Planting Seeds

In his recent comments, Fed Chairman Powell messaged more uncertainty around the continued rate increase cycle. He covered the usual list of things working for and against the U.S. economy. You can read all the ebbs and flows of the economy in any one of our earlier blogs. Skipping ahead to the conclusion, we need to come to terms with a few oddities in interest rate policy.

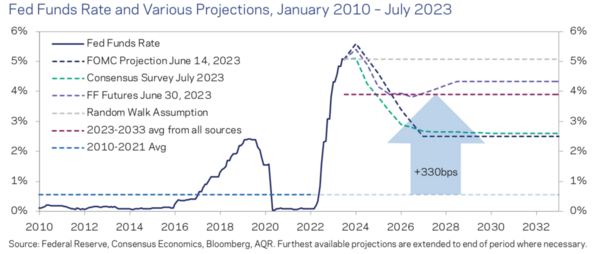

First, the “higher-for-longer” interest rate mantra we are all hearing out of the media might need to be phrased, a “return to the past.” Fed Funds policy rates have spent a long period of time near the 4.5% range rather than the 0.5% range from 2010-2021. 1

It’s my view that we are returning to our past. The simple fact is productivity is up for American workers, offsetting higher wage growth. In as much as that holds true, we could see a more normalized Fed Funds rate at 4%. 2 (see our blog post here for an explanation)

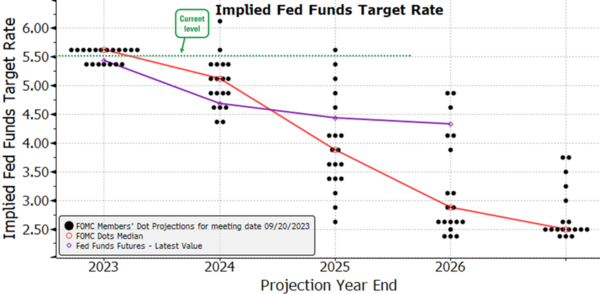

Second, the Fed published the results of their survey of voting members on the Federal Reserve Board’s interest rate setting committee. All the smart, uber-educated people from the best universities are projecting the following: 2

- The members expect rates to go up one more time before year-end to 5.75%

- By the end of 2024 they expect rates to be cut back down to 5.25% from 5.75%, or a 50 basis point cut

- By the end of 2025 they expect rates to be cut back down closer to 4%

- By the end of 2026 they expect rates to be closer to 3%

- In the long run, they expect rates to be 2.5%

Here’s what they are saying: productivity will return to a paltry 1%, with no regard for innovation like artificial intelligence, improved knowledge like software being programed in plain English, or a return to a robust global trade regime.

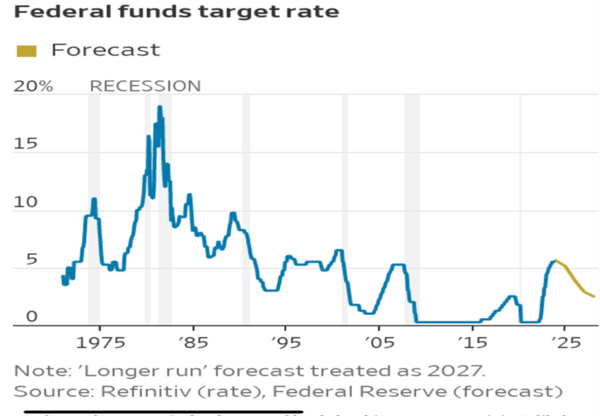

Here’s the reality of what history holds when it comes to Fed Funds rates: Rates historically drop like a rock. The Fed’s forecast suggests this will be some kind of slow landing anomaly. I don’t think so! 2

I think when the economy slows, as it will, the Fed will err on the side of caution and cut rates quickly. It’s their job to protect the American worker and not put them out to pasture.

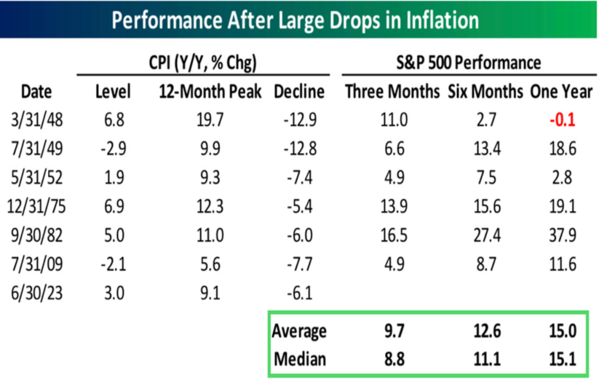

Finally, and perhaps understandably, when the Fed cuts and cuts quickly, it’s usually generated from large drops in inflation. That’s probably why equity markets perform handsomely. 3

While I am sure there is more pain to be felt for both fixed income and equity investors, the folks at the Fed should provide the seeds for the next equity rally.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: