This Time Is Different‽

The exclamation/question mark combo (interrobang) in the title is not a typo. It’s a reflection of my view on what the Federal Reserve Chairman said last week during his press conference. He made a statement that seemed like a question to me.

Of course, all of this still pertains to interest rates and the timing of when the Fed might cut rates. It’s critical we get a feel for rate cuts. After all, higher rates exacerbate and extract precious resources out of our economy; not to mention supercharge any income inequality for those in the lower income cohorts.

Historically, rate cuts ensue when inflation is back down to the Fed Funds target rate and in our case, that's 2%. We know from one of my previous blogs (“Inflation Again or Bad Math”) that the Fed uses a pretty bad survey to measure housing inflation. It’s my view this bad math could be the anatomy of a Fed-induced policy error for the economy.

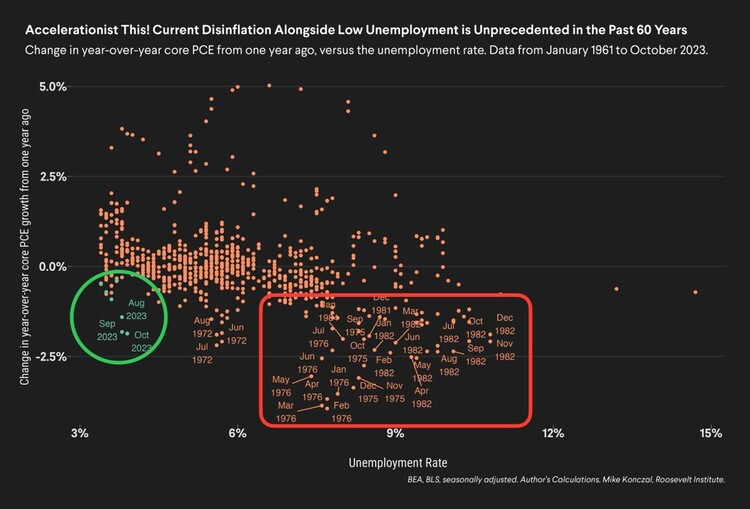

Also, history suggests, rates get cut when there is a rapid rise in unemployment (red box below). However, we are in a time when the Fed might be considering cutting rates when unemployment is at historic lows (green circle). 1

Is this time different‽

It appears the Fed is now actually verbalizing the fact that rates can be cut when unemployment is at record lows.

Here’s the proof. From Fed Chairman Powell’s Q&A session with the press last week: 2

Q Jeanna Smialek, The New York Times. “…A weakening in the labor market would be a reason to potentially cut rates or at least a consideration in making a rate cut, would continued strength in the labor market be a reason to hold off on rate cuts…?”

A Chairman Powell. “No, not all by itself no.”

What did he just say? Record-low unemployment can equate to rate cuts. That's a head-scratcher. Historically you need a weakening labor market to get inflation down and rate cuts. That’s a historical fact.

Powell’s got some explaining to do. 2

A Chairman Powell. “…if what we’re getting is a lot of supply and a lot of demand, and that supply is actually feeding the demand because workers are getting paid and they're spending…what you would have…is a bigger economy where inflationary pressures are not increasing. So, you can have [rate cuts] if you have continued supply-side activity that we had last year with, both with supply chains and also with growth in the size of the labor force.”

Ok, so all we need is continued increases in supply in the U.S. economy to match the increased demand from all of the Americans at work and spending their wages. While there is no great way to measure supply on a macro scale, the best measure is U.S. GDP.

According to the Atlanta Fed, Q1 GDP growth is expected to come in at 2.1%. That’s not bad for overall production growth in the economy. So, supply will perhaps expand to meet demand. 3

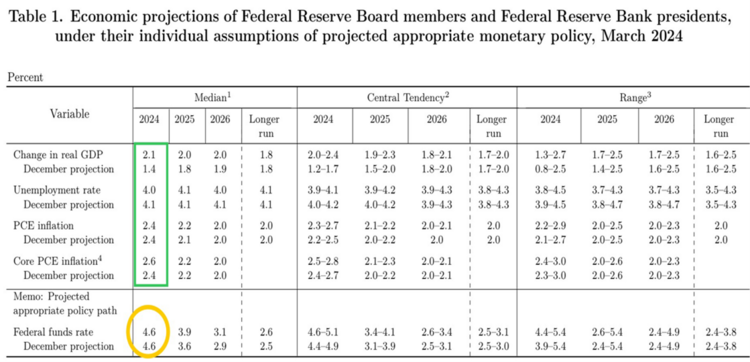

Let’s walk this line of thinking forward one more step. The interest rate setting committee of the Federal Reserve expects:

- Real GDP growth to be stronger than anticipated in December.

- Unemployment rate to be lower than anticipated in December.

- Core inflation to be higher than anticipated in December.

All the while they continue to lower the Fed Funds rate from 5.25% to 4.6%, or three rate cuts. 4

While I doubt this time will be different, the Fed Chairman might just be signaling he understands the flaws in his inflation data and the impact higher rates have on middle America. That might be what’s different.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources: