Dancing with Inflation

The recent uptick in volatility within the equity markets, in my opinion, is due to investors quickly discounting rising inflation. As we alluded to in last week’s post (here), the risk parity guys have done their share to contribute as well.

Inflation has never been the best of friends to equity investors. Look no further than a comment made by famed investor, Warren Buffet on this very matter circa 1977.

"The arithmetic makes it plain that inflation is a far more devastating tax than anything that has been enacted by our legislatures. The inflation tax has a fantastic ability to simply consume capital. ... If you feel you can dance in and out of securities in a way that defeats the inflation tax, I would like to be your broker — but not your partner." [i]

As many of you know, Buffet has been a long-term investor and proponent against market timing of all kinds. In fact, he often reminds us that market timing benefits only those who thrive on transaction costs, which can be applied to timing inflation as well.

Although we have seen a recent rise in expected inflation, much of that can be attributed to the recent rise in energy prices. [ii]

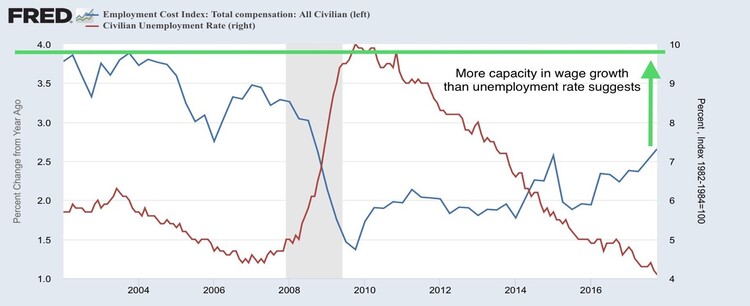

However, the recent increase in wage growth alongside a historically low unemployment rate should not be ignored as a contributing factor as well. [iii]

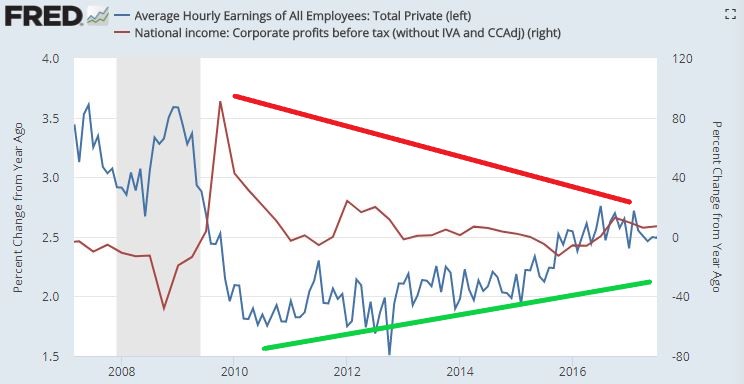

Keep in mind that rising wages do not come without consequences to corporations. As you can see below, rising wages tend to crowd out corporate profits. [iv]

Warren Buffet put it simple when describing corporate profits during periods of rising inflation.

"Unfortunately, earnings reported in corporate financial statements are no longer the dominant variable that determines whether there are any real earnings for you, the owner. For only gains in purchasing power represent real earnings on investment. If you (a) forego 10 hamburgers to purchase an investment; (b) receive dividends which, after tax, buy two hamburgers; and (c) receive, upon sale of your holdings, after-tax proceeds that will buy eight hamburgers, then (d) you have had no real income from your investment, no matter how much it appreciated in dollars. You may feel richer, but you won't eat richer.” [i]

It is worth noting that research done by Capital Spectator shows that there is no clear relationship between stock prices and inflation in the short run. [v]

Perhaps, this too, supports the point that Buffet was making: trying to time the inflation tax by dancing in and out of equities might be foolish.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can email me directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. https://www.cnbc.com/2018/02/12/warren-buffett-explains-how-to-invest-in-stocks-when-inflation-rises.html

ii. https://www.nasdaq.com/markets/crude-oil.aspx

iii. https://fred.stlouisfed.org/series/UNRATE

iv. https://fred.stlouisfed.org/series/CES0500000003#0

v. http://www.capitalspectator.com/a-closer-look-at-the-links-for-stocks-interest-rates-and-inflation/