Things are Flattening Out

Typically, under ordinary circumstances, bond investors expect to get paid more for holding a long-term bond than a short-term bond, as more uncertainty in the future deserves to be compensated. This is what a normal yield curve looks like. 1

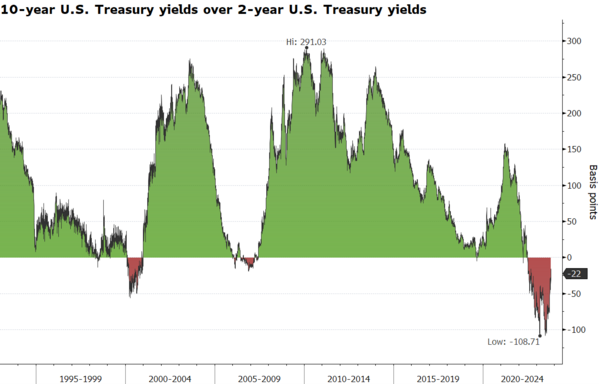

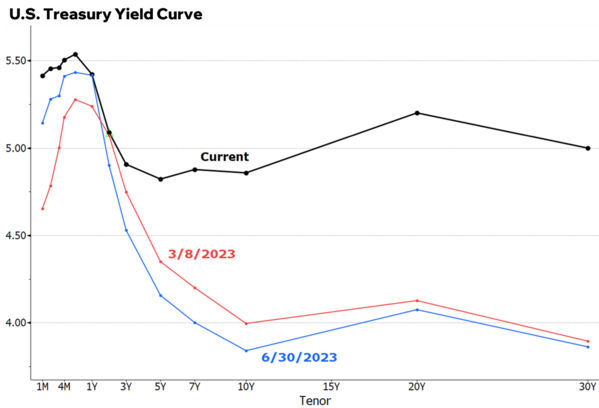

Over the last 15 months the yield curve has been inverted, meaning investors were paid more for shorter term bonds than longer term bonds. At its most inverted, the spread between the 2-year and 10-year bond was 109 basis points. 2

Of late, the yield curve has been flattening compared to the very inverted yield curve in March 2023, with the spread between the 2-year treasury bond and a 10-year bond narrowing to 22 basis points. 2

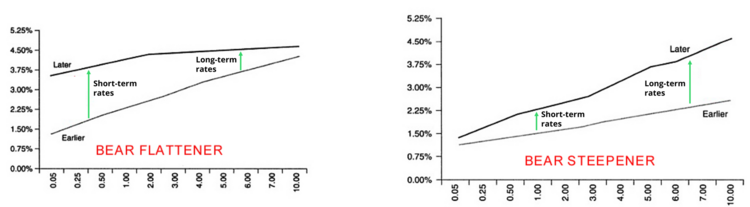

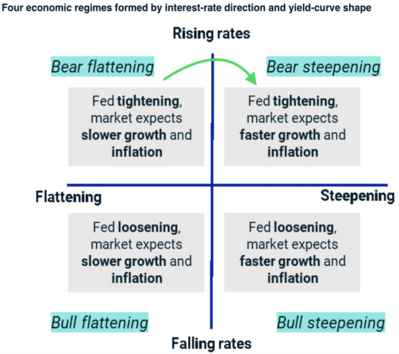

Not all yield curves are equal, however. As you can see from the charts below, different actions in the bond market mean different things. We are likely in a bear flattening period, when short-term rates rise faster than long-term interest rates, and transitioning to a bear steepening period in which longer term rates are rising much faster than shorter term rates. (Don’t get confused with the bear term, it’s being applied to bond prices not stock prices) 3

This action typically occurs when there is strong economic growth and the ongoing threat of inflation. Sound familiar? In fact, Q3 GDP is expected to grow at over 5%. 4

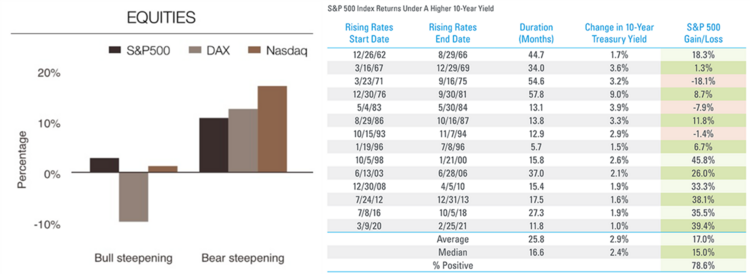

Oddly enough, when longer term rates rise, as they have been in the past month or so, equity markets perform reasonably well. Again, this is driven by prospects for continued growth in the economy and, perhaps, in anticipation of a bull steepening period in the not-too-distant future. That’s when the Fed cuts rates to stimulate more growth. 5 6

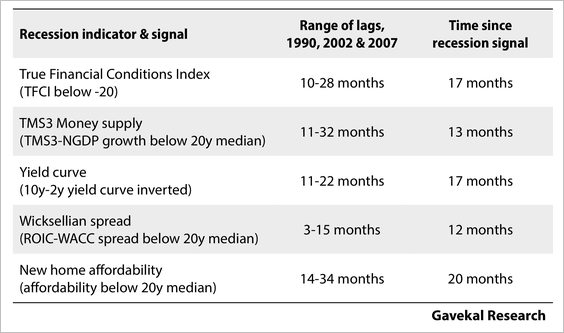

Recent comments by Fed Reserve Chairman Powell referenced the tightness occurring with rising rates and the lag effects from the Fed’s current interest rate policy: 7

“Given the fast pace of the tightening, there may still be meaningful tightening in the pipeline.”

“Financial conditions have tightened significantly in recent months, and longer-term bond yields have been an important driving factor in this tightening.”

Fed Chair Jerome Powell, October 19, 2023

Historically, the impact from interest rate policy lags the actual economy by 18-24 months.8

Things are trying to flatten out and that’s a good thing as we move our way back to a neutral interest rate policy – geopolitical risks aside.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://corporatefinanceinstitute.com/resources/fixed-income/normal-yield-curve

- Bloomberg

- https://www.columbiathreadneedleus.com/blog/chart-two-types-of-steepening-yield-curves

- https://www.atlantafed.org/cqer/research/gdpnow

- https://am.lombardodier.com/gi/en/contents/news/investment-viewpoints/2023/september/1148-SIM-MAC-yield-curve.html

- https://www.lpl.com/newsroom/read/weekly-market-commentary-rising-rates-stock-market-performance.html

- https://www.federalreserve.gov/newsevents/speech/powell20231019a.htm

- https://research.gavekal.com