What Gives?

Reading tea leaves and making precise forecasts are not things I would do, especially when it comes to predicting equity prices. Last week’s post (here) made the case that panic was not an investment strategy. I hope you read it— and reread it. I can’t stress the points I made enough when it comes to wealth management.

Many blame the recent pullback on rising interest rates and inflation. Regardless, the market activity last week demonstrated how little we know when it comes to the direction of equity prices in the very short-run when emotions and herd mentality tend to override fundamentals.

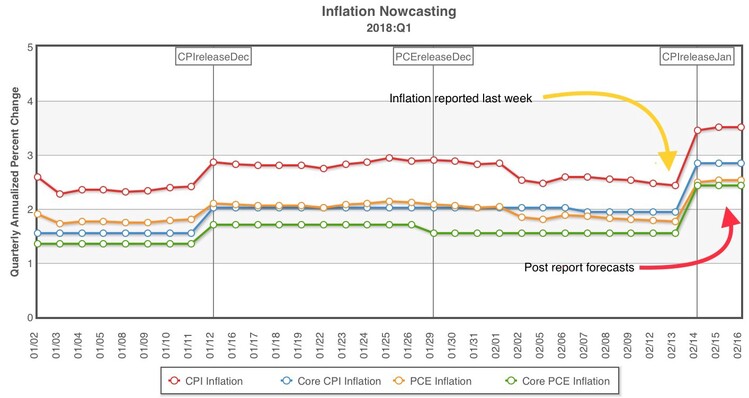

When actual inflation was reported last Wednesday, you would have expected the bottom to fall out of equity prices. Inflation came in at 2.1 percent on a year-over-year basis, which signals that the Fed will likely raise rates in March and indicates that two additional rate increases are likely during the remainder of 2018. [i]

In fact, inflation forecasts by the Federal Reserve, now reflect values above the long-run Fed target of 2 percent. [iii]

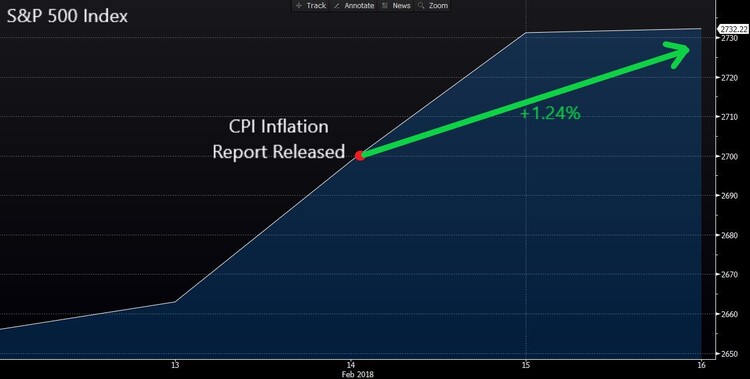

Counterintuitively, equity prices have rallied 1.24 percent since that report. [ii]

So what gives? Why would the markets rally so much in the face of rising inflation and ultimately higher interest rates?

One reason may be that, historically, interest rates have shown a positive correlation to equity prices when interest rates rise between 0 and 5 percent. [iv]

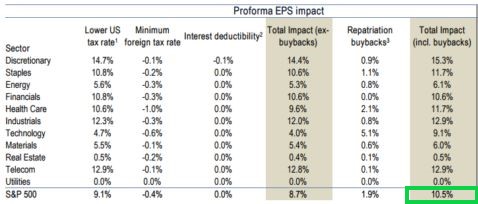

Another reason may be that the madness of the investor crowd is coming to terms with the massive fiscal stimulus associated with the recent U.S. tax reform and the coinciding expansion of the federal budget. Remember that the U.S. tax reform is projected to add an additional 10 percent to corporate earnings per share growth. [v]

