

Nothing is precise about this detailed study on lags by the PhD class.

You read this right:

- Monetary policy lag is between 4 and 23 months. That puts us anywhere from March 2023 to November 2024 to feel the impact of rate increases if the Fed paused today.

Fiscal policy lag is between 5 and 21 months.

- Based upon the three bills recently passed:

That’s a positive lift of about 1.61% of GDP just on the fiscal policy alone.

Based upon recent market expectations we should see a peak in interest rates of 5% in the 475- to 500-day range. That would put us in June or July 2023 – 15-16 months since the Fed started raising rates. We should see a peak in unemployment about six months past that time. That’s a classic “outside lag.” 1

The Fed did comment on their business partner (the U.S. Government) and in a tacit way acknowledged the potential inflationary impacts and fiscal policy lag (as noted above) could have on the economy. Powell said: 2

“So we see those things and what those things tell us is that our job is going to require some resolve and some patience over time.”

More PhD speak as Powell tried to explain the challenges between his tightening monetary policy and the fiscal policy Congress and the Administration passed: 2

“It is very premature to be thinking about pausing. So people, when they hear lags, they think about a pause. It's very premature in my view to think about or be talking about pausing our rate hike. We have a ways to go, our policy, we need ongoing rate hikes to get to that level of sufficiently restrictive.”

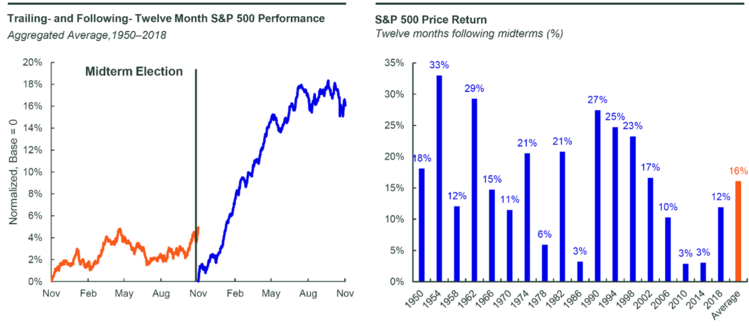

Yes, upcoming mid-term elections historically provide a positive boost to equity markets, and we certainly would welcome any relief. 7

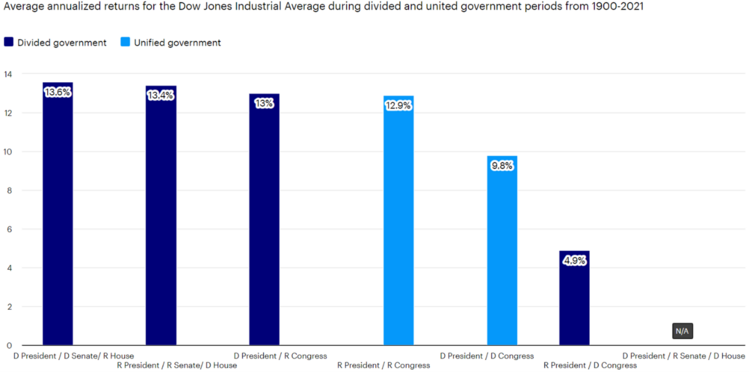

A divided government provides a very good backdrop for equities as policy gridlock helps investors gain a sense of stability. 8

Regardless of outcomes from this week’s midterms, we should prepare for a shallower path to future rate increases, and a longer path, and likely a little bit higher rate celling.

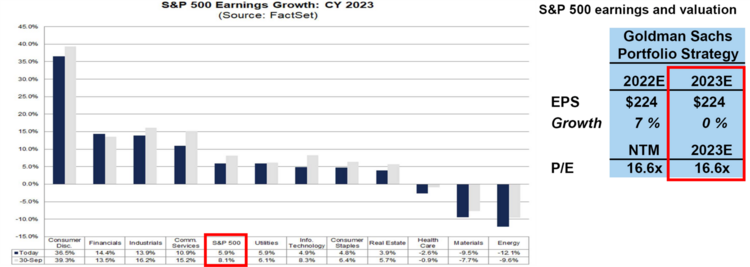

Consumption patterns will certainly be impacted. Corporate earnings expectations will, of course, be adjusted down. 9 10

Just keep in mind investing is often counterintuitive and it’s hard to know what investors have discounted. We might just rally on bad news. After all, bad news means the Fed might actually get what they want in an economic slowdown.

Investment pain is part of the process. I often think about our colleague Morgan Housel, the best-selling author of Psychology of Money when he speaks about pain as an investor. Take a look at our video link.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://dailyshotbrief.com/

- https://www.federalreserve.gov/newsevents/pressreleases/monetary20221102a.htm

- https://www.tandfonline.com/doi/pdf/10.1080/1331677X.2011.11517463

- https://www.crfb.org/blogs/whats-inflation-reduction-act

- https://www.crfb.org/blogs/full-estimates-house-build-back-better-act

- https://www.crfb.org/blogs/cbo-estimates-chips-plus-bill-would-cost-79-billion

- https://www.blackrock.com/us/financial-professionals/insights/student-of-the-market

- https://www.invesco.com/us/en/insights/midterms-and-markets-what-investors-need-to-know.html

- https://insight.factset.com/topic/earnings

- https://research.gs.com