Too Soon to Taper

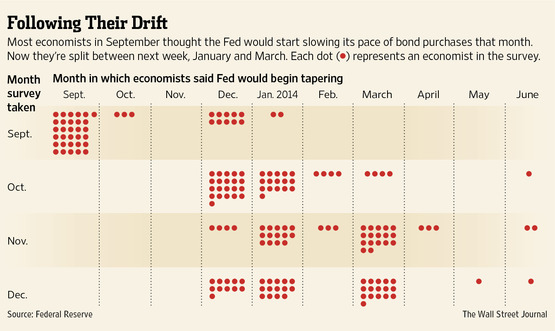

The week before Christmas will certainly be anything but quiet for global equity markets. With the recent strong jobs report, stronger than anticipated Q3 GDP, and consumer confidence improving, some market prognosticators are now suggesting the Fed might begin to cut back on their bond purchases as early as this week. [i]

While I don't believe the Federal Reserve quantitative easing program has created strong growth for much of the economy, there is certainly no question asset prices have improved. Since QE3 began on September 13, 2012, the stock market is up 24.97% and housing prices are up 13.29%. [ii]

Why they should wait

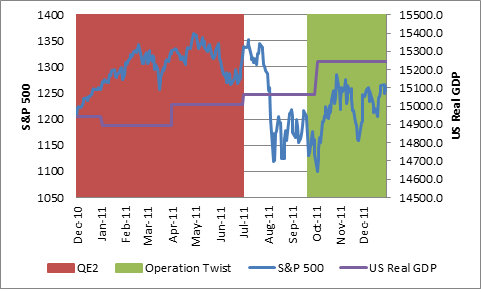

In spite of my personal opinion, the last time the Fed pulled their QE program, the stock market dropped sharply and the economy stalled. [iii]

Second, the economy is still dangerously close to flat-lining when it comes to inflation. [iv]

After spending over $2 trillion on bond purchases since QE 1 [v], it would fly in the face of the Fed's past experience to prematurely pull one of their last tools. Additionally, deflation is far more harmful to the economy than inflation.

Finally, the Fed does have one new tool to attempt to use. As I have written on several occasions, most inflation hawks don't appreciate the Interest Rate Paid on Excess Reserves. Basically, the Fed is paying banks interest to hold excess reserves above the mandatory requirements—creating an incentive for banks not to lend.

In the current case, the Fed is paying 25bp to banks for not taking on any lending risk. [vi] If the Fed wanted to stimulate more money velocity in our economy they could move that rate to zero, pushing banks to take more risks and actually lend, rather than collecting free money.

Specific predictions are almost always wrong, but if I were to predict a course of action the Fed might take this week, it would be some kind of adjustment to the Interest Rate Paid on Excess Reserves.

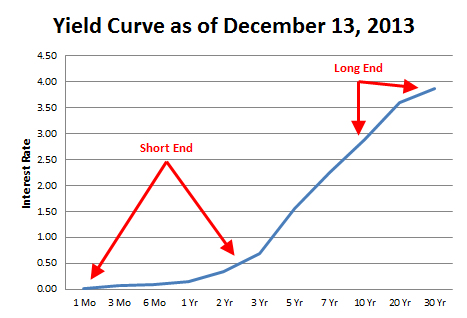

I would also suggest that both the very short and very long ends of the yield curve are most likely to face selling pressure associated with any tapering. That's why we are targeting durations around 4 years. [vii]

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Alex Cook, Investment Analyst – Phillips & Company

[i] “Economists split on start of Fed pullback”, Wall Street Journal, December 13, 2013

[ii] Bloomberg LP. Stock prices are represented by the S&P 500. Housing prices are represented by the S&P/Case-Shiller Composite-20 Home Price Index. Note that the most recent housing price data are as of September 30, 2013.

[iii] Federal Reserve, Bloomberg LP. “Federal Reserve: Unconventional Monetary Policy Options”, Congressional Research Service, February 19, 2013.

[iv] “Consumer Price Index for All Urban Consumers: All Items (CPIAUCSL)”, Federal Reserve Economic Data

[v] “Federal Reserve prolongs stimulus”, CNN Money

[vi] “Interest Rate Paid on Excess Reserve Balances”, Federal Reserve Economic Data

[vii] “Daily Treasury Yield Curve Rates”, US Department of the Treasury