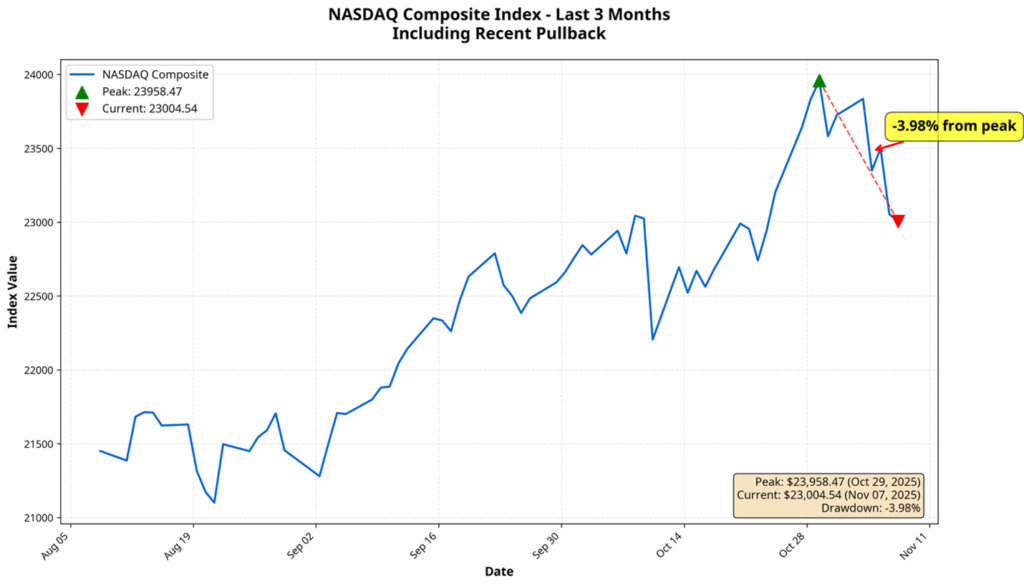

After a stretch of record highs, the market finally caught its breath last week. The NASDAQ is down about 4% from its peak — a move that feels dramatic in the moment but is, in reality, entirely normal.

Pullbacks Happen — Often

If history is any guide, declines like these are not the exception but the rule. Over the past decade, markets have seen pullbacks of varying sizes fairly often — small dips happen several times a year, and even more meaningful drops tend to occur regularly. In other words, periods of volatility are a normal and expected part of investing.

Volatility isn’t a warning sign — it’s the rhythm of a normal market cycle. Short-term pullbacks are the market’s way of resetting expectations before resuming their long-term trend.

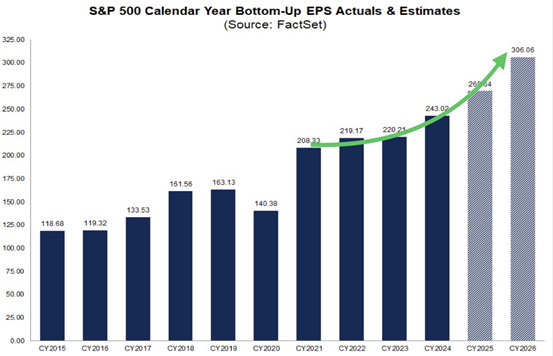

Earnings: The Foundation Remains Solid

While investors may be rattled by a few down days, corporate earnings — the engine of long-term equity returns — continue to impress.

The S&P 500’s bottom-up EPS has grown from about $118 in 2015 to over $243 in 2024, and is projected to hit $306 by 2026. That’s a 26% increase in just two years — a remarkable run of profitability.

Those fundamentals are why markets can absorb volatility: companies are earning their way higher.

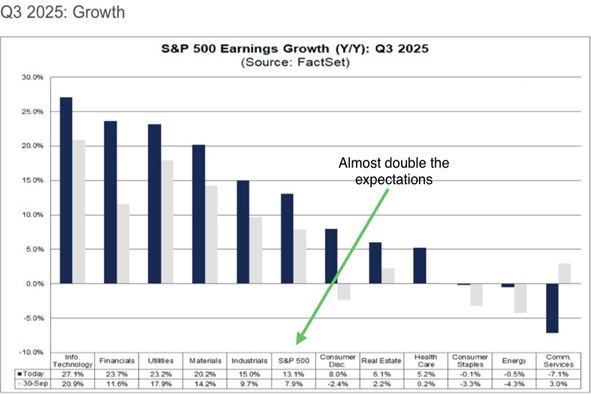

2025: Stronger-Than-Expected Growth

Third-quarter 2025 earnings results came in at almost double expectations, led by Technology, Financials, and Industrials — clear evidence that corporate America is still thriving beneath the surface.

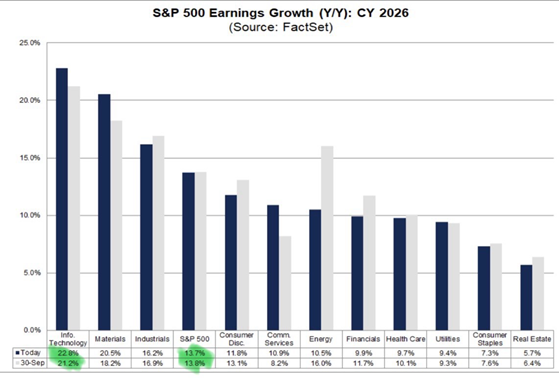

2026: Broad-Based Expansion Ahead

Looking further out, analysts expect broad-based earnings growth across nearly every sector in 2026.

- Technology and Materials are projected to lead with growth above 20%,

- The S&P 500 overall is expected to grow 13.7% year-over-year,

- And even more defensive sectors like Utilities and Consumer Staples are expected to show steady gains.

That’s not the sign of a fragile economy — it’s a signal of resilience spreading beyond the top-heavy tech trade.

Sentiment Shift: Less Fear, More Focus

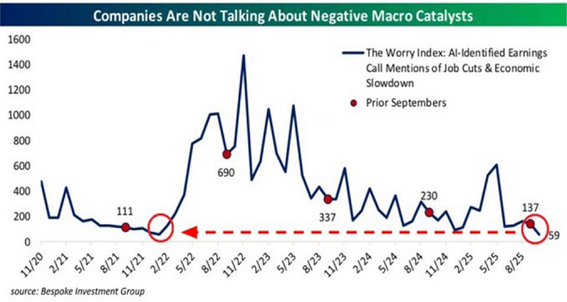

Perhaps the most overlooked development: the “Worry Index” — tracking how often companies mention “job cuts” or “economic slowdown” on earnings calls — has fallen sharply. Companies aren’t talking about crisis; they’re talking about execution.

Context Matters

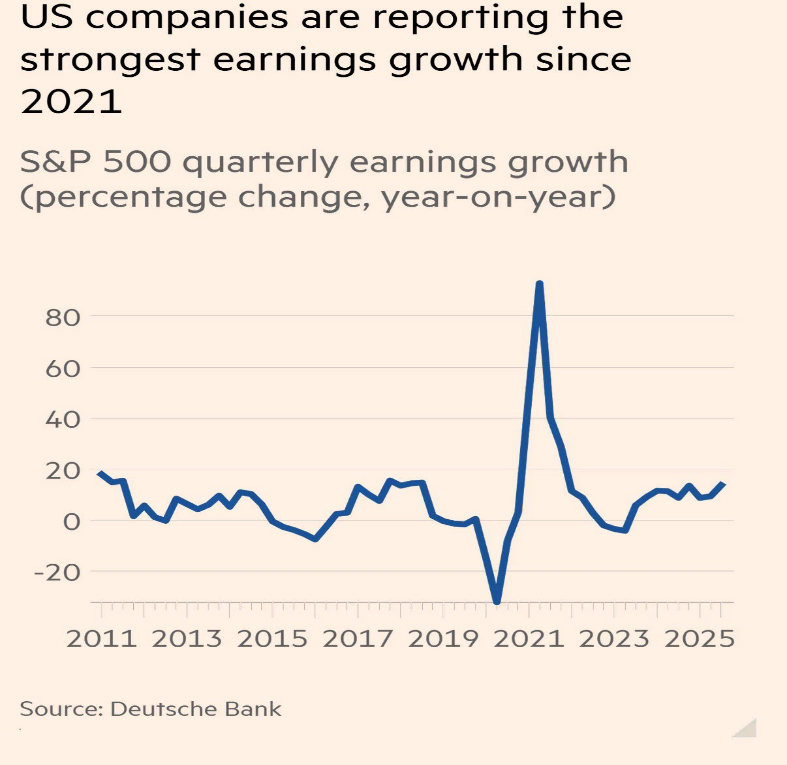

Even zooming out, U.S. companies are reporting the strongest earnings growth since 2021, according to Deutsche Bank. That tells us something simple but powerful: while markets occasionally wobble, profits are still climbing steadily.

Perspective Over Panic

Markets are rarely linear. They climb, they correct, they consolidate — and they do so against a backdrop of consistent corporate strength.

Short-term declines like last week’s are part of that rhythm, not a rupture.

If anything, they remind us that the market is a living system — occasionally volatile, but fundamentally driven by earnings, innovation, and human enterprise.

If you have questions or comments, please let us know. You can contact us via X and Facebook, or you can e-mail Tim directly. For additional information, please visit our website.

Tim Phillips, CEO, Phillips & Company

Sources:

The charts and data presented are sourced from a combination of public domain materials and licensed data providers. Their use is intended solely for educational and analytical commentary and falls within the scope of fair use. For a representative list of sources, please click here.

The material contained within (including any attachments or links) is for educational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, nor should it be considered as a recommendation, offer, or solicitation for the purchase or sale of any security, or to adopt a specific investment strategy. The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. All opinions expressed are subject to change without notice. Investment decisions should be made based on an investor’s objective.