Sorting This Mess Out

The start of 2016 has certainly been a tumultuous one. The S&P 500 is down almost 8%. [i]

It's times like this when investor panic sets in. I hear statements like:

“What happens if the market goes to zero?”

“The world is a dangerous place and stocks are dangerous!”

“My portfolio must be down 8% the same as the S&P 500!”

“I've had it; I just need certainty!”

After 30 years of professional investing I have come to rely on two constants:

- Markets will fluctuate and investors will panic.

- In the end, as long as we continue to grow as a country, and American's aspirations for prosperity continue to endure as they have for over 300 years, the next 30 years will likely look like the last 30 years. [ii]

However, there will be times when investors panic and the truth is professionals need that panic to generate returns beyond the indexes.

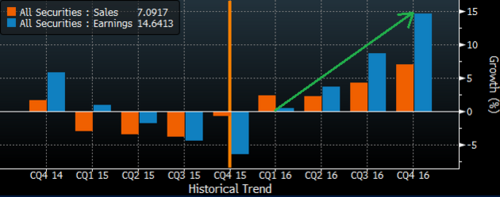

So let me try to help you sort out this mess. Again, I refer you back to our last couple of posts where I reminded you that we are in the worst period for earnings. Q4 2015 earnings are expected to be the 3rd consecutive quarter of shrinkage. It should be no surprise to see markets having adverse reaction to that trend. [iii]

However, looking forward and thanks to weak results in early 2015, we can expect to return to year-over-year earnings per share growth during Q2 2016 (which will be reported starting in June). If I can drive one single point home to you it would be the year-over-year (YoY) Ponzi scheme, we all play a part in.

YoY Ponzi

Here's how it works. Let's say, for example, IBM in Q1 2014 reported earnings of $2/share. A year later in Q1 2015, IBM reports earnings per share of $1. That's a 50% drop in earnings and certainly the stock would be clobbered. Now, let’s again roll forward one year to Q1 2016, where IBM reports earnings at $1.25 per share. That's a 25% increase in EPS growth compared to a year earlier, and the stock would likely appreciate before or after the report (depending on expectations).

Now apply this same concept to the S&P 500 as a whole. You can see the YOY built in system rewards the growth, especially if it is larger than average. [iv]

Now look at earnings expectations for 2016 and you can see on a YOY basis we return to decent EPS growth. Again from our friends at FactSet. [v]

In fact, due to the fact that the S&P 500 has pulled back almost 8% this year we are now seeing a much more reasonable forward P/E ratio. [vi]

KKR did a nice job summarizing what can be expected in the coming year based upon the PE and EPS expectations. While nothing significant, they do see modest growth in 2016. [vii]

Let's also keep in mind two factors that are driving corporate earnings down; the strong U.S. Dollar and abysmal energy (oil/gas) earnings.

If you took Oil and the Dollar out of corporate earnings you see an entirely different story. [viii]

However, let's not be to cheerful about this one scenario. We should expect the U.S. Dollar to stabilize as a condition of a return to EPS growth. Why? Almost 48% of S&P 500 companies generate their revenue from overseas. [ix]

Let's apply the YOY Ponzi math. See the table below comparing 3 years of U.S. Dollar to the Euro. [x]

There was a big jump in Q1 2015, when the dollar gained against the Euro, followed by a period of stabilization up to now. This stabilization will help companies properly hedge against the rising currency and improve their earnings report.

If the dollar and oil stabilize we could see a scenario where we get strong EPS growth, sooner than later. However, we should continue to expect to have to wade through a period of volatility until we get to better YoY comparisons.

As for those that think they are down almost 8% like the S&P 500, remember you likely have some fixed income in your portfolio. Very few of our portfolios are purely equity. In fact, a generic 60/40 equity to fixed income portfolio is down around 5.25%, significantly better than the staggering drop in the S&P 500. [xi]

There is no doubt the start to 2016 has jolted investors. However, if you have the right time horizon and patience, you may see a recovery in earnings which should drive our markets forward.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Chris Porter, Senior Investment Analyst – Phillips & Company

References:

[i] http://money.cnn.com

[iii] Bloomberg, LP

[iv] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_1.15.16

[v] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_1.15.16

[vi] http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_1.15.16

[vii] http://www.kkr.com/global-perspectives/publications/outlook-2016-adult-swim-only

[viii] http://www.businessinsider.com/chadha-earnings-growth-adjusted-for-oil-dollar-fairly-strong-2015-10

[x] http://www.xe.com/currencycharts/?from=USD&to=EUR&view=2Y

[xi] Morningstar, 60% ACWI 40% AGG