Threat Perception and Wishful Thinking

Talk of inflation is a constant and, frankly, an ongoing threat to sustained consumption. That narrative hardly changed last week and, most definitely, was exacerbated by the Iranian attack on Israel.

It’s pretty clear from all the advanced warnings by the Iranians and successful missile interventions by the Americans and other Middle Eastern countries that this was designed to have minimal impact. You don’t warn your adversaries, nor do you launch hundreds of missiles in sequence vs. simultaneously, to have a major impact. However, the rearranging of the status quo for the many decades of coexistence between Iran and Israel can pose a threat to the world’s oil supply.

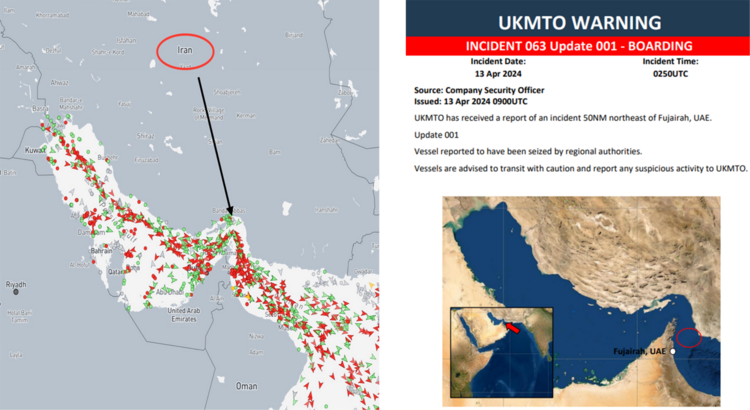

The Strait of Hormuz is a geographic linchpin for oil shipments. About 20% of the world’s oil supply travels through the Strait of Hormuz. What’s even more impactful is over 88% of Middle East oil must travel through the Iranian-controlled Strait. It shouldn’t be overlooked that Iran took an Israeli-owned oil tanker just a day before the so-called "surprise missile attack.” It’s what the Iranians do with this strategic pinch point that will immediately impact lives. 1

I don’t believe the Iranians will attempt to choke the supply of oil to the world and there will likely be little impact on oil markets – notwithstanding some disproportionate reaction from Israel, which I also don’t expect.

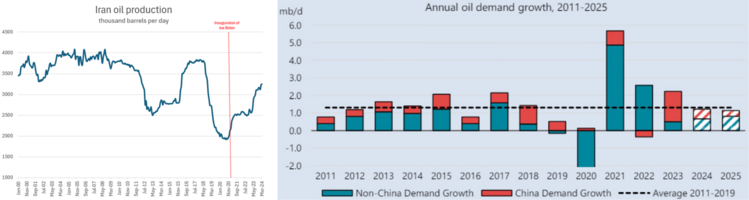

The fact is the Biden administration has allowed Iranian oil to leak into global markets despite the current Iranian sanctions regime. That kept a lid on oil prices and supported the Iranian economy. However, that oil supply can now be used against oil-consuming countries. The saving grace might be the fact that China is a large driver of growth in oil demand, and the Iranians shouldn’t want to disrupt their largest customer. 2 3