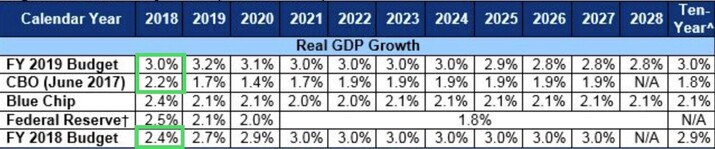

Additionally, it’s worth noting that the recent expansion of the federal budget forecasts the potential to add 1 percent to GDP growth over the projected 10-year long-run projected average. [vi]

Finally, and probably most likely, investors may be realizing that the financial engineers who pitched portfolio insurance to large pensions and endowments— along with billionaire family offices— were only selling snake oil. Look no further than the CEO of AQR, Clifford Asness, PhD. He, in my opinion, is the black belt of financial engineering. Here is his thought on taking responsibility for the recent pullback in risk parity. (By the way, billionaires really need to stay off Twitter.)

And here’s my personal favorite from the billionaire Asness’ Twitter feed.

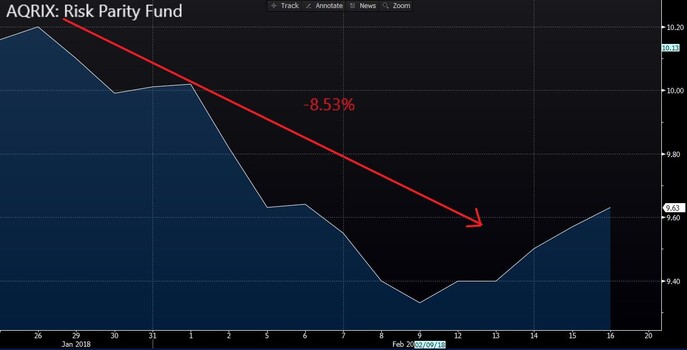

Asness seems defensive for a guy who is unapologetic about risk parity being blamed for the recent pullback. Not to be unfair in this editorial, let’s look at how his risk parity (portfolio insurance) fund performed during the market pullback. [ii]

Notice that when you overlay the S&P 500, you see a good picture of what a sham these types of funds really are. Risk parity was down 8.53 percent, while the S&P 500 declined 10.16 percent. [ii] Those results are not exactly the kind of portfolio insurance state pension funds and institutions thought they were going to get.

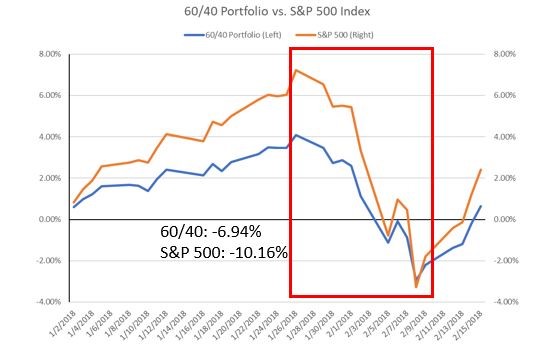

Now, look at a common portfolio that we manage on behalf of our clients and compare that to the S&P 500 over the same period.

You can see that, in many instances, sticking to the basics works just fine.

To be fair to Dr. Asness, he’s following in a long line of financial engineering-related market corrections that include the following:

- Flash crash 2015

- Flash crash 2013

- Taper Tantum in 2013

What gives might just be what we thought all along; good fundamentals, good fiscal policy stimulus, and another bout of financial engineering.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can email Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Robert Dinelli, Investment Analyst, Phillips & Company

References:

i. https://www.bls.gov/news.release/cpi.nr0.htm

ii. Bloomberg L.P.

iii. https://www.clevelandfed.org/en/our-research/indicators-and-data/inflation-nowcasting.aspx|

iv. https://mail.phillipsandco.com/files/8915/1915/1225/MI-GTM_1Q18_February.pdf

v. http://www.valuewalk.com/2018/01/tax-reform-bad/

vi. http://www.crfb.org/sites/default/files/PB_FY_2019_Final.pdf