For the Pessimist – Play Blackjack not the Big Wheel

There are a lot of headlines that can and are fueling the pessimist within all of us. That creeping, silent voice in our head that says, “danger ahead.” The fascinating thing about pessimism is it can act as a compelling emotion by helping us act with caution.

Take the prevailing and reoccurring theme I hear from investors that a recession must be around the corner. Of course, we are certainly one day closer to a recession today than we were yesterday. That was the case in 2010 and it is now.

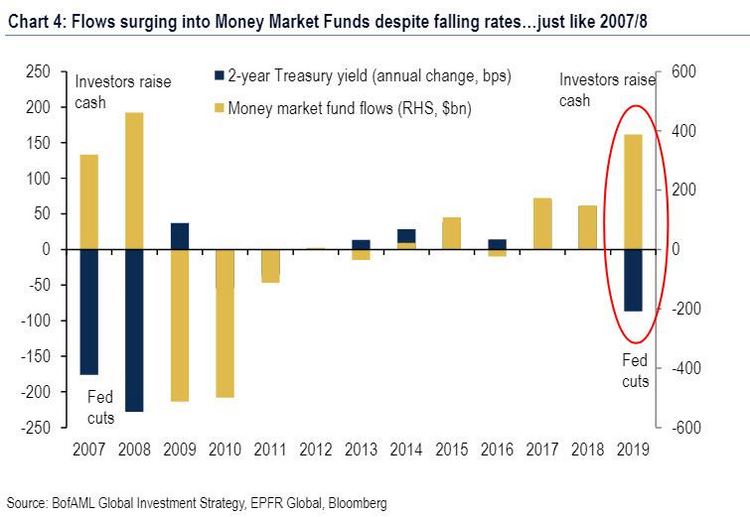

It’s pretty clear investors are acting on their gut and building larger cash reserves. [i]

Similar to 2007 and 2008, investors are raising cash and that will add fuel to that pessimistic inner voice. In fact, cash is at record levels nearing $3.5 trillion.

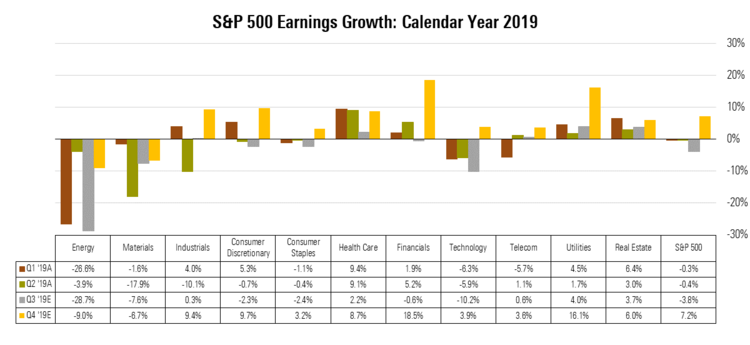

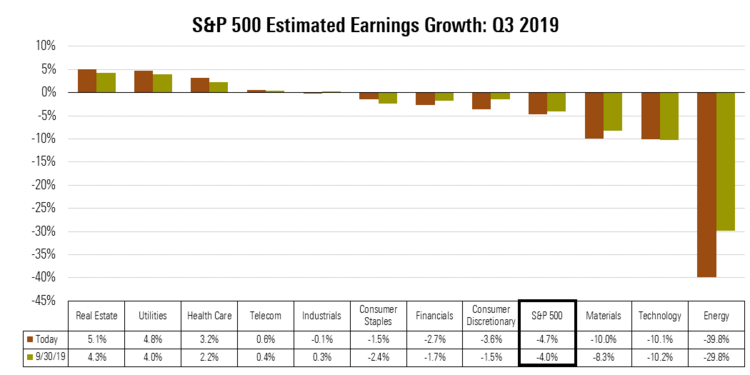

Corporate earnings are certainly in the throws of an earnings recession. According to FactSet, early earnings reports for Q3 are confirming our belief that we will have a 3rd consecutive quarter of no earnings growth. [ii]

As of October 18, 15% of S&P 500 companies have reported Q3 earnings, posting a cumulative decline of -4.7%. [iii]

Again, more fuel feeding that creeping, dark voice in our minds that things are going to get bad.

The problem with pessimism is it’s so darn seductive and for action-oriented people like us we want to do something about that scary little voice in our heads or that gnawing feeling in our gut. After all, you’re saying, “I’m going to regret it if I don’t do something.”

Here is the big “but”…

When we need to invest, especially using public market equities, we need to make daily decisions about how we want to behave and interact with those investments.

I hate to use a casino analogy because proper investing offers much better odds than any casino, but this will illustrate my point.

The Difference Between Blackjack and the Big Wheel

When you play blackjack properly, the house odds (when the casino wins) are as low as 0.13% to 1%. The house odds on the Big Wheel that has 54 segments is between 11% and 24%, so you have a pretty poor chance of winning, however the wheel is big and bright and looks like fun.