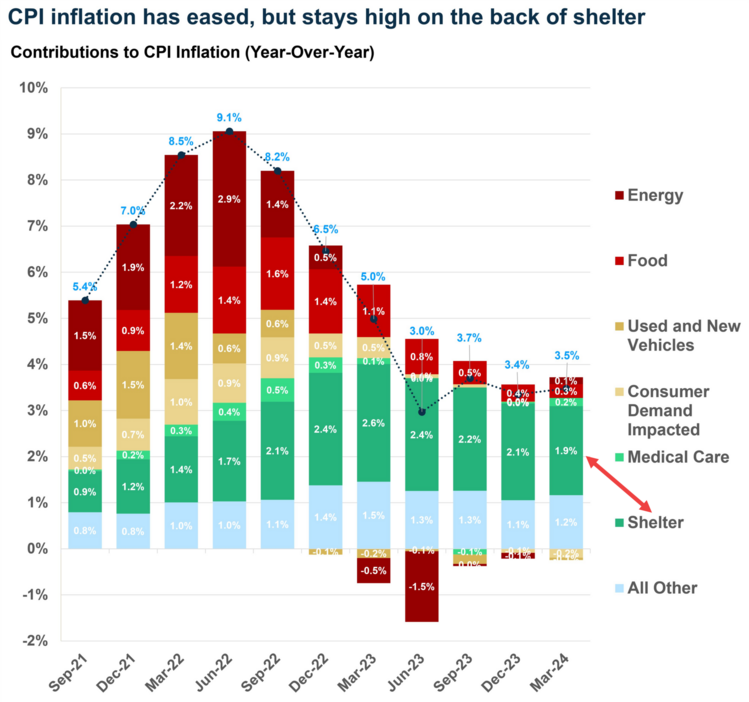

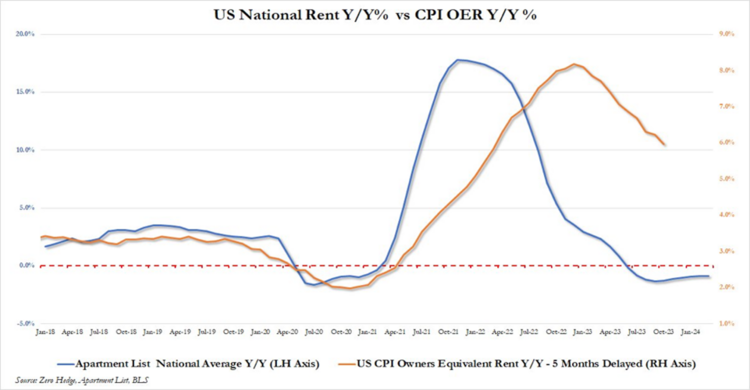

The second part of the dual inflation threat is the ongoing misreading of the recent Consumer Price Index. I’ve been haranguing about the flaws in the way the U.S. Bureau of Labor Statistics (BLS) has measured inflation, specifically shelter inflation. The BLS can accurately measure rental inflation. However, when it comes to surveying homeowners to see what they would rent their places for, the measure is completely flawed. Homeowners have no idea what rents are other than their perception of what their home is worth, or what their mortgage payment might be. It’s a pretty biased cohort. See my recent blog, Inflation Again or Bad Math?, to get all the details.

Once again shelter inflation (both rents and owners’ guess at rents) is driving the bulk of inflationary pressures. It’s skewing inflation much higher than reality. 4

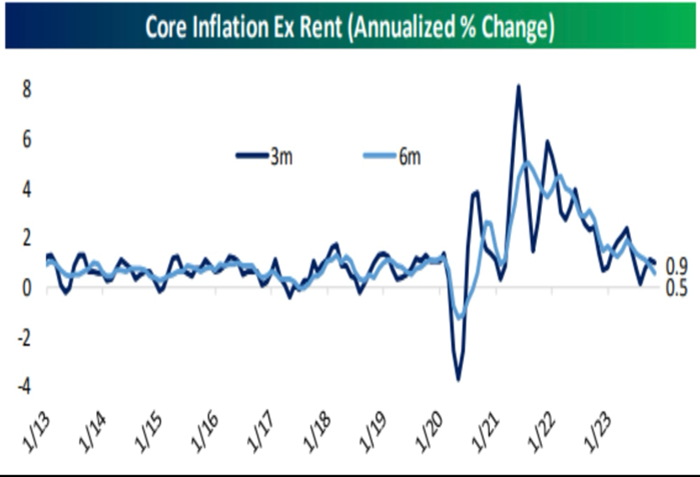

When you strip out rent (of course, you wouldn’t) you get a different reading on inflation. Inflation is well below the Fed’s 2% target. 5

Let’s not strip rent out from inflation (like most economists who strip everything else out) and just bifurcate inflation with rent vs. owners’ equivalent rent (the guessing by homeowners as to what they would rent their place for). 6

Now you are seeing the difference between the two survey methods the BLS uses. Actual rent is inflating below the Fed’s target of 2% while homeowners’ guessing at what their equivalent rent would be is around 6%.

If the BLS used real-time statistics vs. the flawed survey data, inflation would be an entirely different picture, and perhaps the Fed would lean into rate cuts now. Core CPI would be below the 2% threshold and the interest rate picture would be more on easing than higher-for-longer. 7

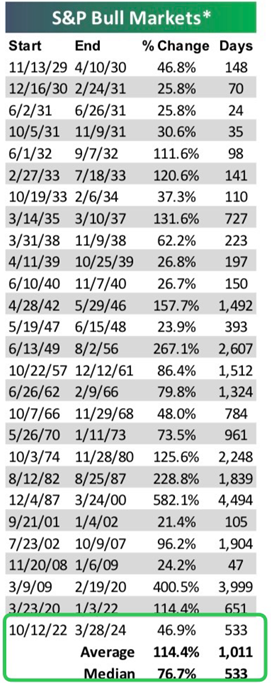

Is it wishful thinking that the hundreds of Ph.D.-level economists working for the Fed can’t see the flaws in their system? Is it also flawed thinking to believe the Iranians and Israelis understand the delicate geopolitical game they are playing? Is it wishful thinking to believe this bull market has a long way to go to match historic performance? 5

Wishful thinking is flawed thinking when it comes to equity investing. Anything can happen and usually does. The best approach I have found is to be sure you have an ample time horizon to manage the risks we see and don’t see.

If you have questions or comments, please let us know. You can contact us via Twitter and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

- https://x.com/UK_MTO/status/1779073141706268690

- https://www.bloomberg.com/opinion/articles/2024-04-14/iran-s-attack-on-israel-upsets-opec-seach-for-goldilocks-price

- https://x.com/JavierBlas/status/1778696005984133417

- https://x.com/sonusvarghese/status/1778112172708528350

- https://www.bespokepremium.com/

- https://www.zerohedge.com/markets/consumer-prices-print-hotter-expected-led-surge-energy-shelter-costs

- https://x.com/dailychartbook/status/1778369903726309870