"The Wealth of Common Sense" vs The Death of Common Sense

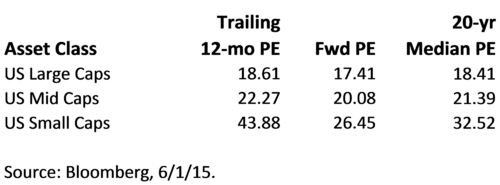

It seems to me that everyone is talking about the excessive valuations the US equity markets are trading at today. Indeed it is elevated, and certainly much of the concern is warranted based upon dismal Q1 earnings.[i]

The diatribe has almost reached a crescendo when I begin to see very skilled large foundation and endowment managers ponder market timing.

I think it's time we all rely on the Wealth of Common Sense vs the Death of Common Sense. To do this, I borrow from Ben Carlson, a very skilled writer who explains in simple terms the reality of corrections.

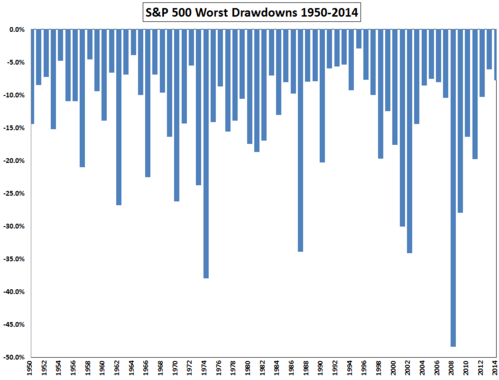

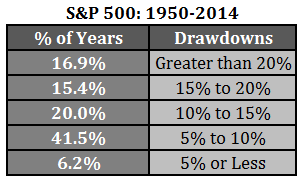

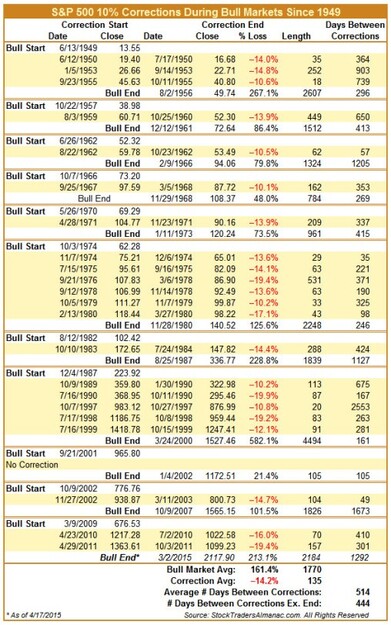

From his recent blog posting, we can see the following data:[ii]

Simply put, markets correct and quite often. Every year since 1950 there has been at least a 5% correction, except for 4 years (1954, 1958, 1964, and 1995).[iii]

In fact, according to data Ben presents, just over 50% of all years since 1950 have seen a 10% correction or more.[iv]

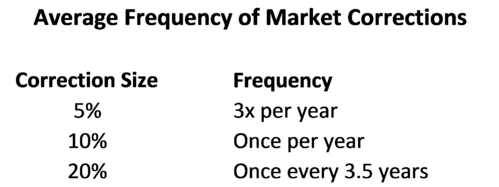

Fidelity data shows the following:[v]

While it's been nearly 4 years since the S&P 500’s last 10% correction, we are certainly due for one.[vi]

The data suggests market corrections are a matter of course for equity investing. As such, we should just accept it as part of the risk of equity investing. Well-meaning investors will try to time corrections, as certainly it would fly in the face of common sense to just do nothing when we know the market will correct. However, doing nothing is exactly what most should do, unless you think you can do the following:

- Time when you should get out of the markets, although they can easily continue to move higher.

- Time when you should get back in the markets. After all, 10% corrections can turn into 20% corrections. While you might time the first phase of a pullback correctly, you still may catch the next phase down. Oh and just for good measure, you might pay some of the highest capital gains tax rates in the last couple of decades for the privilege of trying to time the markets.

Ben conveniently points out that when markets are down as much as -25.9%, -27.6%, or even -33.5%, they can still end the year with positive returns. In almost 60% of all years since 1950 with a drawdown in excess of 10%, the market finished the year in positive territory.[vii]

In fact, corrections tend to happen quickly and don't last that long.

You can see from the data in the table the average bull market lasts about 1770 days with a 161.4% gain and corrections only last on average 135 days with a meager -14.2% pull back.[viii]

I know it's within all of us to avoid danger, but the danger is what provides you the returns you need. This is called "risk premium".

If you don't need excess returns to fund a pension plan, retirement, or payouts on a foundation, change your asset allocation.

In fact if you’re nervous, I suggest you should reexamine the returns you actually need. Perhaps you can cut your spending, stop funding more scholarships for students, or simply plan on living with less in retirement. All are reasonable adjustments if you fear a pull back.

Don't let the death of common sense trump the "Wealth of Common Sense".

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Jeff Paul, Senior Investment Analyst – Phillips & Company

References

[i] Bloomberg LP. (Jun 1, 2015). Trailing and Forward PE Ratios.

[ii] Carlson, B. (May 25, 2015). To Win You Have to be Willing to Lose. A Wealth of Common Sense.

[iii] Ibid.

[iv] Ibid.

[v] Fidelity Investments. (Jun 4, 2012). CMSG Update on Recent Market Volatility.

[vi] Hirsch, J. (Apr 17, 2015). 1292 Days and Counting Since Last 10% Correction.

[vii] Carlson, B. (May 25, 2015). To Win You Have to be Willing to Lose. A Wealth of Common Sense.

[viii] Hirsch, J. (Apr 17, 2015). 1292 Days and Counting Since Last 10% Correction.