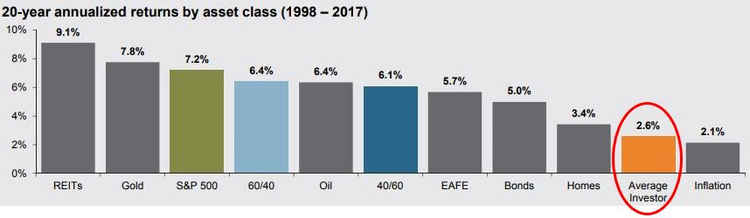

That’s how I think about proper investing, but with better odds. As an investor, trying to time markets is nearly impossible. Just look at the returns individual investors generate when they attempt to time the markets. [iv]

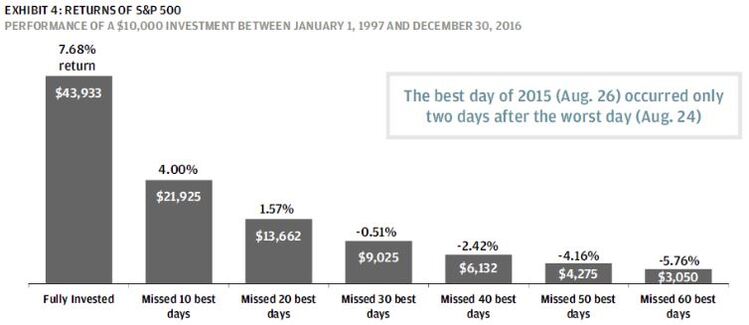

Timing requires two skills, knowing when to sell and then having the same skill on knowing when to buy back in. The problem with equity investing is markets tend to move in very short bursts. Just look at the data chart below. If you miss just a few days, you could lose all the advantage. [iv]

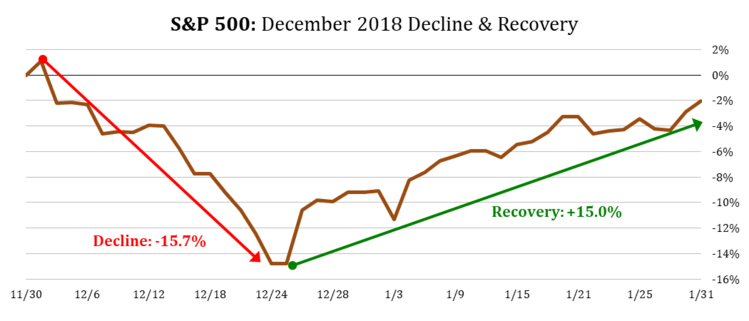

Just think about the last 20% pullback in December 2018 and realize it would have been virtually impossible to sell and buy perfectly. [v]

For my full presentation on the 5 Basic Rules for Equity Investors click here.

Despite that little voice in your head trying to drive your investing behavior, simply have a strategy:

How long can you go without touching your equity investments?

How much cash will you need to survive a long-term downturn in the markets?

How much emotional pain can you withstand?

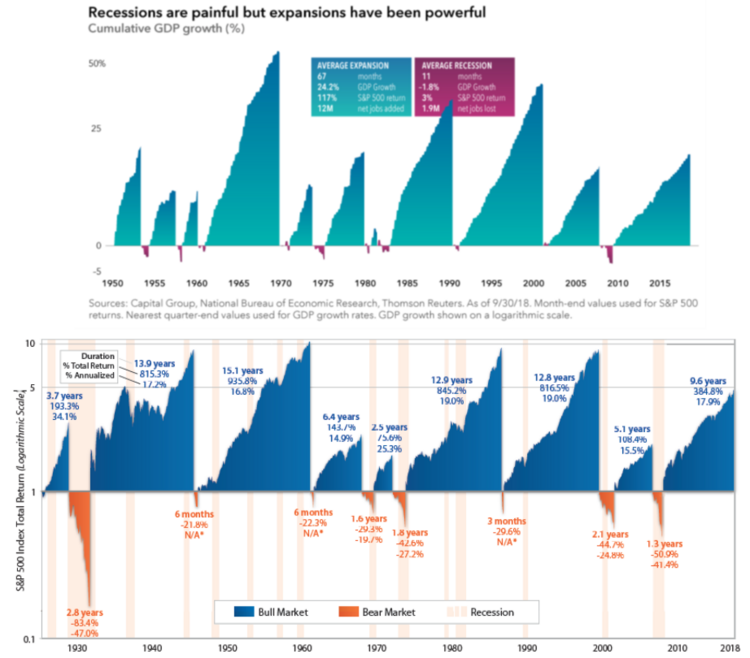

The good news is recessions and bear markets don’t last that long. [vi]

Yes, the data suggest there is a lot of caution in the market. Investors are stockpiling cash. Nonetheless, that same cash stockpile will come back into the markets and you won’t want to miss that.

It is very easy to see that smart investors need to do something different than react to the fearful, dreadful voice in their heads. Play blackjack, not the big wheel.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

i. https://www.rethinkingthedollar.com/retail-investors-are-saving-cash-like-a-financial-crisis-is-around-the-corner/

ii. https://phillipsandco.com/files/8615/7046/8807/Look_Ahead_-_2019Q4_-_Final_-_No_Audio.pdf

iii. https://www.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_101819.pdf

iv. https://phillipsandco.com/files/4915/7167/2924/5_Rules_For_Equity_Investors_2019-02-03_18_02_44.pdf

v. https://www.bloomberg.com/quote/SPY:US

vi. https://phillipsandco.com/files/3615/7167/3232/401k_Education_.pdf