Who Missed Catching the Ball?

The answer: Most of Wall Street, including to some degree us, when it comes to the short-term direction of interest rates.

While we knew rates would be persistently low for some period of time, we expected a small rise in rates at the beginning of the year. See our posting on Too Soon to Taper (Dec 2013).

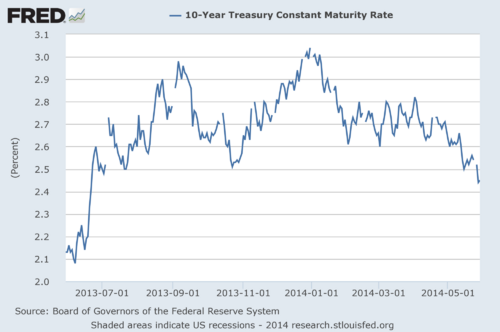

It's always hard to be right when forecasting the future and it appears bond bulls were rewarded in the short run. You can see from the chart below, rates actually dropped and bond traders accurately forecasted a pullback in US economic growth.[i]

With the 2nd revision of Q1 GDP posting a reduction, a recession is only one more quarter away. The common definition of a recession is a period of two consecutive quarterly declines in real GDP.[ii, iii]

So what is the actual risk of recession? There is actually an indicator for risk of recession and it's dropped. The risk of recession is lower now than in prior periods, which flies in the face of the latest print on GDP.[iv]

Clearly a more granular look at the component parts of GDP is needed to see how things look for Q2.[v]

Looking at recent trends, consumption in Q1 remained stable, which is important as it makes up about 70% of GDP. The decline in Q1 GDP was driven by drops in the inventory, fixed nonresidential investment, and net exports segments. Businesses produced less product, invested less in capacity, and sold less internationally. Initial reports for GDP-related data suggest that Q2 GDP is off to a slow start.

- Retail sales, which account for one third of consumer spending, were up just 0.1% in April, after rising 1.5% in March.[vi] Sales were held back by declines in receipts at furniture, electronic and appliance stores, restaurants and bars, and online retailers. Economists noted that a late Easter may have caused difficulties with smoothing the data for seasonal fluctuations.[vii]

- According to the Commerce Department, orders for durable manufactured goods rose 0.8% in April from the previous month.[viii] This was mainly due to a large jump in defense goods. Excluding defense, orders would have fallen 0.8%.[ix]

- Orders for core capital goods, a proxy for business investment plans, fell 1.2% in April, the weakest showing since January.[x]

- Total exports increased 2.1% in March, after a drop of 1.3% in February and just 0.6% growth in January.[xi] Imports also increased, due in part to a higher volume of petroleum imports and higher oil prices. The US trade deficit improved, but was still higher than Bureau of Economic Analysis estimates. There is also concern that slower growth in China could reduce demand for US exports in the coming months.[xii]

- The Labor Department reported that import prices fell 0.4% in April. Weak import prices are helping to keep inflation low.[xiii]

Will we have another quarter of GDP shrinkage? It’s possible, but slow growth appears more likely based on the indicators. Economists are calling for a significant rebound in Q2, in part due to pent-up demand from consumers who delayed purchases due to the bad weather earlier in the year. We’ll know soon enough if they are correct, or if the ball gets dropped again.

In this type of environment, we are adding some duration to the fixed income portion of our portfolios. With continued low inflation and slow GDP growth, rates are likely to remain low for the near term and higher duration portfolios should benefit in this scenario.

If you have questions or comments, please let us know as we always appreciate your feedback. You can get in touch with us via Twitter, Facebook, or you can email me directly. For additional information on this, please visit our website.

Tim Phillips, CEO – Phillips & Company

Jeff Paul, Senior Investment Analyst – Phillips & Company

[i] Federal Reserve Economic Data.

[ii] Moody’s Analytics. (5/29/2014). United States: GDP (Second Estimates).

[iii] Shenk, M. (10/10/2008). What Exactly Is a Recession – and Are We in One? The Cleveland Federal Reserve.

[iv] Moody’s Analytics. (5/30/2014). United States: Risk of Recession.

[v] Moody’s Analytics. (5/29/2014). United States: GDP (Second Estimates).

[vi] Moody’s Analytics. (5/13/2014). United States: Retail Sales.

[vii] Mutikani, L. (5/13/2014). Retail sales slow, but growth outlook still upbeat. Reuters.

[viii] Moody’s Analytics. (5/27/2014). United States: Durable Goods (Advance).

[ix] Crutsinger, M. (5/27/2014). US durable goods orders rose 0.8 percent in April, but business investment demand declined. Star Tribune.

[x] Ibid.

[xi] Aleman, E. (5/6/2014). Net Exports Will Still Be a Drag on Q1 GDP. FXstreet.com.

[xii] Crutsinger, M. (5/27/2014). Star Tribune.

[xiii] Mutikani, L. (5/13/2014). Reuters.