Where Will We Land?

Phillips & Company has the privilege of advising thousands of clients from all walks of life and economic backgrounds with varying goals and objectives. All are impacted by rising interest rates, even those that have low to no debt. That’s why we field the same question frequently: “When will we have rate cuts?”

I would suggest the real question should be: “Where will the Fed Funds rate land to be neutral to the economy?”

It’s this level that allows all of us to plan for current and future purchases, investments, and capital allocation decisions.

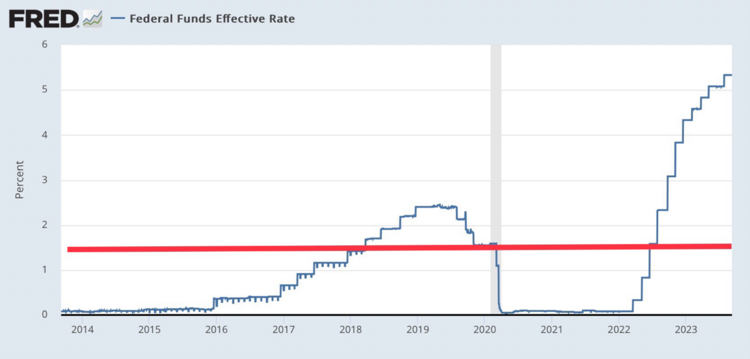

When you look at the last 10 years of the Fed Funds Rate you get the feeling that interest rates might land back at near 1.5%. When you pull out the economic aftermath of the Great Financial Crisis and Covid, around 1.5% seems to be the modern era landing zone. 1

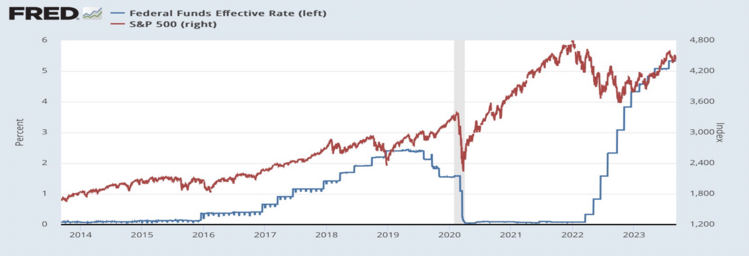

Equity returns have been consistently supported by low rates, and more recently, the anticipation of lower rates ahead. Knowing where we might land is worth estimating. (Speculating might be a better word) 2

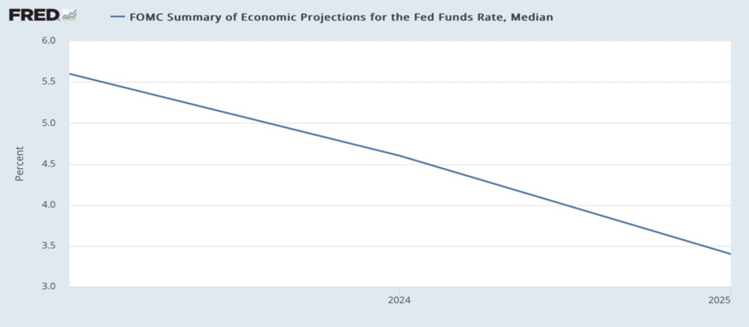

Considering where the Federal Reserve estimates projected rates gives one indication of where we will land. Currently, Fed Governors anticipate the neutral rate on Fed Funds to land at around 3.5% by the end of 2025. Certainly, much higher than in our modern era of extremely low rates. 3

However, if we look at what rate will create neither a drag on economic growth nor fuel inflation, we get a different picture.

The Fed looks at wage growth as a primary driver for inflationary pressures. That’s easy, the higher wages rise, the more pressure on prices we all pay.

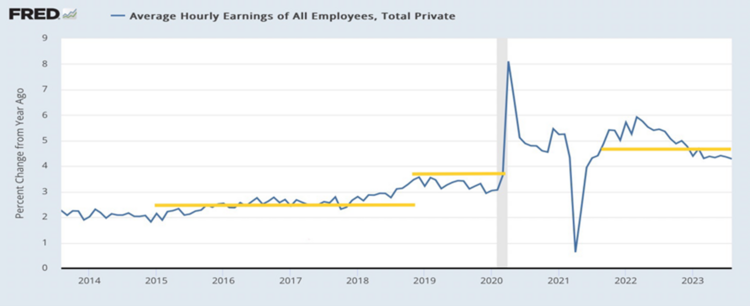

Wages have had a few different levels of growth recently: 4

- 2015-2018: Wages grew at a paltry 2.5%. That seems to be the Fed’s basis for their expectations in their interest rate forecast.

- 2019-2020: Some strong wage growth, in the 3%-3.5% range.

- 2021-2023: 4.5% wage growth, which seems to be the post-Covid trend.

