The Perfect Landing

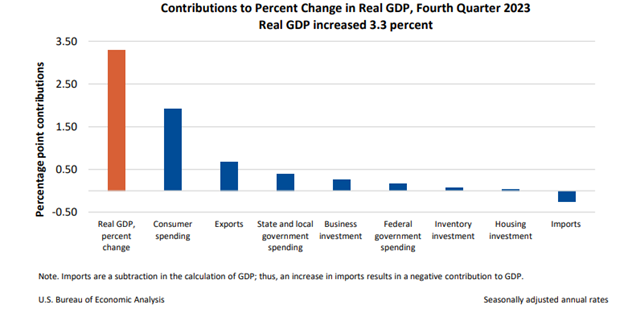

In the last quarter of 2023, the US economy had the perfect landing as the overall economy grew at a 3.3% rate with hardly a blemish. The consumer continues to drive our prosperity, ultimately dictating corporate earnings growth. 1

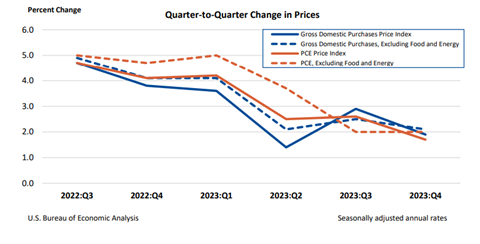

Simultaneously, the Fed’s preferred measure of inflation, Personal Consumption Expenditure (PCE), continued to moderate. It’s now measuring just below the Fed’s target of 2% on a quarterly basis. 1

In fact, the economy is in such a perfect spot the probability of a March rate cut has fallen from 90% to 40%. That’s an astonishing change of opinion in the last 30 days. It’s another great reminder of how fickle investor sentiment is right now. 2

The perfect spot in a massive and dynamic economy like ours doesn’t last long. There are simply too many competing forces and exogenous events that can tip the U.S. economy to either reinflate or deflate.

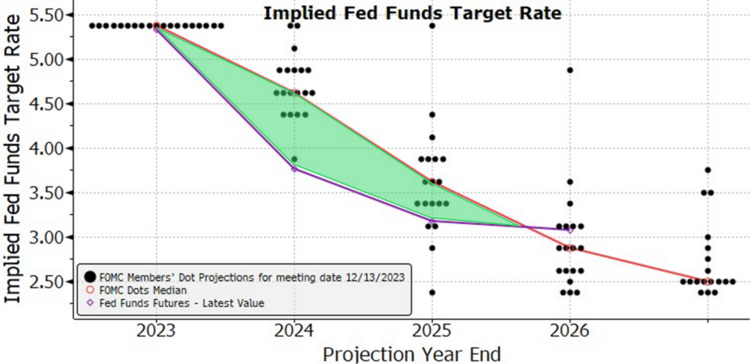

The battle between what the Federal Reserve will do with interest rates and what market participants believe will happen, will be the making of tremendous volatility in the coming year.

Currently the gap between what the Fed forecasts and what investors are expecting is fairly large. The Fed is suggesting a smooth series of cuts this year (3 cuts) and a slow cut trajectory in coming years (red line). While investors are thinking of more dramatic cuts (5-6) this year (purple line) and even more next year. The shaded green area is the conflict. 3

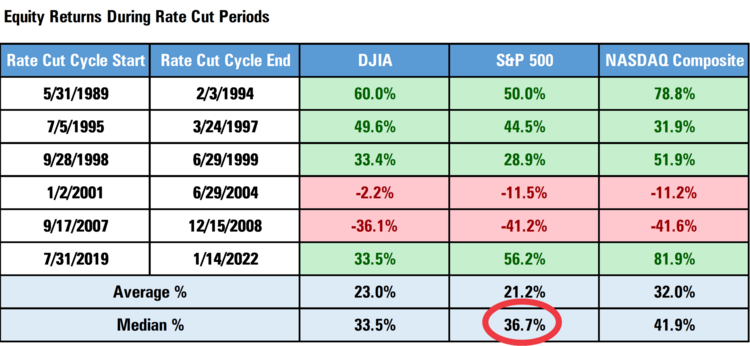

Historically when we get rate cuts, equity markets benefit. The median return for S&P 500 during the last six rate cut cycles is 36.7%. That’s solid. 3

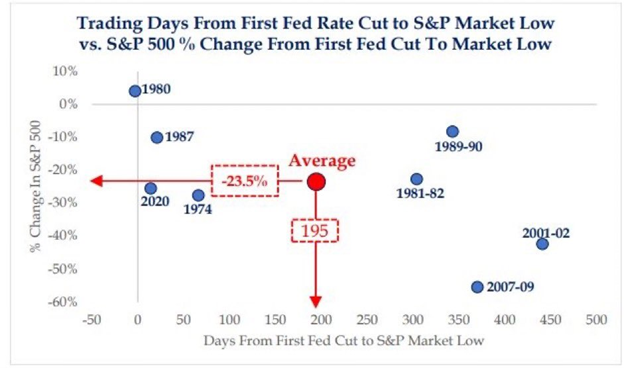

However, those are point-to-point returns. It doesn’t tell us the full story we have to live with in the middle. The actual pain is what happens in the middle. During rate cut periods – and quite counterintuitive – the S&P 500 has pretty significant drawdowns. That’s right, the average length of the drawdown is 195 days and a -23.5% average return. 4

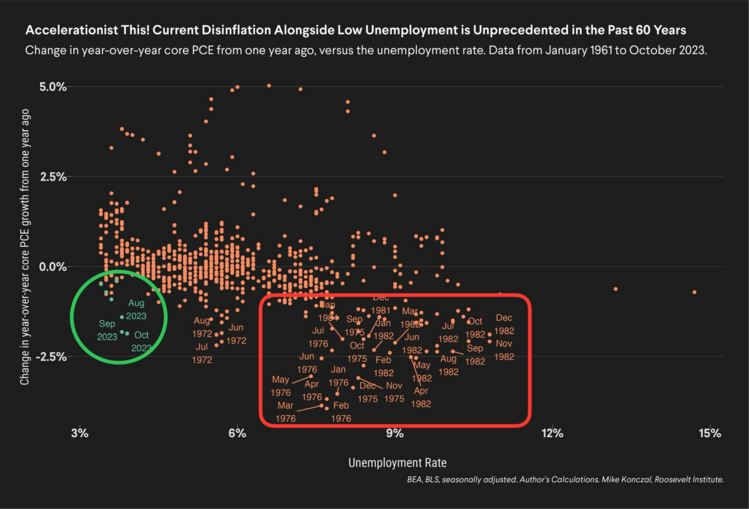

Now before you react, realize that, historically, rate cuts happen when things are really bad in the economy. Traditionally it’s when unemployment spikes (red box) and we are facing threats of deflation. In fact, interest rate cuts now would be a first for the U.S. economy with full employment (green circle). It’s hard to make major portfolio moves when we have an amazingly strong economy. 5

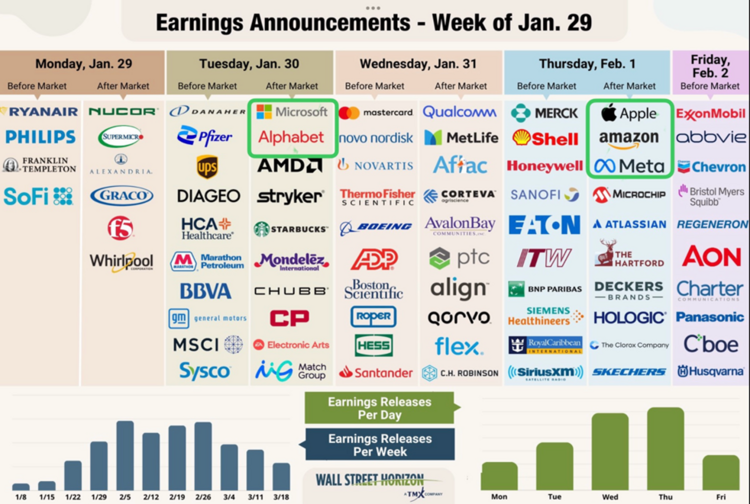

Earnings growth should emerge from all of this strong consumption growth and that should show itself this week with some major corporate earnings on tap. 6

Let’s just be prepared for the coming volatility in this investor/Fed clash. We will certainly be looking at tools and techniques to dampen portfolio volatility beyond the fixed income allocations most portfolios contain.

Let’s see how long the perfect landing can stay perfect.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: