There is a Recession

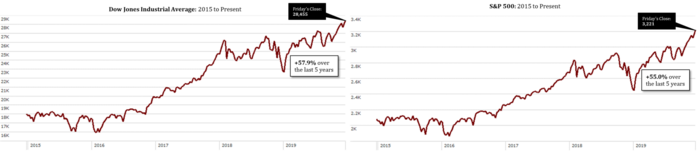

It’s hard to talk about recessions when the U.S. stock market hit record highs last week, [i][ii] however, and quite unusually, there is a recession brewing in one important industry: Freight.

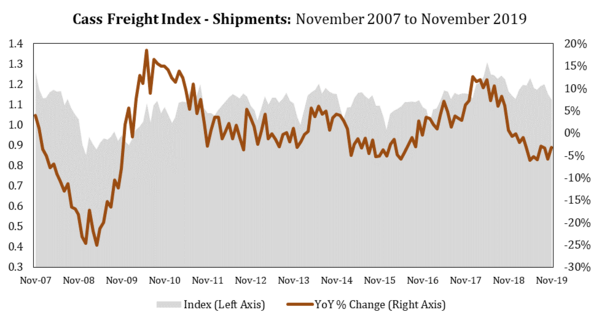

Cass Information Systems, a leading freight payment and logistics provider, recently reported a rather gloomy picture of freight volumes, with November shipments falling 3.3% YoY. November also marked the twelfth consecutive months of declining volumes. [iii]

Looking ahead, Cass’ outlook for the freight industry was also pretty uninspiring: [iii]

“Both the shipments and expenditures components of the Cass Freight Index remain down from their peaks in May and September of 2018, respectively, but both appear to be getting “less bad” with y/y comps not off as much as we saw in October. Over the coming months, expect y/y growth to flatten out, as the industrial economy is expected to bottom, while the consumer remains relatively healthy.

Shipment volumes, which have been negative y/y all year, fell 3.3% y/y in November. We’ve been talking for several quarters now about how we’re in another freight recession (the other being 2015-2016) during this long-tenured economic expansion in the U.S., which shows most clearly in the rail carload, LTL tonnage, and Cass shipment data. Some of this is due to an inventory destock (primarily at the retail level), while much is due to the softening industrial economy (where we believe inventories are still elevated). Moving into 2020, we expect volumes to flatten out but not surge much, and a turn to positive y/y comps in the shipments index could be seen as soon as January 2020.”

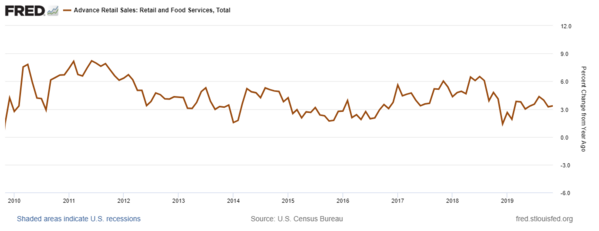

Now juxtapose the freight industry data with retail sales reported last week and you get some rather confusing data. [iv]

Retail sales are up 3.3% on a year-over-year basis, mostly driven by autos and electronics. [v][vi]

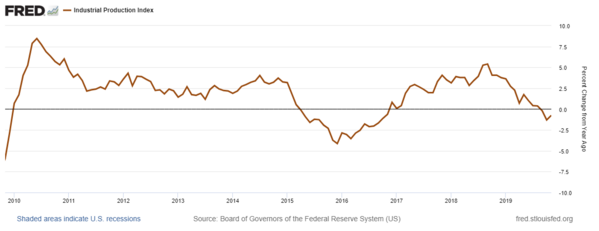

How is it that the freight industry has been in a long-trending recession and retail sales continue to push higher? One catalyst may be the outsized freight pull forward in mid-to-late 2018 as industrial and manufacturing companies raced to beat tariff implementation. Industrial production – which includes manufacturing, oil & gas drilling, mining activities, and utilities – had boomed in late 2017 and 2018 with year-over-year growth rates topping out at 5.5%, the fastest growth since the recovery from the Great Recession. But it peaked in December 2018, then started declining precipitously. The month-to-month drop was particularly sharp in October, according to Federal Reserve data. This was followed by a big month-to-month bounce in November, leaving year-over-year industrial production down just 0.8%. [vii]

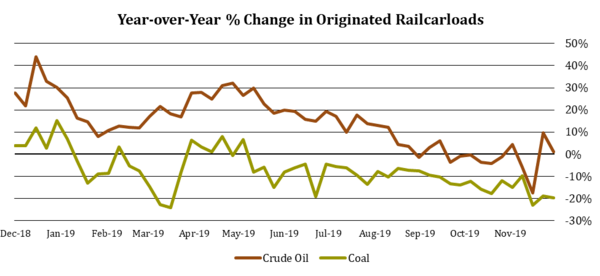

Another factor that could be putting a damper on overall freight trends is the weakness throughout the year in energy shipments via railcar, along with overall softness in exports of durable goods mainly due to the trade war with China. [viii]

As we close out 2019, these diverging trends are yet another piece of the macro puzzle worth watching in 2020 as all are generally considered leading economic indicators.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.bloomberg.com/quote/SPX:IND

ii. https://www.bloomberg.com/quote/INDU:IND

iii. https://www.cassinfo.com/freight-audit-payment/cass-transportation-indexes/november-2019

iv. https://fred.stlouisfed.org/series/RSAFS

v. https://fred.stlouisfed.org/series/RSMVPD

vi. https://fred.stlouisfed.org/series/RSEAS

vii. https://www.aar.org/data-center/rail-traffic-data/