The Financially Conservative Millennials

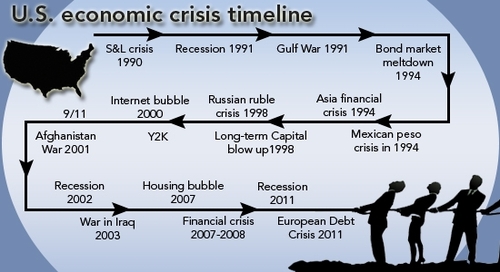

The Millennials, those born since 1979, have witnessed profound events during their young adult lives: the Internet Bubble, 9/11, wars in Afghanistan and Iraq, the Financial Crisis, and the Great Recession.[i]

Based on recent investor profile surveys by Wells Fargo, UBS, and the Transamerica Center for Retirement Studies, entering adulthood amidst all of these events has impacted the financial priorities and investment behaviors of the Millennials.

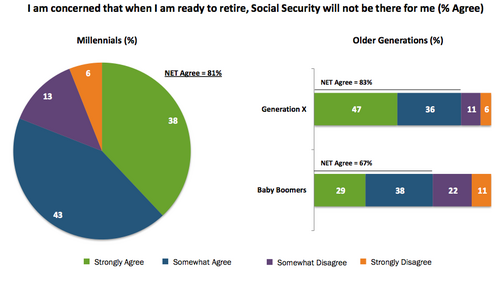

Millennials understand that their retirement will look different than for previous generations. 81% expressed concern that Social Security would not be there upon reaching retirement.[ii]

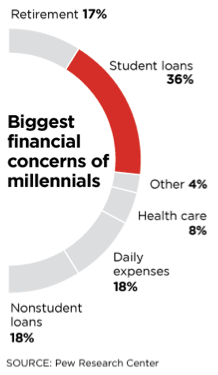

Despite this sentiment, just over half of Millennials have started saving for retirement.[iii] Unemployment has been one cause, with Americans between the ages of 18 and 24 being 10% less likely to have a job now than they were a decade ago.[iv] Millennials are also worried about debt, mainly from student loans.[v]

With the combination of the Great Recession, high unemployment, and high debt levels, it is no surprise that Millennials are more conservative with their finances and have redefined risk as “permanent loss”.[vi] While this provides security during crises, in terms of long-term retirement, being too conservative can place retirement goals at risk.

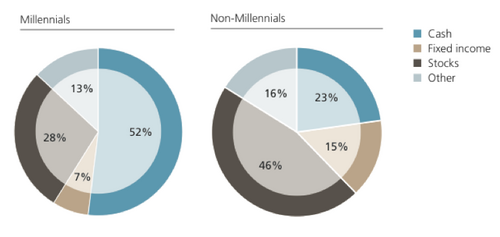

For example, Millennials hold 52% of their assets in cash compared to 23% for non-Millennials.[vii]

This ultra-conservative allocation may be a temporary condition until Millennials feel more secure about their jobs and reduce debt levels. However, even Millennials aged 30-36 with at least $100,000 in assets reported holding 42% in cash.[viii]

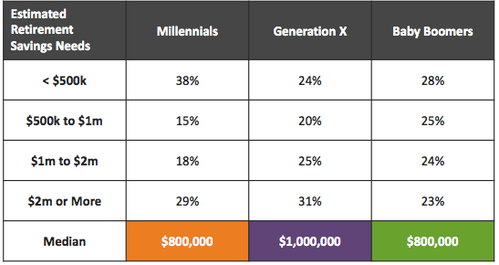

The high cash allocation may be influenced by Millennials’ estimates of their retirement savings needs. 38% of Millennials thought they would need less than $500,000 to retire, though 52% of respondents said their estimate was a guess.[ix,x]

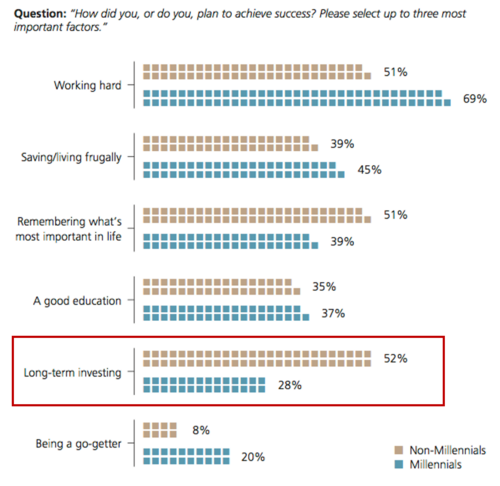

If Millennials believe they will shoulder more of their retirement burden, then higher savings will be required, as well as investing more in stocks and bonds versus cash to achieve higher investment returns. However, when asked how they plan to achieve success, long-term investing rated much lower for Millennials than for other generations.[xi]

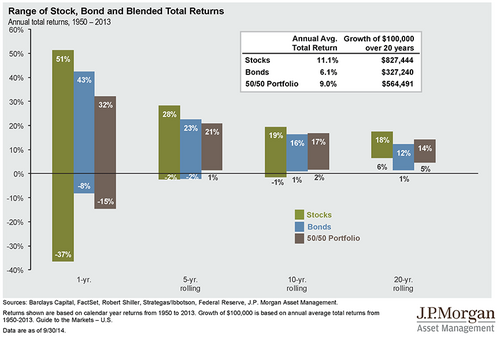

The volatility of the Financial Crisis has made Millennials cautious about investing in the stock market. But instead of letting the times define their investment decisions, Millennials can use time as their ally. Over longer time periods, a blended portfolio has delivered positive returns within a much narrower range.[xii]

There is no denying the significant impact of the Financial Crisis and Great Recession on the US economy, stock markets, and investors. These events hit Millennials particularly hard, as they were just entering the workforce starting around 2001, and shaped Millennials into very conservative investors.

If Millennials eventually raise their retirement savings estimates and overcome their risk-aversion, their current cash and future income would supply new fuel for the stock market. However, with Millennials currently focused more on paying off debt, working hard, and living within their means than on long-term investing, this cash will likely remain on the sidelines for now.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Jeff Paul, Senior Investment Analyst – Phillips & Company

Tim Phillips, CEO – Phillips & Company (Editor)

References

[i] Hunkar, D. (Sep 7, 2011). Economic Crises Hold Back the Stock Market. SeekingAlpha.com.

[ii] Transamerica Center for Retirement Studies. (July 2014). Millennial Workers: An Emerging Generation of Super Savers. p 27.

[iii] Wells Fargo. (2014). 2014 Wells Fargo Millennial Study. p 1.

[iv] Marks, M. and Martin, W. (Aug 31, 2014). Millennials battle persistent debt, jobless woes. Dallas News.

[v] Ibid.

[vi] UBS. (1Q 2014). Think you know the Next Gen investor? Think again. p 3.

[vii] Ibid. p 5.

[viii] Ibid. p 5.

[ix] Transamerica Center for Retirement Studies. p 36.

[x] Ibid. p 37.

[xi] UBS. p 10.

[xii] JP Morgan. (Sep 30, 2014). 4Q 2014 Guide to the Markets. p 64.