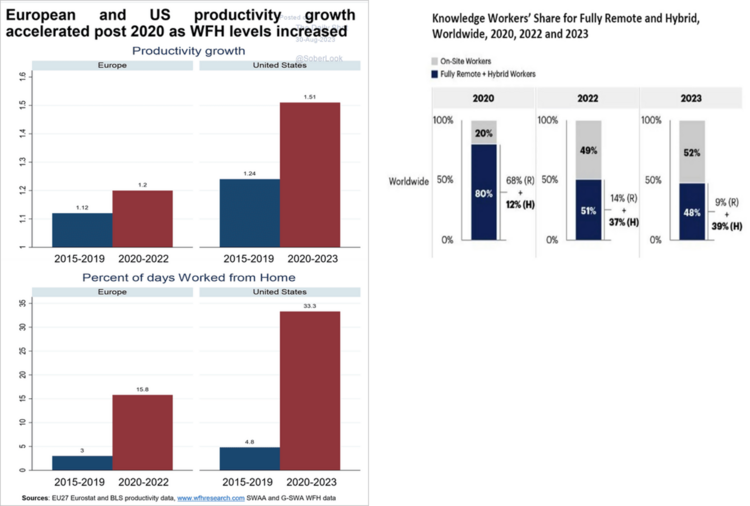

The Fed then factors in productivity. Productivity growth is the rate at which the economy is producing goods and services per hour of work. When productivity grows, it means that businesses are able to produce more output with the same number of inputs, which can help to keep inflation in check.

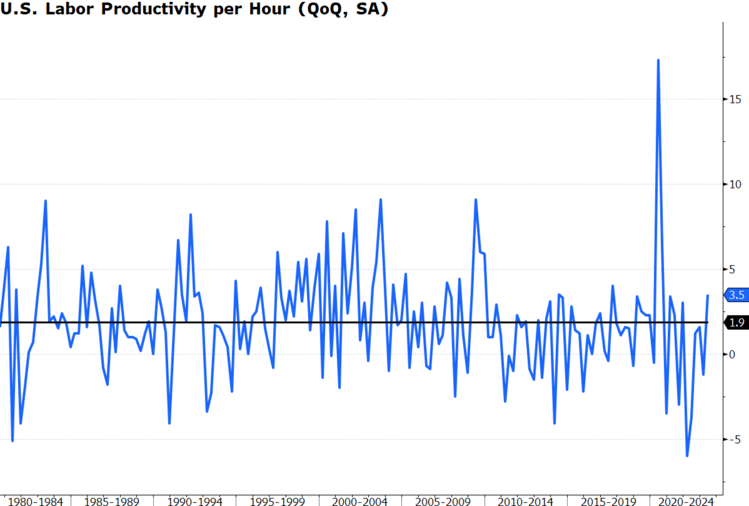

Productivity is at a high level of 3.5% based upon the latest report from the Bureau of Labor. 5

The math goes something like this:

If the Fed wants inflation at their 2% target and productivity is at 3.5%, they will need wages to shrink by 1.5%. Their inflation target = Wage Growth + Productivity. This scenario calls for high interest rates to shrink wages or crush productivity.

So, what if productivity is pegged at higher levels for longer?

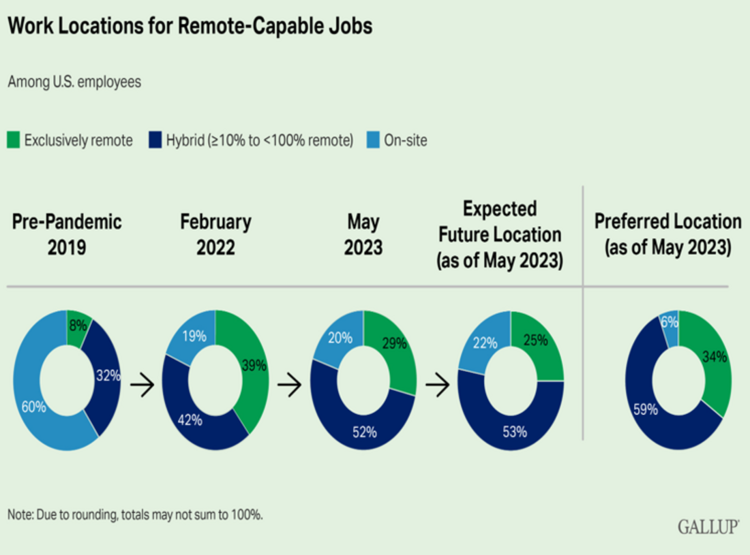

Productivity in Europe and the U.S. has shifted higher and that seems to be correlated to the work from home trends, which do not seem to be diminishing anytime soon. With a full reopening, on-site has hardly moved, compared to fully remote and hybrid. 6

According to Gallup, working hybrid is the preferred work environment compared to on-site. 7

If wage growth were to return to the 2.5% trend and productivity was as high as 1.5%, the Fed Funds rate would be around 4% -- well above the trend for the last 10 years and certainly higher than the current Fed expectation by 2025.

If I am doing capital allocation planning or determining when I would refinance a mortgage, I would be considering a long-run 4% Fed Funds rate.

Tim Phillips, CEO, Phillips & Company

Sources: